The S&P 500 just broke its record high and now sits above 5,300 as I type.

One of my 2024 predictions in the January issue of Disruption Investor was that we’d see “S&P 5,000” by year-end. We surpassed it already.

I also predicted US stocks would finish the year up 20%. So far, they’re up 12%.

I know many folks are worried about war, inflation, and politics, among other things. Yet stocks remain resilient. This is important information. It tells us there’s real strength behind this market.

- Bitcoin’s (BTC) on the move, too.

It’s gained about 10% over the past week.

But it’s roughly flat since the big “halving,” which was almost a month ago.

I’ve seen some folks on Twitter/X asking, “What happened? I thought bitcoin was supposed to soar after the halving!”

As I’ve shown, bitcoin has followed a predictable pattern around each halving. Crypto prices tend to bottom 12–18 months before bitcoin undergoes a halving. They then rally into the halving… then rally more in the year following the halving. (Key word: Year, not weeks.)

Bitcoin is right on script for this cycle. Prices bottomed 17 months before the halving and have now jumped 300%+ off the lows. And as I said in my crypto advisory, RiskHedge Venture:

I don’t expect prices to immediately rocket higher. Our analysis of past halving cycles suggests we may even sell off a little. But any dips are buying opportunities.

I still believe bitcoin will hit at least $150,000 this cycle. But in Venture, we’re investing in real crypto businesses that are smaller, with more upside.

- “Roaring Kitty” is back... and so are the meme stock traders.

Keith Gill (Roaring Kitty on X) is the man behind the famous 2021 short squeeze that sent GameStop (GME) to the moon.

After turning $50,000 in GME call options into $48 million, Keith left the public eye.

Earlier this week, he posted this picture, with no text, on X—his first post in nearly three years:

Source: @TheRoaringKitty on X

Markets saw it as “game on.”

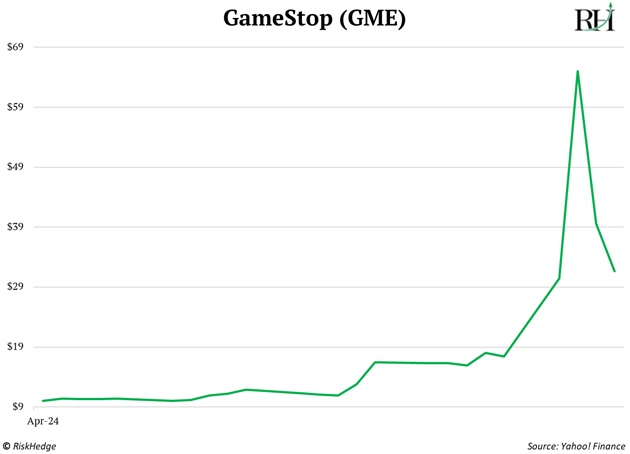

GameStop shares rocketed around 270%:

While this doesn’t have the same “millennials band together to take down big hedge funds” narrative 2021 did, it’s still noteworthy.

As I said when GameStop, AMC (AMC), and other meme stocks went crazy last time, this story runs much deeper.

The narrative about young folks since the financial crisis has been that they don’t own any assets. They weren’t participating in the markets, they didn’t know anything, and they were just living in their parents’ basements.

That’s changed. Tens of millions of millennials—the largest and most educated generation in American history—have flooded the market for the first time ever. This is a generation of stock pickers.

And I think it’s jet fuel that will continue to propel the stock market higher for years.

But be careful with GameStop if you decide to dabble. It’s a “bottle rocket” stock, and the complete opposite of the stocks I recommend in Disruption Investor. Upgrade here.

Bottle rockets shoot up... then they plunge back down to Earth.

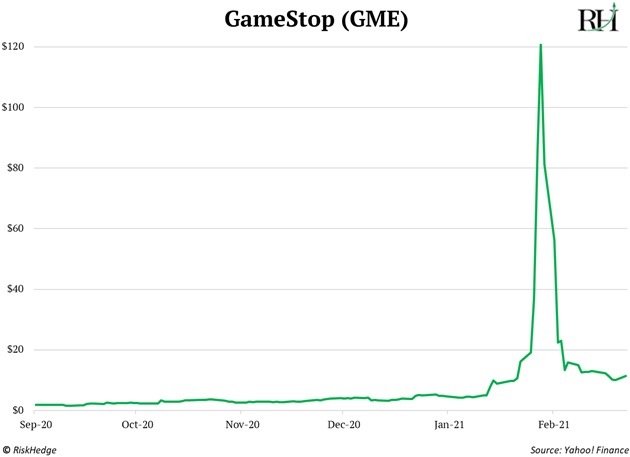

It’s exciting... but over in an instant. Just like we saw with GME in 2021:

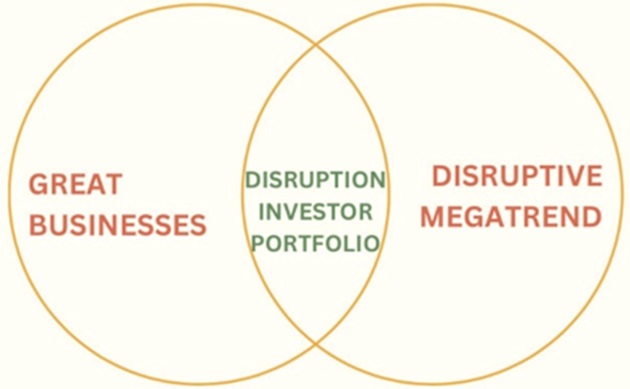

If you’re here to build lasting wealth, I recommend investing in great businesses profiting from disruptive megatrends.

This Venn diagram is our North Star in Disruption Investor. Print it out and keep it close by.

- Today’s dose of optimism...

My friend and prolific writer Jared Dillian says, “The most important decision we will ever make is what to do with the next 24 hours.”

I repeat this to myself every morning. It forces me to be ruthless about how I spend my time...

Because how we spend our days is how we spend our lives.

Your top competitor isn’t wasting two hours watching Netflix every evening. They’re not staying up until 11 pm scrolling through Instagram. Nor are they skipping gym sessions.

You have the same 24 hours as everyone else to achieve your goals. And having kids isn’t an excuse to be lazy. It’s no coincidence most of the world’s best entrepreneurs are parents. I jump out of bed a lot quicker every morning since becoming a dad.

See you Monday.

Stephen McBride

Chief Analyst, RiskHedge