Microcaps have been some of the hottest stocks on earth.

Over the past year, microcaps (as measured by the iShares Microcap fund IWC) have rocketed 107%.

That’s more than double the return of the S&P 500 (blue line), which has climbed 47% over the same time frame.

Source: YahooFinance

Source: YahooFinance

If you’ve been following along, you know microcaps are tiny stocks. Because of their small size, they’re able to grow in ways that are simply impossible for large companies.

As our microcap expert Chris Wood says, “With big stocks like Amazon and Google the best you can really hope for is a double from here… the ‘10X’ days are long gone. Microcaps are different. They allow you to get in close to the ‘ground floor,’ before the most explosive growth occurs.”

Chris’s paid-up subscribers are seeing that play out firsthand, recently booking a 399% gain in Kopin (KOPN) and a 422% gain in Magnite (MGNI).

Today, I’m bringing Chris in to find out 2 things:

- Can microcaps continue their run? And

- How can readers profit?

***

Chris Reilly: Chris, microcaps are on fire… but you wouldn’t know it by listening to the financial news. It’s all about Bitcoin, SPACs, NFTs, “environmentally sustainable” stocks…

Chris Wood: Yeah, I’m starting to lose track of all the acronyms…

You’re right: Microcaps are having what you might call a “quiet boom”…

As you mentioned, microcaps soared 126% as a group in the last year…

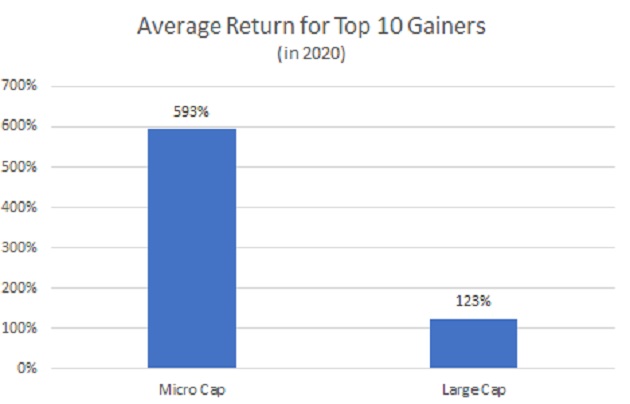

But can you guess how much the top microcaps outperformed the top S&P 500 stocks?

CR: I’d guess something like 3X?

Chris Wood: Almost 5X.

The top 10 microcaps last year averaged a 593% return. The top 10 S&P 500 stocks? 123%.

Source: Bloomberg

Source: Bloomberg

Sometimes it’s easier to think about it in dollar terms.

Theoretically, had you put $1,000 in those 10 microcaps, you’d have walked away with nearly $70,000.

Park the same amount in those S&P 500 names and you’re looking at around $22,000.

I say “theoretically” because nobody’s going to pick the top 10 stocks in a given year. But that’s what’s great about microcaps... all you need are one or two great picks to transform your investment returns from “average” to “superior.”

CR: So, microcaps have more than doubled in the last year. Does that mean it’s too late to get involved in microcaps today?

Chris Wood: It’s a great question. It may seem like microcaps have run up too far, too fast—and that all the big gains are off the table.

But let’s remember what was happening in markets a year ago. Stocks were in meltdown mode after the corona crash. Microcaps plunged 24% in one month... one of the quickest falls on record.

So, more than half of that 126% rally over the last year was microcaps climbing back out of the hole they fell into.

If you measure microcaps’ performance since January 2020, before the corona crash, they’re up 45%. Still a nice gain, but nowhere near 126%.

But there’s something even more important going on with microcaps that most people don’t realize: They have 15 years of “catching up” to do...

CR: Go on…

Chris Wood: Let’s zoom out and look at the big picture.

When you do that, you’ll see that small stocks have actually been lagging large stocks for 15 years.

Take a look at this chart. It’s a “ratio” chart that measures the performance of small stocks vs. large stocks going back to 2006.

Source: StockCharts

Source: StockCharts

When the line’s falling, small stocks are losing ground relative to large stocks. That’s been happening for a decade and a half!

CR: Wow. What do you chalk that up to?

Chris Wood: There’s been an obsession with a handful of very large tech companies over the last 10 years or so. Amazon, Facebook, Google, Netflix...

They’re the first batch of companies that successfully used the reach of the internet to enter every aspect of people’s lives.

Amazon boxes show up on your doorstep every day. Netflix is on your TV for hours every night. Google’s Nest thermostat is constantly monitoring your home. Not to mention, the average American “googles” something 4 times per day...

These companies are almost cultural icons at this point. It makes sense that so many folks have been buying their stocks for years and years without thinking twice. People buy what they know.

I think we’re in the early stages of a reversal, though. As you can see from the ratio chart, the market is starting to favor new, smaller companies with exciting technologies. In other words, microcaps.

And keep in mind, the relationship between small and large stocks tends to “trend” for a long, long time.

I think investors need to ask: What if microcaps outperform large stocks for the next 15 years? Are you prepared to capture that move?

CR: Based on how little attention microcaps are getting—even after soaring 126% in the last year—I’d say most people are not.

Any advice for investors who are looking to get started in microcaps?

Chris Wood: As with all types of investing, risk management is key. The right microcaps have massive profit potential—often 1,000% or more. But with that upside comes risk.

NEVER bet more money than you can afford to lose on any position. While you can make an extraordinary amount of money in very little time with microcaps, they’re also more volatile than larger stocks.

And I recommend taking “free rides” often. Regular readers are surely familiar with our “free ride” strategy by now...

In short, it’s a simple strategy we often use to lock in profits when one of our recommendations shoots up 100%+. The idea is you sell enough shares to take your initial investment off the table, and then let the rest "ride" risk-free.

It's the best way to eliminate any risk… while still going after big gains.

My Project 5X members and I have taken 8 free rides this year. Of course, sometimes you miss out on bigger profits by taking a free ride, but I’d gladly give up a little upside in order to guarantee 100% that a trade will be a winner.

CR: Last question: What’s the easiest way to take advantage of the setup in microcaps today?

Chris Wood: If you’re just starting out and looking to get a little exposure, there’s nothing wrong with buying some shares of microcap fund IWC. The upside in IWC is limited; you’re not going to see 500% gains in a year or two owning a “basket” of stocks, like IWC. But over time, you’ll benefit as microcap stocks outperform large stocks, as I expect them to.

If you’re looking for a high-upside individual microcap to buy, I’d suggest reading this. It’s a write-up that details my #1 microcap to buy now.

***

Chris Reilly here again. And I can vouch that Chris Wood’s microcaps are some of the most explosive names you’ll find today. Besides just taking a quick glance at his portfolio (7 open positions up triple digits)… I recently scored my first 10-bagger off one of his recommendations. And this gain came in just 10 months… doubling Bitcoin’s return over the same time frame.

If you’d like to get in on Chris’s top microcap picks for the rest of 2021—and have a chance to set yourself up for some transformational gains—go here to read his latest briefing. It details his #1 stock to buy now (with 900% upside).

Chris Reilly

Executive Editor, RiskHedge