CHEAP.

Smart investors want to know… “Are stocks cheap yet?”

The answer to this question could be worth tens or hundreds of thousands of dollars.

Because truly cheap quality stocks can make you a lot of money… with very low levels of risk.

The defining trait of cheap stocks is they’re close to their floor. They have a ton of upside… and very little downside.

|

This Secret Tech Initiative is designed to change EVERYTHING. |

Markets across the board have gotten clobbered this year. The S&P 500 just had its worst first half since 1970. The tech-heavy Nasdaq posted its worst first half ever.

So there must be bargains out there, right?

Yes, there are.

Today, we’ll discuss how to identify them.

First, let’s clear up some common misconceptions about what cheap really means.

-

“The stock’s trading for under $5—it’s gotta be cheap!”

What’s the first thing novice investors look at in a stock?

Price per share.

In other words: How much money will 1 share cost me?

They think the lower the share price, the “cheaper” the stock.

This is wrong.

Compare superinvestor Warren Buffett’s Berkshire Hathaway (BRK-A) with popular electric carmaker Tesla (TSLA).

Berkshire’s A shares trade for around $452,600/share.

Tesla’s stock sells for roughly $875/share.

This doesn’t mean Berkshire is 500 times more expensive than Tesla.

(In fact, Berkshire is a heck of a lot cheaper than TSLA today.)

See, share price doesn’t mean anything by itself. It’s a nominal number, driven only by the number of shares the company is sliced into.

This might be obvious to you. But there are millions of novice investors who think this way.

Here’s another misconception about cheapness:

-

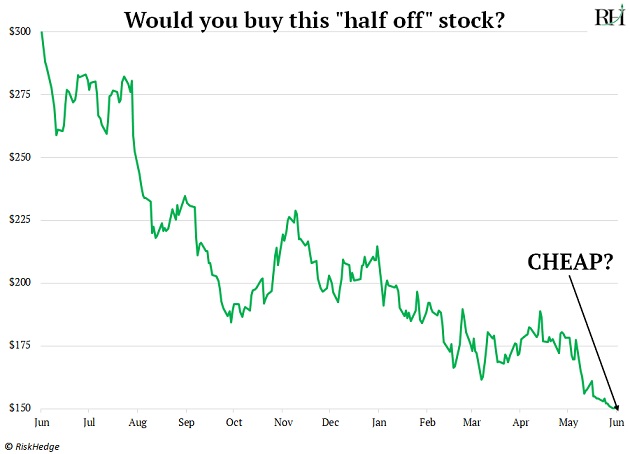

“The stock’s down 50% over the past year—it’s gotta be cheap!”

Last year, a stock was $300/share.

Now it’s $150/share.

It’s sitting on the “half off” clearance rack.

Does that mean it’s truly cheap?

We’re taught to buy low and sell high.

And getting in at half-off prices sure seems low.

Wrong.

Again… this might seem obvious to you. But…

-

It is impossible to identify cheapness by looking at price alone.

Instead, you must compare the price of a stock to the performance of its business.

There are many ways to do this.

You can look at a stock’s price in relation to its earnings—also known as the P/E ratio.

You can look at a stock’s price in relation to its revenue—also known as the P/R ratio.

You can look at a stock’s price in relation to its book value—also known as the P/B ratio.

But no matter which one you choose… you’re only halfway there.

Because none of these metrics account for growth.

Growth trumps everything in investing.

A company can look absurdly overvalued based on its past accomplishments. But if it’s growing revenue and profits at a blistering rate, it may actually be cheap.

Which brings me to an announcement:

-

Our longtime analyst Chris Wood has been working on an exciting project over the past month and a half...

In short, using a very specific valuation formula that he created, he’s determined that a select group of stocks is trading at prices he “never thought he’d see again.”

The last time some of these stocks were this cheap was during the 2020 COVID crash.

Others haven’t been this cheap since the 2008 financial crisis.

Simply put...

Chris says this is a chance to buy Ferrari assets at Honda Civic prices.

He’s putting the finishing touches on this research right now.

We’ll have more details for you very soon.

Chris Reilly

Executive Editor, RiskHedge