Editor’s note: Stephen McBride and Chris Wood just published what they call their “most serious Disruption Investor issue ever.” In short, after a long period of domination, US big tech stocks are in trouble... and new opportunities are arising.

Today, we’re sharing an exclusive look at this important issue.

***

I (Stephen) have been lucky enough to meet many Disruption Investor members over the past few years. From Jim in Nashville to Joel in San Francisco to my dear friend Tariq in Abu Dhabi, I always enjoy seeing you in the flesh.

Each time I meet members, I’m reminded of just how important our job is. You trust Chris Wood, me, and our team to inform your investment decisions. To protect and grow your nest egg.

It’s a serious job. And this issue of Disruption Investor is the most serious I’ve ever written.

Our deep research suggests we’re at a major inflection point in the market… and that the opportunities are shifting.

As we explained last month, US big tech stocks are in trouble. Most investors who cling to the names that worked for the past 15+ years will be left behind.

But not us...

We’re already hunting for the winners in this new landscape and staying ahead of the curve with our disciplined, selective strategy. So far, our “script” has been on point...

As you know, we saw this volatility coming and have been cautious on the market since January. Our put options on the S&P 500 helped us profit from this year’s selloff (up 115% on our remaining position). And we’ve been buying into unloved megatrends like cybersecurity and solar, which have paid off.

In this month’s issue, we’ll update you on our market script. We’ll share what to expect through the midterms and how to prepare, because it’s crucial to have a plan even if we know it won’t be exactly right.

While the stock market “leaders” are shifting, our strategy remains the same: Buy great businesses profiting from disruptive megatrends. Our unique strategy is “all-weather,” meaning it’s designed to work in all markets.

We’ve entered a new regime that’s opening up exciting opportunities. Grab a coffee and buckle up. We’re about to get into it all...

“Situation’s changed, Jules”...

Since 2009, US stocks have dominated the rest of the world. The S&P 500 outperformed international stocks for 15 consecutive years. That’s by far the longest streak ever. And it was deserved!

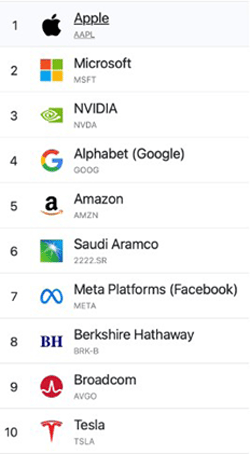

Apple (AAPL)… Amazon (AMZN)… Alphabet (GOOGL)… Microsoft (MSFT)… and Meta Platforms (META) grew earnings faster than their international peers. They led virtually every important innovation of the past decade: smartphones, digital ads, social media, cloud computing, and artificial intelligence (AI).

Look at this list of the world’s 10 most valuable companies. Nine of the 10 are US companies. Eight are tech companies founded on America’s “left coast.”

Source: companiesmarketcap

Source: companiesmarketcap

(Pop quiz: Only one of these companies was founded in the city of San Francisco. Can you guess which one?

Saudi Aramco. The Saudi oil giant was a division of the Standard Oil Company of California, aka Chevron Corp. (CVX). It was headquartered in San Fran until 1948.)

|

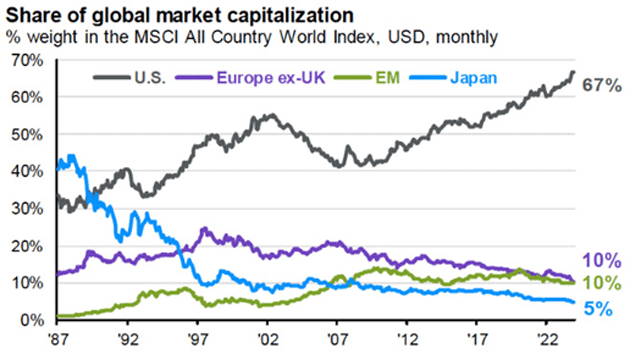

This outperformance turned US stocks into a money vortex. Since 2019, over $10 trillion in overseas capital has flowed into great American companies. Foreign investors now own double the percentage of US stocks as they did a decade ago.

At the end of 2024, US stocks made up a historic 67% of the global equity market, their highest weighting in history—13X bigger than Japan at 5%:

Source: Meb Faber Research

Source: Meb Faber Research

Every index—from the S&P 500 to MSCI’s “global” All Country World Index—turned into a concentrated bet on big tech.

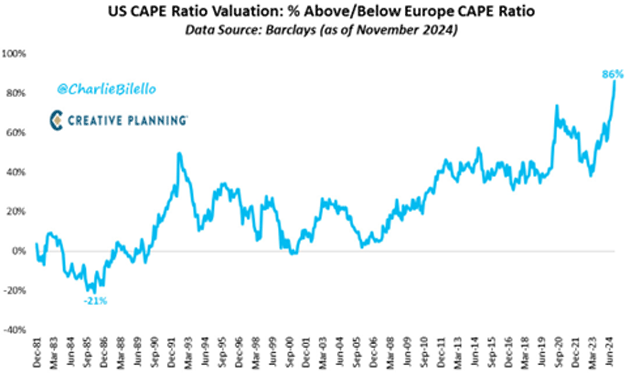

Record inflows allowed US stocks to command a valuation premium that stretched to historic levels:

Source: @CharlieBilello on X

Source: @CharlieBilello on X

The great philosopher Mark Twain once said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Coming into 2025, everyone knew you had to own big tech. Uh oh.

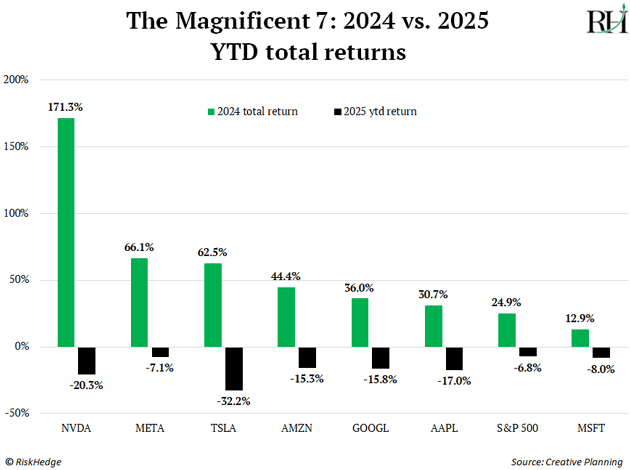

The trade that worked gloriously for the past 15 years is now turning into the biggest loser. All of the “Magnificent 7” names are down so far this year:

Big tech has entered a bear market.

To quote my favorite Far Side cartoon: “Situation’s changed, Jules.” (Hat tip to my friend Jared Dillian.)

Welcome to the “great rotation.” We’re taking advantage by sticking to our bread and butter: Buying stellar businesses riding unstoppable megatrends.

But what really set this shift into motion?

Why big tech is challenged until further notice

Big tech’s bull run had to end eventually. Think about it like a rubber band stretched too far in one direction. It couldn’t go on forever.

This was always going to happen, but here are two events that finally snapped the rubber band...

To continue reading, upgrade to Disruption Investor here. Stephen and Chris have a lot more to lay out in this issue, including the losers of this new investing landscape... the winners... and an important update on their artificial intelligence portfolio picks.

Stephen McBride

Chief Analyst, RiskHedge