Editor’s note: Nuclear stocks are crushing the market...

And in today’s special Jolt, Stephen McBride and Chris Reilly discuss how to position yourself to profit from nuclear’s historic comeback.

***

Chris Reilly: Stephen, nuclear stocks are hot.

The VanEck Uranium and Nuclear ETF (NLR) is up 45% this year—more than 4X the S&P 500.

Next-gen nuclear tech play Oklo (OKLO) has surged 255% over the past year.

And NuScale Power Corp. (SMR), which develops small modular reactors (SMRs), has soared 340%.

What’s going on?

Stephen McBride: A nuclear resurgence. After decades of stagnation, governments and investors have woken up to the fact that nuclear is the only energy source that scores a perfect four: it’s clean, safe, dense, and reliable.

And now nuclear has the one thing it’s lacked: strong momentum. States are lifting bans, the World Bank is financing projects for the first time in decades, and big tech is signing long-term nuclear contracts. The tide has turned—and it’s spawning great new investment opportunities.

Chris: Most people hear “nuclear” and think mushroom clouds and Homer Simpson asleep at the controls.

Source: The Simpsons

Stephen: Nuclear has a PR problem. For decades, it’s been painted as dangerous, dirty, and outdated. But the reality is very different.

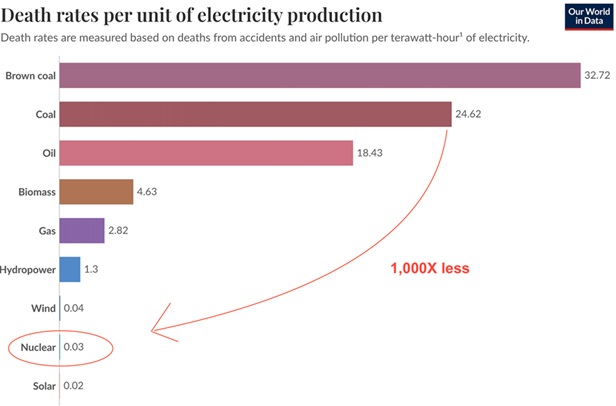

Take safety: Coal kills over 1,000X more people per unit of energy produced than nuclear. You actually get more radiation from eating a banana than you do from living next to a nuclear plant for a year.

Source: Our World in Data

Nuclear is also incredibly dense. A uranium pellet the size of your fingertip contains as much energy as a ton of coal. It’s like stuffing an oil barrel into a sugar cube. That’s why it takes only a small footprint of land to power millions of homes.

Chris: If nuclear is this good, why did the US regulate it nearly to death?

Stephen: Politics and misguided fear.

Cheap, reliable energy is the foundation of prosperity. Every big leap in human progress—steel, semiconductors, fertilizer, space travel—was made possible by access to abundant energy. And nuclear could have been the backbone of that. Instead, we got stuck in fear and red tape.

But that’s changing, and the catalyst isn’t climate policy—it’s artificial intelligence (AI).

|

Chris: What does AI have to do with nuclear energy?

Stephen: Everything. AI data centers are electricity hogs. One Nvidia (NVDA) AI chip draws as much power as two US households. Every ChatGPT query you make uses at least 10X more electricity than a Google search.

Multiply that by hundreds of millions of users, and we need a lot more energy quickly.

If you’re running a $10 billion AI facility, you can’t rely on the weather. Wind and solar are nice, but they’re intermittent. Nuclear is 24/7, carbon-free, and steady. That’s why big tech is sprinting into nuclear. In just the past year:

- Microsoft (MSFT) inked a deal to help restart a reactor at the iconic Three Mile Island plant in Pennsylvania.

- Google (GOOGL) signed an agreement with startup Kairos Power to build several SMRs to power its data centers.

- Amazon (AMZN) entered a 17-year contract with Talen Energy Corp. (TLN) to power its data centers with nuclear energy. It’s also among a consortium investing $500 million into SMR startup X-energy.

- Meta Platforms (META) inked a 20-year deal to buy power from Constellation Energy Corp.’s (CEG) Clinton nuclear plant in Illinois. The deal ensures the Illinois plant will stay operational past its previously scheduled 2027 closing.

Just a few years ago, the idea of “AI-powered nuclear factories” sounded crazy. Today, it’s happening.

Chris: Let’s bring it back to investing. A lot of readers know you recommended Cameco (CCJ) back in 2018, and it’s up sevenfold. Is uranium still the way to play this?

Stephen: Cameco has been a fantastic trade, but it’s a commodity stock. Its fate rises and falls with uranium prices, which are volatile. In the past decade, uranium has swung between $18 and $100 per pound. That’s not a recipe for steady wealth-building.

At Disruption Investor, we seek consistently growing companies at the forefront of long-term megatrends. These stocks can power higher for years and years, often no matter what the market is doing.

Chris: So you’ve found a company like that?

Stephen: Yes. It’s a company most people have never heard of, but more than 95% of the world’s nuclear plants already depend on its technology. Its systems are mandatory for regulatory compliance and safety. And because these products are installed during construction and replaced regularly, it generates recurring revenues for decades.

This is the kind of “linchpin” business that quietly powers the nuclear resurgence from behind the scenes.

Chris: And that’s your top nuclear stock for 2025?

Stephen: Yes, it’s our #1 nuclear play, and we just released the full writeup in our brand-new Q4 Disruption Playbook.

Chris: Reader, I’ll leave you with this: Stephen and his team have just released their Q4 Disruption Playbook, which reveals this top nuclear stock—along with other big disruptive ideas they’re tracking so you can finish 2025 strong.

Right now, we’re running a Labor Day sale on Disruption Investor. If you’ve ever thought about joining, this is the time. You’ll get immediate access to Stephen’s #1 nuclear stock and the full playbook. Go here for details.