Fears of rising inflation continue to dominate the news.

I’m sure you’ve seen the headlines:

“Another inflation warning”—The Wall Street Journal

“The Fed needs to get real about inflation”—CNN

“Is it time to panic about inflation?”—The New York Times

A recent Bank of America survey shows inflation—not COVID—is now the biggest risk to the markets...

Americans are now Googling the word “inflation” more than any time since 2004…

And we’ve been getting a lot of questions on the subject in our mailbag.

So what’s really going on? And what should you do about it?

I’ll answer that in today’s essay. As you’ll see, inflation fears are pushing prices of one particular asset class through the roof.

And if history is any indication, this could be the very beginning of a massive, multi-year boom.

I’ll show you the facts to back up this assertion in a second.

-

First, let’s quickly look at the latest numbers…

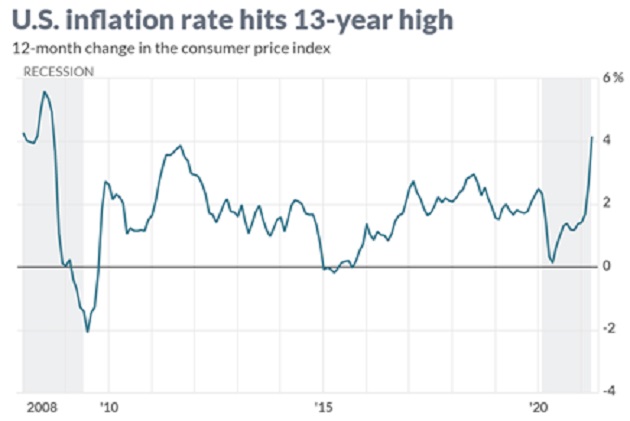

According to the Department of Labor, the US inflation rate—as measured by the Consumer Price Index (CPI)—has soared to its highest level since 2008. Take a look:

Source: MarketWatch

Source: MarketWatch

While the CPI is a widely accepted way to measure inflation—we take it with a grain of salt. It’s hard to sum up the change in prices of thousands of goods and services into a single number.

Plus, the CPI is a government statistic. And the US government has an interest in making inflation seem as low as possible. Especially when it’s borrowing and spending unprecedented sums of money—as the Biden administration is intent on doing.

But, we don’t need the government to tell us inflation is raging...

-

Because commodity prices are spiking in a way we haven’t seen in 10+ years...

Commodities are the building blocks of our world.

Lumber, steel, concrete, oil, aluminum, silver, natural gas, palladium, corn, soybeans...

They’re the “inputs” that form the foundation of the economy.

While there are a lot of ways to hide or misstate inflation... commodities prices always tell the truth.

In other words, if there’s real inflation going on... it’ll show up in commodities prices.

And over the past 12 months, commodity prices have gone absolutely berserk.

Look at the price of lumber. It’s exploded more than 300% over the past year:

Source: StockCharts

Source: StockCharts

To put that in perspective: In April 2020, the average cost of building a 200 sq. ft. wood deck was $936. If you want to build that same 200 sq. ft. deck today, it’ll set you back nearly $4,000.

Not only that, the National Association of Home Builders says the spike in lumber prices has added nearly $36,000 to the average price of a new single-family home... in the last year alone!

And it’s not just lumber…

Corn prices have catapulted more than 100%...

Source: StockCharts

Source: StockCharts

Copper’s doubled too…

Source: StockCharts

Source: StockCharts

Same with crude oil…

Source: StockCharts

Source: StockCharts

Soybeans are rocketing …

Source: StockCharts

Source: StockCharts

Aluminum just struck a 10-year high, and palladium and iron ore are sitting at all-time highs.

By now, you get the point…

But here’s what’s really important...

-

Despite the huge runups in lumber, copper, palladium, and others… we’re still nowhere near past commodities peaks.

This next chart is the most telling of all. It shows a zoomed-out view of the Bloomberg Commodity Index, which tracks prices for 23 commodities, going back to 1960.

As you can see, commodity prices had gone nowhere but down for the prior 12 years.

And even now, despite all the skyrocketing prices I just showed you—commodities are just starting to turn the corner (circled in red).

Source: Bloomberg

Source: Bloomberg

How can that be?

If you read my Saturday Roundup, you know commodities have one defining trait:

Commodities are cyclical.

That means commodity prices go through huge booms and busts that often last years… even decades, as you can see above.

Look what happened when commodities got going during their “supercycle” that began in the 1960s…

They soared nearly 10X from 1960 to their top in 1980.

Then, just like that, the switch flipped. Commodities topped out… and were dead money for the next 20 years.

Then in 2000, the next supercycle began. Gold rose from below $300/oz. to over $1,000 by 2008. Crude oil soared from $20 per barrel to over $140. Copper went from below $1 per pound to as high as $4.

Then commodities prices topped out in 2008... and have been sliding lower ever since.

This is what commodities do. BIG ups, BIG downs. They’re cyclical.

Which makes their prices predictable, to an extent.

-

Don’t blame yourself if commodities haven’t been front and center on your mind…

After all, they’ve gone nowhere but down for the last 12 years!

Like stocks and bonds, commodities are an asset class. But most investors ignore them—because they’ve generally offered negative returns since 2008.

But that seems to be changing. And if history repeats itself, commodities prices are headed a lot higher.

So how can you profit? The easiest way is to buy a commodity ETF, like the Invesco DB Commodity Index Tracking Fund (DBC).

If commodities continue to skyrocket, DBC should do well.

Fair warning: For reasons we won’t get into here, commodities funds like DBC don’t make good long-term holdings. If you buy DBC, treat it as a trade, not a long-term investment.

-

To maximize your profits in commodities, we suggest listening to industry veteran Marin Katusa…

Marin is one of the foremost experts—and our “go-to” guy—in commodity investing. As a professional investor, he has a strong track record of delivering big profits in commodities stocks—with wins of 1,050%, 1,450%, 1,852%, 2,400%... even 4,160%.

And he’s recently revealed a brand-new way to invest in commodities.

We’ve never heard of it before, and we doubt even 0.1% of investors have either. In short, it’s a "secret" commodities sector that has crushed Bitcoin, gold, the Nasdaq, and the S&P by as much as 10X. And according to Marin, early investors stand to make a killing.

As a RiskHedge reader, you can now listen to Marin explain the details on this opportunity in his emergency briefing. Act soon if you want the full scoop—it’s only available until tomorrow.

Go here now to sign up and watch immediately.

Chris Reilly

Executive Editor, RiskHedge