The market is starting to sniff out rate cuts… and it’s becoming more obvious by the day.

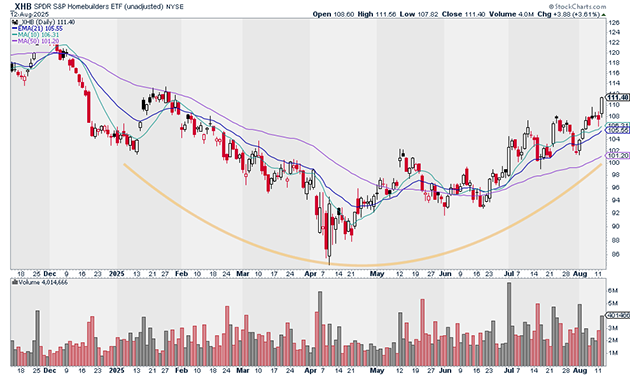

Just look at the SPDR S&P Homebuilders ETF (XHB). It’s up 32% since April and is now breaking out of a multi-month base.

Source: StockCharts

Homebuilders are hyper-sensitive to interest rates. Lower rates mean cheaper mortgages, which fuels housing demand. That’s why they tend to lead when rates are falling… or when investors expect them to.

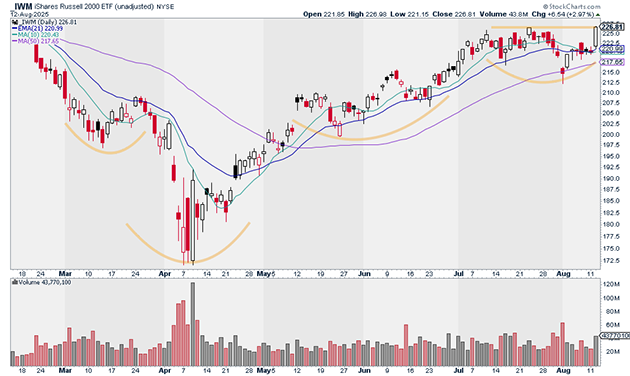

Small caps are sending the same message.

The iShares Russell 2000 ETF (IWM) woke up in a big way yesterday. It finished the day up nearly 3% after the latest CPI report came in. CPI—a key inflation gauge—was softer than expected, cracking the door open for the Fed to finally start cutting rates.

Source: StockCharts

IWM now looks like it’s coiling for a major breakout.

Here’s why this matters… When rate cuts are on the table, small caps tend to shine. They’re more rate-sensitive, borrow more, and can see profits pop quickly as capital gets cheaper.

That’s why now is the time to play small ball—shifting more capital into nimble, under-the-radar names that can sprint ahead in a falling-rate environment. Big tech has carried the market for months, but the next leg higher could belong to the little guys.

Of course, when the market starts shifting like this, you can’t just throw darts at a board and hope to hit the winners.

Instead, I first let my PRO Meter tell me what kind of market environment we’re in. Then I either press the gas or pump the brakes depending on whether the PRO Meter is flashing “risk on” or “risk off.”

With small caps waking up and potential rate cuts on the horizon, we could be entering a trader’s market, signaling “risk on.”

But I’ll wait until my PRO Meter confirms this before “forcing” any trades.

Once we do get the signal, Express Trader members will be the first to know. Join us here to start receiving my three strongest trades at the start of the week.

Justin Spittler

Chief Trader, RiskHedge