As I write this, Ethereum (ETH) is over $3,600... up 40%+ in the past month alone.

Bitcoin (BTC) is holding steady at $115,000...

And many smaller cryptos are soaring.

The crypto market is in a new boom period… and today, I’ll show you two ways to capitalize. The safer way, and the aggressive way.

- Welcome to Day 2 of Crypto Week...

If you missed essay #1, you can catch up here.

In short, now is an ideal time to get involved in crypto if you’ve been sitting on the sidelines.

Trump’s victory in the 2024 US presidential election marked the end of crypto’s four-year regulatory siege, and the implications are far bigger than most realize.

Under the old administration, crypto entrepreneurs had their bank accounts shut down and were harassed and surveilled by regulators. They were afraid to innovate, understandably, for fear of incurring the government’s wrath.

This led to an explosion in “dumb” projects, like memecoins that had no underlying business value. Regulators actually liked that crypto markets were flooded with these joke projects because they delegitimized crypto. They made a mockery of crypto’s unique and incredible potential to build real, valuable, lucrative businesses.

Had regulators not stepped on crypto’s throat, there would be dozens of flourishing, multibillion-dollar crypto businesses already. Investors in their tokens would be much richer.

Better late than never. That era is officially over. Crypto’s legitimate boom era now begins.

Think of it like taking the handcuffs off thousands of entrepreneurs at once. The coming innovation surge will shock people who think crypto is just about speculation...

- Regulatory uncertainty acted as a tight lid on crypto’s price.

It kept the big money at bay. Wall Street firms couldn’t touch crypto because authorities couldn’t provide clear guidance around which tokens are securities and which are commodities.

That’s all changing with the CLARITY Act, which I wrote about here.

CLARITY draws a line. If a token is decentralized—like ETH—it’s a commodity. If not, it’s a security. It also gives early stage token projects three years to decentralize before getting swept into SEC enforcement.

With CLARITY, developers finally have a clear path toward launching compliant tokens in the US.

It gives the big financial institutions the green light to rush into crypto. And it gives crypto the certifiable legitimacy it desperately needed.

- If you’re thinking, “I’ll just buy bitcoin to profit off this boom”...

You’re going off the old playbook.

Bitcoin makes up around 60% of crypto’s total market cap.

This is a direct result of the regulatory onslaught against crypto businesses. Invest in a protocol that could get sued tomorrow? Nah, I’ll just buy BTC instead.

My research suggests bitcoin can hit $250,000 this cycle, and eventually $1,000,000. But the real money will be made buying great crypto businesses emerging from regulatory hell.

Protocols will now be able to share fees with token holders without fear of SEC action. Entrepreneurs can build real products without calling up their lawyers first. Expect to see a wave of exciting announcements from crypto founders in the coming months.

This is the best setup for crypto in years.

- Here’s what to do...

I recommend all investors own at least a little crypto.

As a starting point, Ethereum and Solana are by far my favorite large cryptos to buy.

They will both benefit from regulatory clarity because developers will now have incentives to innovate again on their platforms. Their prices could easily double from current levels.

|

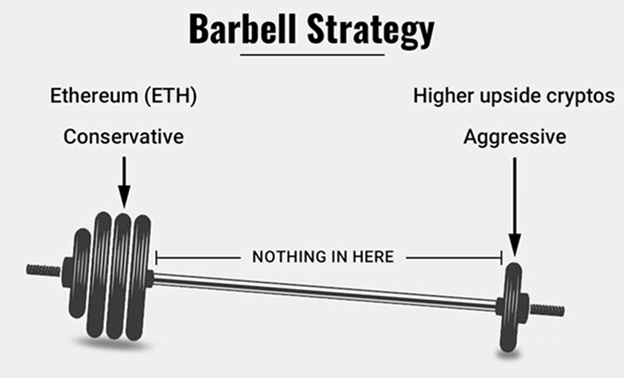

Using my barbell strategy, I suggest putting 75% of your total crypto portfolio into larger cryptos like ETH and SOL. The other 25% can be made up of smaller, higher-upside tokens, the kind I recommend in my RiskHedge Venture advisory.

This allows you to potentially earn higher returns… while the “safer” portion should cushion any losses. (I put “safer” in quotes because crypto is an early stage technology, and no crypto has a comparable level of safety to financial assets like government bonds, cash, and certain groups of stocks.)

It should look something like this:

If you’re interested in the more “aggressive” side of the RiskHedge Venture portfolio—comprised of real crypto businesses, many of which trade for under $1.00—you can learn about it here.

We’re running a special discount for new Venture members. Go here to join us.

Stephen McBride

Chief Analyst, RiskHedge