There’s a strange log jam forming off the California coast…

Over 35 giant oil tankers are floating in waters from Long Beach to the Bay Area…

They’re carrying more than 20 million barrels of crude oil… and have nowhere to go.

As you may have heard, there’s a stunning disruption happening in oil right now.

The price of a barrel of oil recently fell below $0 for the first time ever… meaning companies had to pay others to take oil off their hands!

- As regular RiskHedge readers know, I believe the coronavirus is the most disruptive event since WWII.

This pandemic will change entire industries forever.

It’ll ignite certain ones… and be the final nail in the coffin for others.

Two weeks ago, I showed you three industries that the coronavirus will wipe out for good. It was one of the most popular RiskHedge Reports I’ve written… and the feedback continues to pour in.

So today, we’re doing something similar.

I’ll show you how this crisis is speeding up three super-important industries.

These three industries were accelerating before this pandemic took over—but now, they all just officially moved into hyperdrive.

And now’s the time to take advantage.

Let’s get started…

- Accelerated Disruption #1: Solar Stocks

Oil’s collapse is front-page news right now. And my research suggests it will be the death knell for “old energy” companies.

Meanwhile, the coronavirus will accelerate the clean energy revolution already in motion.

America now gets 3X more power from clean energy sources than it did in 2008. And last year, 75% of newly installed capacity came from clean sources, like solar and wind.

Virginia recently passed a bill that requires energy utilities to generate 100% of the state’s electricity from "clean" sources by 2045.

Big oil companies know they’re an endangered species. Since 2014, the 10 largest oil firms have ploughed $20 billion into clean energy sources.

Old energy is drying up bit by bit. While clean energy grows by double digits each year.

And solar technology has quietly improved by leaps and bounds.

In fact, since 2009, the cost to produce electricity using solar has plunged 90%.

And get this… the rapid cost declines mean solar is now cheaper than oil!

This gets to the heart of why the coronavirus will speed up the move to clean energy.

When you think of solar power, you likely envision panels on house rooftops. But the vast majority of clean energy comes from wind and solar farms dotted across America.

Electricity providers, like California’s Pacific Gas & Electric and New York’s ConEdison, buy this power… and then sell it to us.

Here’s the thing… these power companies will be looking to slash costs during the coronavirus downturn. And the easiest way to do that is to buy cheaper electricity—ike solar and wind.

It’s a no-brainer to bet on solar stocks.

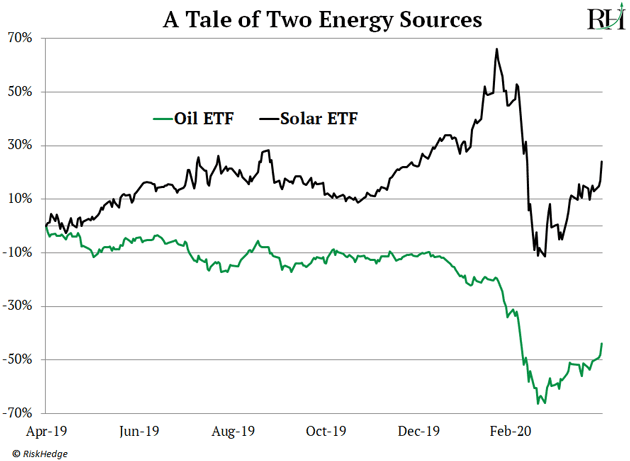

Old energy stocks have been total disasters, while solar stocks are still up 25% over the past year:

- Accelerated Disruption #2: Fifth-Generation Wireless Networks (5G)

Wireless network giant Verizon (V) released startling figures last week…

Internet usage in America has jumped 50% in just the past two months!

The coronavirus has forced tens of millions of Americans to work from home. Millions more school kids are using “video app” services like Zoom to attend virtual classes. Families separated by the pandemic are doing daily “video calls.”

This is pushing America’s internet to the brink.

Think of our wireless networks as a highway. With the recent huge spikes in “traffic” flowing through the digital highway, cracks are appearing.

According to internet research site Broadband Now, average internet speeds in the US dropped over 25% in the past month.

This forced the FCC, America’s internet “overlord,” to open up extra “lanes” on Wi-Fi networks. Something it hasn’t done since the ‘90s!

And the EU recently asked Netflix… Facebook… and YouTube to lower video quality in order to free up space on its digital highway.

In short, our existing 4G networks are maxed out. They can’t handle the huge increase in traffic. And this is turning the big upgrade to 5G into an urgent necessity.

Remember, 5G can handle thousands of times more traffic than today’s networks. It will widen the wireless “highway” by around 100X.

I’m on record as saying 2020 is the year for America’s 5G rollout. And so far, it’s shaping up that way.

Last week, Apple (AAPL) announced its first 5G iPhone will launch in September. And you better believe Apple will push wireless firms to build 5G as fast as possible before the launch.

T-Mobile and Sprint fast-tracked their 5G rollouts to cities like New York and Philadelphia. And Verizon announced it’s pumping another $500 million into 5G networks this year, bringing the total to $18.5 billion.

- Accelerated Disruption #3: The Dollars in Your Bank Account

The clean energy revolution and 5G are both big megatrends we can make money from.

But they pale in comparison to the importance of this last disruption. The coronavirus is sending the disruption of money into hyperdrive.

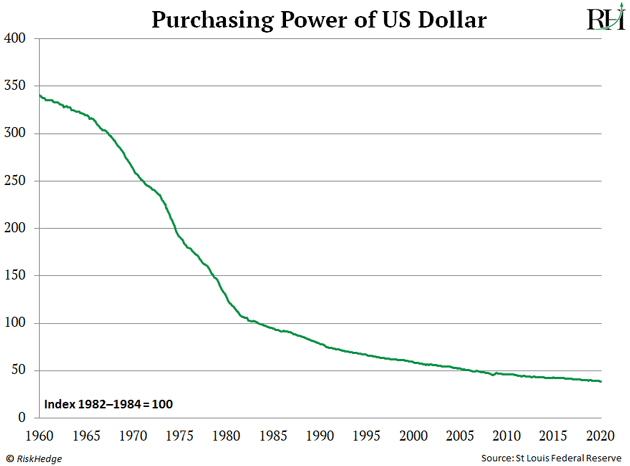

If you’ve paid a medical or tuition bill recently, you know a dollar doesn’t go as far these days. In fact, by the US government’s own calculations, a dollar is worth 86% less than it was 50 years ago!

Take a look:

If this were a chart of a stock, would you buy it?

Absolutely not.

This disruption mostly comes from the US government messing around with the dollar.

If you’re familiar with how our financial system works, you know our money isn’t tied to anything of real value anymore.

Rather, the value of the dollar largely depends on politicians making responsible financial decisions.

And governments are spending record amounts of money right now. As I mentioned last week, $7 trillion worth of stimulus packages have been passed in just the past few weeks.

This dwarfs what we saw in the financial crisis… and even the Great Depression.

- But there’s a simple way to profit from this insidious disruption of the dollars in your bank account.

When governments start messing with the value of money, hard assets like gold tend to soar.

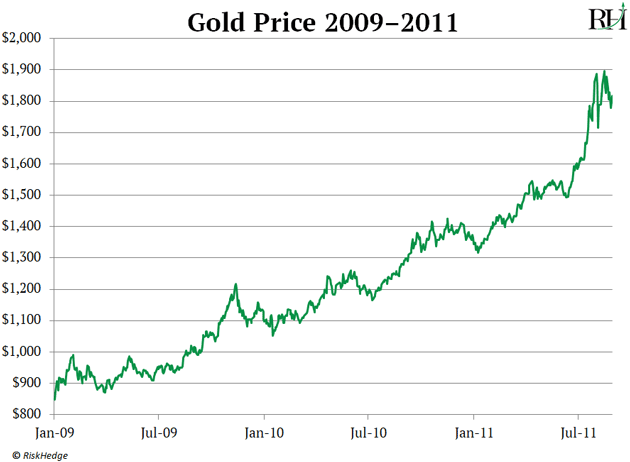

Following the 2008 meltdown, the US government launched a $1 trillion+ stimulus package in 2009.

This kicked off a monster run in gold. In fact, gold investors doubled their money in two years:

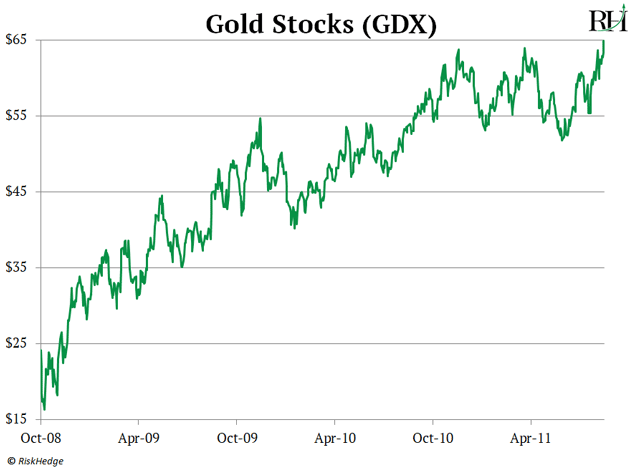

And folks who bought some gold stocks did even better. Remember, gold stocks are gold on steroids. As a group, they soared 270% over the next three years:

- The same forces that sparked this huge move in gold are even greater today.

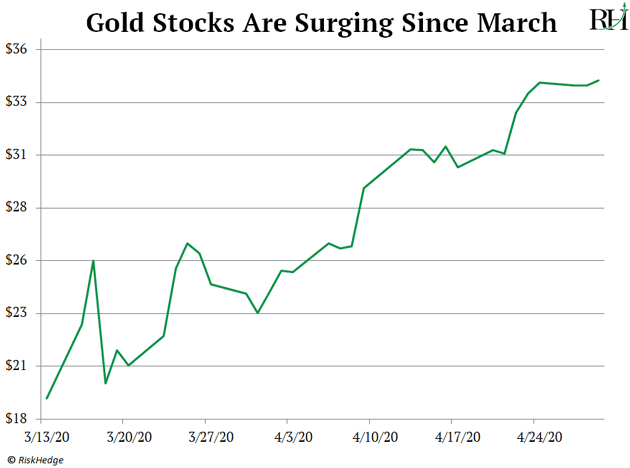

Since the US Congress started debating the historic $2.2 trillion stimulus package in early March, gold stocks have surged 78%:

Longtime RiskHedge readers know me as the disruption guy. My team and I invest in fast-growing companies changing the world.

But it’s clear the disruption of money has become one of the most important trends to get behind right now.

Not only is it affecting the dollars in your bank account, it could also be handing you an unprecedented opportunity in gold stocks.

In fact, this opportunity is so big… I recently interviewed one of the world’s leading resource experts so you could get the full story.

- His name is Marin Katusa—and he’s our go-to guy in the resource space.

Not only is he one of the most trusted and well-connected dealmakers in the industry... he has also personally financed some of the most successful mining businesses. And his track record in the junior mining space is unmatched, with wins as high as 2,400%... and even 4,160%.

In short, when he talks, it pays to listen.

And right now, he says we’re entering an of incredible change and opportunity in the resources markets.

- The stage is set for what he believes are the “greatest investment opportunities we’ve seen in a generation.”

Because this is such a rare and lucrative opportunity, we’ve arranged an exclusive deal for RiskHedge readers only to save over 40% on Marin's premium research service—Katusa’s Research Opportunities.

It truly is some of the best research you'll find in the sector. It’s a must-read each month for all of us here at RiskHedge. And we believe it’s hands down the No. 1 resources advisory for anyone looking to take advantage of this rare opportunity.

Go here to take advantage of this incredible offer today.

Stephen McBride

Editor — Disruption Investor

Reader Mailbag

Today, more readers share their thoughts on my recent essay: Coronavirus Will Wipe Out These Three Industries for Good. Which industries do you think will get wiped out for good because of the coronavirus? Which ones will survive? Let me know at Stephen@riskhedge.com.

Sadly, many of the local restaurants we love to frequent will probably not be around in six months to a year. They just about make a profit with a full house. How are they going to stay alive with 50% of their seats full?—Mirakian

Grocery stores: they will not go away but will likely diminish, particularly in dense population areas. People are figuring out that home grocery delivery is extremely convenient.

Couple that with the significant increase in home cooking resulting from inability to order in from restaurants and you have to have a large group of people realizing they are eating healthier and saving a lot of money cooking for themselves. Companies selling repacked means to prepare are hitting the convergence of these two trends.—Jeff