In 1936, William Randolph Hearst was facing total wipeout.

The newspaper mogul had invested millions of dollars in mills that turned wood pulp into paper…

But a new, different kind of paper made from hemp was disrupting the market.

Hemp paper was cheaper… and could be grown much quicker.

To shut down this threat, Hearst used his newspapers to demonize hemp’s byproduct—marijuana.

He ran a smear campaign calling marijuana a “vicious racket with its arms around your children.”

It worked. The Federal Bureau of Narcotics outlawed hemp in 1937.

- For much the past century marijuana was a “Schedule 1 narcotic,” which put it in the same category as dangerous drugs like heroin.

The business of growing, processing, and selling marijuana was conducted in the shadows, illegally.

But as you probably know, the laws are changing.

In 1996 California was the first US state to let folks use marijuana for medical uses. Now a dozen US states have completely opened up the market for marijuana.

Adults in Vermont, Colorado, Massachusetts, Washington, Oregon, and a half dozen other states are free to smoke it for pleasure. I spend a lot of time in Vermont. Hemp stores are sprouting up everywhere.

Even if you live where marijuana is still illegal, you’ve likely heard a lot about “pot stocks.”

Internet marketers have seized the opportunity to promote the heck out of this exciting new industry. If you’re anything like me, ads promising to make you a “pot stock millionaire” follow you around the web.

Longtime RiskHedge readers are asking why I never talk about marijuana stocks.

At a glance, they seem like a disruption investor’s dream...

After all, it’s a multi-billion-dollar market opening up after 100 years in the shadows. It’s forecast to grow at breakneck speed. And big companies are plowing huge sums of money in.

This should spell big opportunity for investors, right?

WRONG.

- I won’t put a penny into marijuana stocks.

Before I tell you why, look at the crazy gains marijuana stocks have produced.

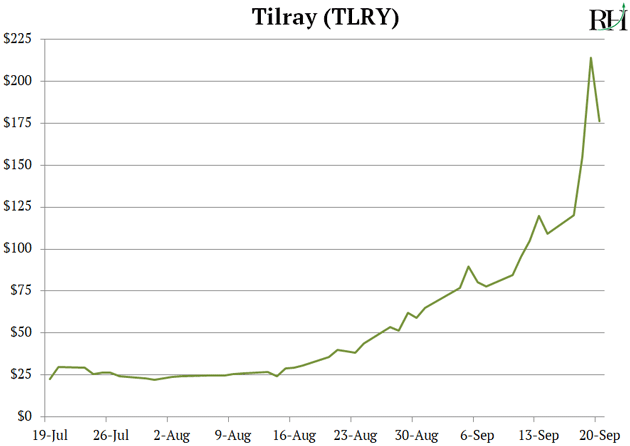

Canadian marijuana grower Tilray (TLRY) shot up 400% in less than three months last year, as you can see here:

It briefly hit a $20 billion valuation–roughly the same as American Airlines (AAL).

But get this… Tilray only brought in $43 million in revenue in 2018. American Airlines raked in $45 billion!

Dozens of other tiny marijuana stocks, with barely any sales, soared 10x… 20x… even 30x in just a few months.

- The pot stock boom is mostly empty hype.

To understand why, you must look past the stock performance and into the actual business of selling marijuana.

The fact is, most marijuana companies stand little chance of ever making significant profits. Sure, it’s new and exciting. But marijuana is a tough business... and it’s going to get much, much tougher as the market matures.

You see, now that it’s becoming legal, there’s nothing special about marijuana. Like corn or wheat, it’s a crop.

Selling marijuana was lucrative because it was illegal. To grow it and sell it, you risked getting locked in jail. You risked getting beat up by rival drug dealers. You risked encountering DEA agents and their snarling, drug-sniffing German Shepherds.

Most people won’t break the law. For decades, only people who were okay being labeled as criminals went into the marijuana business.

Today, there are over 9,000 marijuana “growers” across the US. That’s more breweries than there are in America!

And although only 11 states have legalized marijuana so far, more than 5,000 marijuana stores have opened up shop.

Care to guess how many Walmart (WMT) stores are in the US?

About 4,750.

Do you see 5,000 specialty broccoli stores? Or 5,000 carrot stores? No, vegetables sit on grocery shelves and sell for $0.99. Farmers and grocers are lucky to squeeze out a penny or two of profit.

This price compression is marijuana’s future.

- Many pot fans will take issue with this statement...

Marijuana is a commodity. It’s all roughly the same, no matter where or how it’s grown.

Pot enthusiasts will argue this point. They’ll insist there are dozens of different strains that all make you feel a different way when you consume it. They’ll point out that while the THC in weed makes you feel high, CBD does not.

They’ll emphasize that CBD seems to have important medicinal properties and could one day be a key ingredient in many new drugs. They’ll say marijuana has dozens of uses other than getting you high.

I’m sure all this is true. But it’s mostly irrelevant for investors.

Half a dozen different kinds of apples sit on the shelf of every grocery store. Granny Smith, red delicious, fuji, gala, yellow apples. You can turn apples into apple sauce, apple cider, apple juice, apple pie.

The apple is a versatile fruit. Yet, selling apples is far from lucrative.

- Oregon was one of the first states to legalize marijuana back in 2015...

At first there were only a handful of growers, so they could charge exorbitant prices.

But according to a state government report, marijuana prices have been cut in half over the past three years.

What happened? In short, new companies flooded the market. The same report estimated there is enough pot in the state to last for six-and-a-half years!

Few things can devastate an industry like rapid price compression. Many pot stocks are already falling apart.

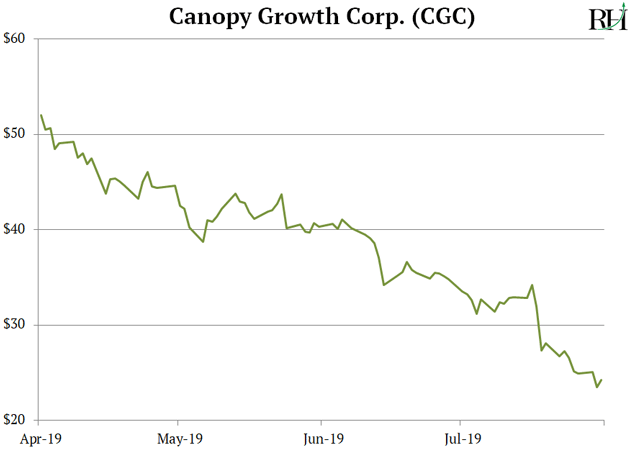

Tilray and Canopy Growth (CGC) are the two biggest public marijuana producers. Revenues for both companies doubled last year. Yet as marijuana prices tumbled, both companies posted record losses!

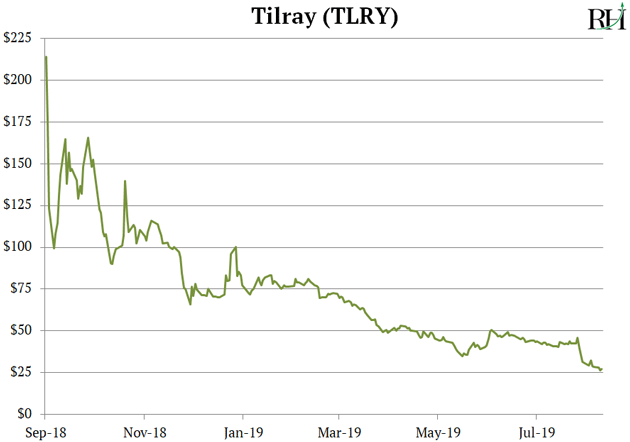

After much hype, investors have sprinted out the exits. Tilray has plunged 90% in the past year as you can see here:

While Canopy Growth has cratered 50% since April;

- To be clear, parts of the marijuana business will boom over the next couple of years.

Cannabis shops will continue popping up all over the place. I’m sure big American companies will continue to invest billions in the sector. And I’m sure a handful of pot stocks will defy the odds and go on to achieve big gains.

But make no mistake: the whole marijuana industry is staring down the barrel of price compression.

Pot stocks are no place for disruption investors to put their money.

Have you been burned by pot stocks? Tell me at Stephen@riskhedge.com.

Stephen McBride

Editor, Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

Reader Mailbag

Following last week’s letter about using stop losses in your portfolio, RiskHedge reader Tor asks “when to get back in:”

“Stephen, thanks for the very interesting comments. One question, when you get stopped out, when do you get back in again?

Selling is only half of the challenge the way I see it. Best regards, Tor”

Tor, thanks for your question.

Sometimes you’ll love stop losses. For example, limiting your loss to 20% on a stock that goes on to crater 70% could be considered a “win.” Other times you will hate them. It never feels good to you sell a stock you like, only to see it bounce back.

In my second scenario, you’ll often want to buy straight back into the stock. This is usually a highly emotional decision. Speaking from experience, it’s usually a mistake. Typically, I’ll wait two to three months before buying back into a stock that was stopped out. This “cooling off” period takes emotion out of the equation, which is what following a disciplined stop-loss strategy is all about.