Can you name the most profitable business in the world?

It’s not Apple (AAPL), Microsoft (MSFT), or Nvidia (NVDA).

It’s a crypto business.

Tether (USDT) raked in $14 billion in profit last year with just 150 employees. That’s $93 million per employee. No other company comes close.

Even the mighty Nvidia rakes in “just” $2 million per employee.

- Tether is the company behind USDT.

USDT is the largest and most popular stablecoin in the world.

Stablecoins are digital dollars that move on blockchains and are pegged 1:1 with USD.

I’ve been saying for years that stablecoins are crypto’s killer use case.

They basically give everyone on Earth instant access to a US dollar bank account. They can be transferred anywhere around the world in mere seconds. 24/7/365.

If you’ve ever found yourself asking, “What is crypto good for?” run this experiment for me. Try sending money overseas. I had to make an international wire transfer recently and oh, man, what an ordeal. It cost me $20 and almost an hour of my time.

Then try to send the same payment with stablecoins via blockchain rails. No banks. No waiting. Stablecoins are the only way to send $10,000 to a friend halfway around the world in seconds, from your phone, for less than a penny.

It’s finance at internet speed.

When I lived in Argentina, locals trying to escape hyperinflation would beg me for dollars. Now, they can instantly change money into “digital dollars.”

Folks often talk about crypto replacing the US dollar. If anything, stablecoins strengthen the dollar’s dominance. But I’m certain they’ll replace the 100+ worthless currencies around the world.

In Bolivia, some grocery stores now show prices in USDT:

Source: @paoloardoino on X

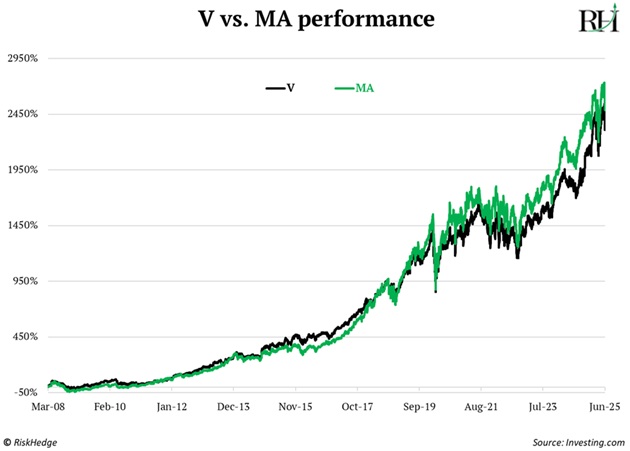

- Visa (V) and Mastercard (MA) are two of the greatest stocks in history.

Look at their charts. Just one all-time high after another. Truly two of the greatest moneymaking machines on Earth:

Visa and Mastercard dominate the payments landscape, processing trillions of dollars in card payment each year. Everywhere I travel in the world, I see two things: Coca-Cola and Visa terminals.

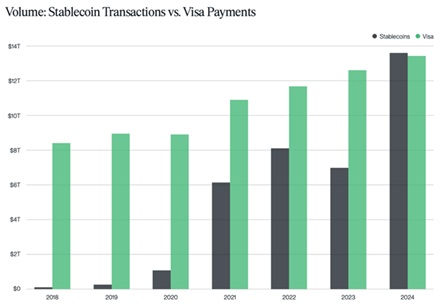

What if I told you stablecoin transactions just surpassed both Visa and Mastercard for the first time? In 2024, stablecoin volumes hit $14 trillion compared to Visa’s $13 trillion:

Source: Binance

Guys, wake up. There’s a financial revolution unfolding.

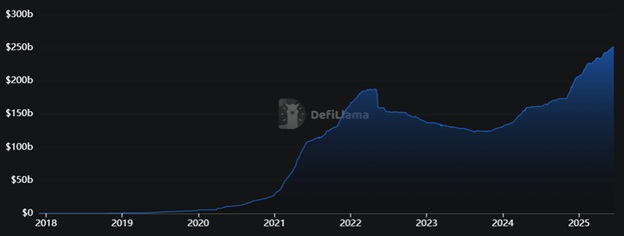

The number of stablecoins in circulation also recently hit $250 billion for the first time ever. We’re on a path to $1 trillion:

Source: DefiLlama

Tether’s USDT dominates the stablecoin landscape with around 70% market share.

Unlike money transmitters like Western Union (WU), Tether doesn’t slam you with fees. It basically runs a “money market” business model. Every time someone buys USDT, Tether takes that cash and buys mostly US Treasuries. Then it collects the yield.

Multiply that by $155 billion in circulating USDT and voila, you have the most profitable business in the world.

- Coming soon: “WalmartCoin.”

The Wall Street Journal just reported America’s two largest retailers, Walmart (WMT) and Amazon (AMZN), are preparing to launch their own stablecoins.

Why give Visa 2%–3% of every transaction when you can own the payment rails yourself?

Paying with WalmartCoin or AmazonCoin will soon become a checkout option.

|

This is just another example of stablecoins transforming the financial world.

Payments giant Stripe recently acquired stablecoin platform Bridge for $1 billion. And Shopify (SHOP) now allows sellers on its platform to accept stablecoins and bypass card networks.

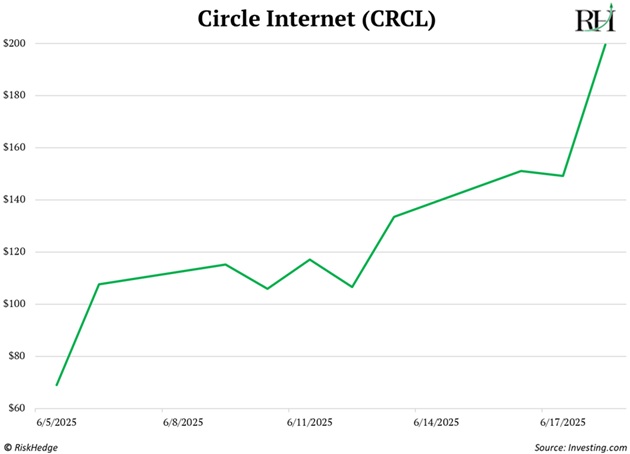

- Tether’s biggest competitor just IPO’d…

Circle Internet (CRCL) is the company behind the second-largest stablecoin, USDC.

Circle went public two weeks ago and took off like a rocket ship, tripling in price:

If Tether were public, I’d buy it in a heartbeat. But I’d avoid Circle.

At first glance, its business is identical to Tether. It invests its reserves into Treasuries and pockets the yield.

But unlike Tether, Circle doesn’t keep all its profits.

It hands over a massive chunk of that revenue to Coinbase (COIN).

USDC was originally a joint venture between Circle and Coinbase. The crypto exchange is still the main distribution platform for USDC. That allows Coinbase to earns half of USDC’s interest income.

I’d much rather own Coinbase than Circle.

Circle shot out of the gates, but I don’t think it’ll last. It will be acquired by Coinbase or a bank in the next year or two.

- What’s the easiest way to profit from the rise of stablecoins?

Own the rails.

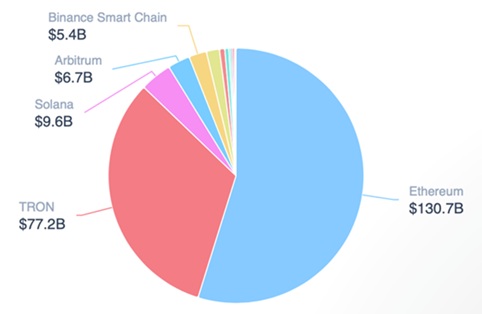

As I mentioned, there’s roughly $250 billion worth of stablecoins in circulation today.

Over 60% of these transactions happen on Ethereum’s (ETH) blockchain and its Layer 2 networks like Arbitrum (ARB).

Source:rwa. xyz

Each time you use Ethereum’s blockchain, you pay a fee.

Over the past two years, stablecoin transactions alone have generated $288 million in revenue for Ethereum.

As stablecoin volumes continue their steady march higher, expect revenue from fees to surge. That’s great for Ethereum and Ethereum holders, who can earn a slice of these fees by staking their tokens.

Stablecoins are crypto’s first killer use case, but they won’t be the last. Watch this space.

Stephen McBride

Chief Analyst, RiskHedge