The indices have been lying to you.

They haven’t been telling the whole story.

But the situation is even worse below the surface. We know this because market breadth is on the skids.

Now, there are many different ways to measure market breadth.

But one of the simplest ways to assess breadth is to simply look at the performance of equal-weight ETFs. So, that’s what we’re going to do today…

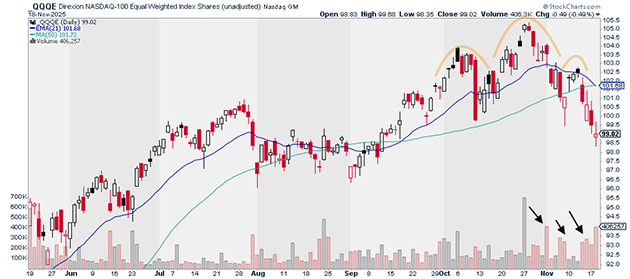

Let’s start with the NASDAQ-100 Equal Weight ETF (QQQE)—a fund that invests equally across the Nasdaq 100.

Below, we can see that QQQE is rolling over after putting in a head-and-shoulders pattern. This sort of action often leads to sharp reversals.

So far, it’s playing out that way:

Source: StockCharts

Source: StockCharts

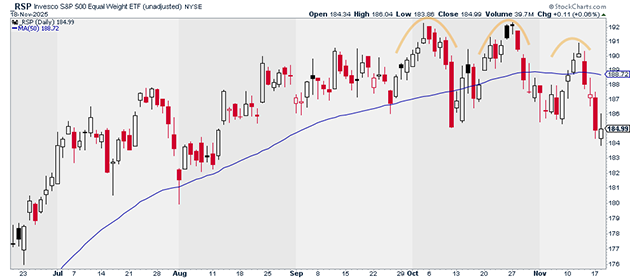

The Invesco S&P 500 Equal Weight ETF (RSP) has its own problems. It too is rolling over after putting in a head-and-shoulders pattern.

RSP is now well below its 50-day moving average, which is starting to roll over:

Source: StockCharts

Source: StockCharts

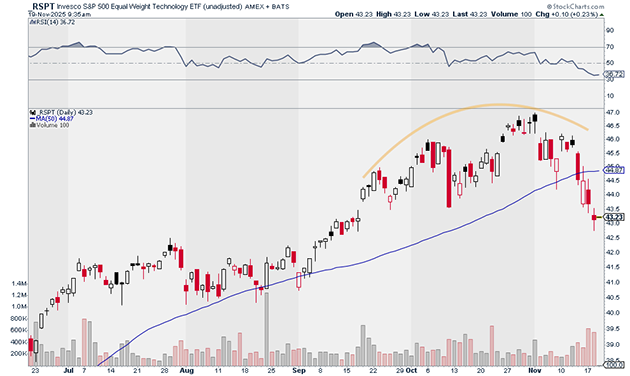

We’re also seeing this play out at the sector level.

Take a look at this chart. It shows the performance of the S&P 500 Equal Weight Technology ETF (RSPT).

RSPT has been putting in a topping pattern for the past several weeks:

Source: StockCharts

Source: StockCharts

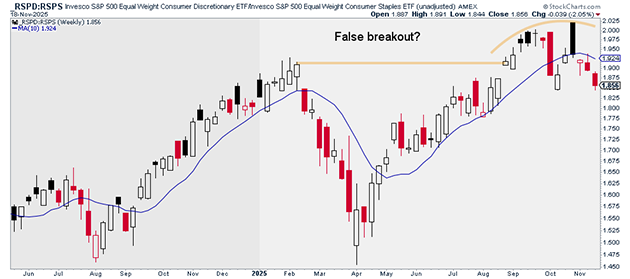

The S&P 500 Equal Weight Consumer Discretionary ETF (RSPD) is also breaking down on a relative basis versus the S&P 500 Equal Weight Consumer Staples ETF (RSPS).

This is evidence of the market going “risk off.”

Source: StockCharts

Source: StockCharts

As I said in my Express Trader letter this week, it’s best to exercise patience until this selloff plays itself out.

That’s what we’re doing, and when new opportunities arise, my Express Trader members will get my three strongest ideas to kick off the week.

Justin Spittler

Chief Trader, RiskHedge