Stocks are coming under pressure.

Yesterday, the S&P 500 (SPY) finished down 1.2%, while the Invesco QQQ Trust (QQQ) dropped 2%.

On the surface, these declines don’t mean squat.

After all, pullbacks are perfectly normal. Plus, this market has shrugged off everything that’s been thrown its way since April.

Will this time be any different? It’s certainly possible.

I say this because we’re seeing some major deterioration below the surface.

Let’s rip through some charts so you can see what I’m talking about…

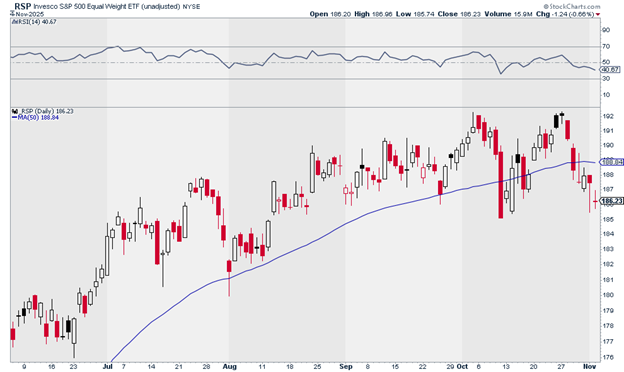

The first shows the performance of the Invesco S&P 500 Equal Weight ETF (RSP).

This fund invests equally across every stock in the S&P 500. It gives us a much more holistic view of how “the market” is doing compared to the SPY.

We can see that RSP is currently trading below its 50-day moving average. Its 50-day moving average is also starting to flatten out. That’s a red flag.

Source: StockCharts

Source: StockCharts

Bulls want to see RSP reclaim its 50-day moving average sooner rather than later.

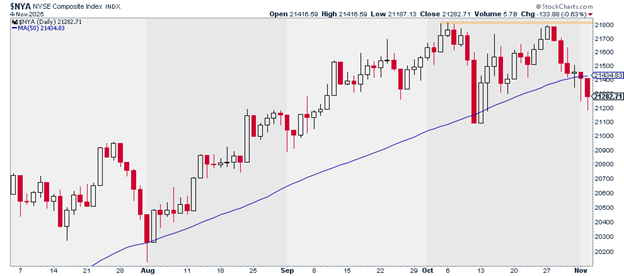

The NYSE Composite Index (NYA) paints a similar picture. It peaked a month ago and is now trading below its 50-day moving average.

Source: StockCharts

Source: StockCharts

Like RSP, the NYSE Composite gives us a picture of how the broader market is performing. So, its recent weakness is a red flag.

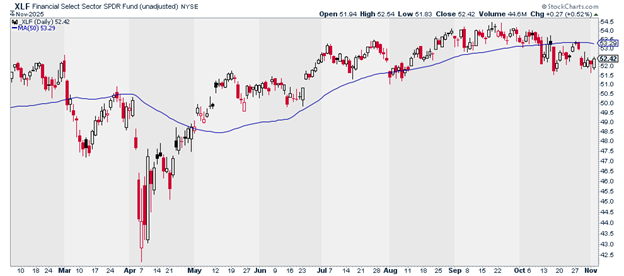

I also don’t love what I’m seeing from financials. Check out the recent performance of the Financial Select Sector SPDR Fund (XLF) below.

XLF is even weaker than RSP. It’s been trading below its 50-day moving average for the past month or so.

Source: StockCharts

Source: StockCharts

Financials are one of the market’s most important sectors. They don’t necessarily have to lead the market. But it’s vital that they participate.

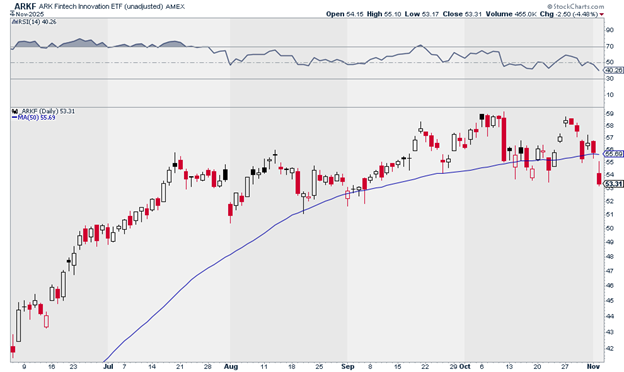

Finally, we have fintech stocks, which are basically the growth stocks of the financial sector. The ARK Fintech Innovation ETF (ARKF) failed to break out last week and now appears to be rolling over.

Source: StockCharts

Source: StockCharts

Now, this doesn’t mean the bull market in stocks is over. But it looks due for a pullback—or at the very least, a pause.

We’re seeing too much weakness under the surface to ignore. Key areas like financials and fintech are lagging. Broader indexes like RSP and NYA are struggling to stay above key moving averages. That’s not what a healthy market looks like.

The good news? A reset here would be constructive. It would let overextended stocks cool off and give the market a solid base for its next move higher.

In the meantime, stay nimble and focus on strength.

That’s what we’re continuing to do in my Express Trader advisory. We just took some chips off the table yesterday, selling one of our positions for a 10% gain and another for a 34% gain.

When it’s time to step on the gas again, my readers will be the first to know.

If you’d like to join us in Express Trader, go here to sign up.

Justin Spittler

Chief Trader, RiskHedge