Editor’s note: We continue our special series with Chief Trader Justin Spittler, who’s sharing his top trading strategies for picking stock winners. Read on to learn his favorite “cheat code” to identifying explosive stocks right before they take off. And if you haven’t already, go here to see the new, simple way to get his top three handpicked trades every single week.

***

Today I’m going to show you a trading tactic so simple, yet so reliable...

That it’ll allow you to predict when certain stocks will take off days or even weeks in advance.

Master this tactic, and it’ll feel like you’ve got a “cheat code” to the markets.

Let me show you exactly how it works… how it led my readers to 47% gains in one day… and how you can start applying it to your own trading today.

- In short, you want to identify stocks that are climbing out of a “base.”

A stock forms a base when it trades within a narrow price range for a period of time.

In other words, the stock isn’t crashing… and it’s not zooming higher (yet).

It’s essentially trading “sideways.”

Now, many people disregard sideways price action.

They think it’s “no man’s land.” A place where money just sits stagnant.

They’re only focused on charts that showcase big moves to the upside or downside.

- This is a big, costly mistake…

You should learn to LOVE sideways price action.

I’m extremely interested in stocks that form “big bases.” In other words, stocks that trade sideways for a long time.

Why?

A strong base often serves as a launch pad for an explosive move where a stock can leap 30%–50% higher within weeks... sometimes within days.

And the more time a stock spends carving out its base, the higher the upside.

I’ve found that the biggest moves come right as a stock starts climbing out of a strong base.

- At the height of the COVID pandemic, this exact setup presented itself…

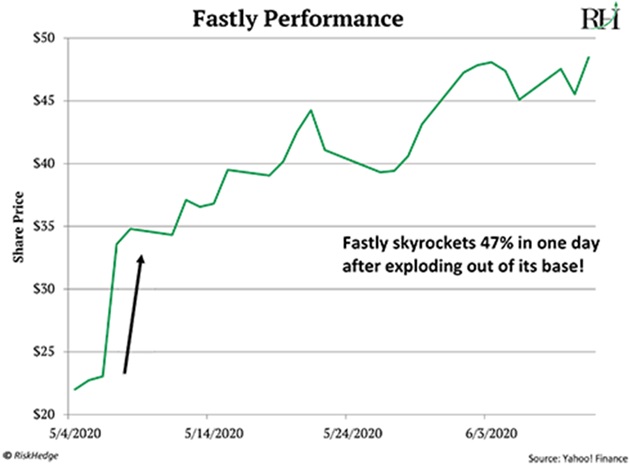

You’re looking at a chart I showed to my premium subscribers in an urgent alert on April 27, 2020.

Fastly (FSLY) was an “edge computing” pioneer. Most people ignored it because its stock didn’t do much for 12 months. But Fastly was “carving out a base” before starting its climb higher.

As I told my subscribers, this action suggested Fastly “could be in the early innings of a major move higher.”

And that’s exactly what happened.

- Less than two weeks later, Fastly erupted, soaring 47% in just one day...

Take a look:

Now, seeing 47% gains in one day is not typical. But it is possible if you hunt for stocks that’ve carved out strong bases.

And as you can see, Fastly didn’t stop there. After a year of “sitting on the launchpad,” Fastly took off with unstoppable force.

It kept roaring higher… and we eventually closed the position for a 330% gain in less than 10 months. The stock has since collapsed to $7, but we had taken our profits and walked away long ago.

- Intellia Therapeutics (NTLA) is another stock that was setting up on the launchpad.

Intellia is one of a handful of companies pioneering gene editing—one of today’s most transformational technologies.

I had been watching NTLA for months. I pulled the trigger and recommended it in June 2021, because Intellia’s chart was a screaming buy. Here’s what I said in my original buy alert:

Source: StockCharts

I think NTLA will break out of this multi-month consolidation soon for a couple of reasons. For starters, biotech stocks as a whole are beginning to display a ton of strength. I’m also beginning to see strength in genomics stocks.

NTLA looks like it could emerge as a leader in the genomics space.

A couple weeks later, I doubled down on my bullish stance... and emphasized that Intellia had “monster stock potential.” Two days later, Intellia shocked the world. Intellia successfully edited genes inside the human body in a clinical trial.

In other words, it demonstrated CRISPR gene editing technology works for the first time ever. Intellia’s share price spiked on the news… surging 124% over the next five days.

Now, I’ll be the first to admit I didn’t know Intellia’s game-changing announcement was coming. Still, I had a good hunch something big was brewing because a stock’s chart can tell you a lot about the future.

|

Leading up to the trial, many genomics stocks were struggling. Not Intellia. It was holding steady near all-time highs and trading in a tight sideways window... just waiting to erupt from the launchpad.

We ended up booking an 86% gain in five months.

More recently, we booked strong wins in hot artificial intelligence stocks like Super Micro Computer (SMCI) and Nvidia (NVDA) using this tactic.

- If you want to find the next big winner, I recommend using this reliable tool.

Look for a great stock like Fastly or Intellia that’s carving out a long-term base.

And pounce when the stock has successfully climbed out of that base.

It’s that simple.

Justin SpittlerChief Trader, RiskHedge

PS: If you want my best breakout trades every week, my new Express Trader might be perfect for you. It’s a quick-reading, no-nonsense way to help you own the three strongest stocks every week.