“We could see a very powerful rally in the short term.”

I said this on an exclusive call with RiskHedge Reserve members on July 21.

At the time, many investors wanted nothing to do with stocks. Sentiment was in the gutter.

A survey by the American Association of Individual Investors revealed 53% of respondents were “bearish.” They expected stocks to head lower. That reading came in well above the historical average of 31%.

And I get why folks were nervous.

Inflation has been through the roof. The economy had contracted by 0.9% from the previous quarter. And many large companies were beginning to announce mass layoffs.

-

But I saw one key indicator was going from “horrible” to “less bad”... and it was setting up an opportunity…

Since our Reserve call, the Nasdaq has rallied 8%. The S&P 500 has climbed 7% over the same period.

Many individual stocks have performed far better. In fact, some of the best growth stocks have surged 100% or more off their lows.

These are major moves. But I think many stocks will head much higher.

Today, I’ll explain why I think the current rally could have serious legs. I’ll also share my number-one piece of guidance for folks who want to buy stocks in this environment.

But let’s first look at why I saw a rally on the horizon.

-

In short: I knew inflation was peaking…

Today, we know this to be true.

Last month, the official inflation rate came in at 8.5%. That’s down from 9.1% in June.

I saw this coming because I’ve been watching commodity prices like a hawk. Commodities are the building blocks of our world. Steel, oil, natural gas, copper. They’re the “inputs” that form the foundation of the economy.

Because of this, commodity prices can clue you in to what’s really going on with inflation... before the government readings come out.

Last month, many key commodities were in the process of rolling over, as we showed you here.

And they’ve continued to fall since.

Oil has fallen 28% from its peak. Copper is down 26% from its highs, while the price of wheat has collapsed 38%.

This is a huge deal.

Inflation has been the #1 headwind weighing on the stock market. Now that it’s “officially” falling, stocks are ripping.

But that’s not the only reason I see stocks headed higher.

-

Many of the biggest, most important stocks are on the rise…

Apple (AAPL), the world's biggest and most important stock, has been trading above its 200-day moving average since late July. It’s now trading within 6% of its all-time high.

Microsoft (MSFT) has rallied 21% off its lows. Amazon (AMZN) has surged 41% over the past eight weeks. And Google (GOOG) is up 15% over roughly the same period.

These stocks have an outsized impact on the overall market. When they do well, the rest of the market tends to follow. And vice versa.

Of course, healthy markets aren’t only propped up by a few big stocks. I like to see many stocks participating, and that’s exactly what’s happening.

- Market breadth has been steadily improving…

Simply put, market breadth refers to the number of stocks in a particular sector or index rising in price versus those declining in price.

Market breadth has improved significantly in recent weeks. You’re looking at the performance of the Invesco S&P 500 Equal Weight ETF (RSP). It’s rallied 17% over the past eight weeks.

Source: StockCharts

Source: StockCharts

It’s now trading above its 200-day moving average. If it can stay above this key indicator, it could begin a new long-term uptrend. And I believe there’s a good chance for that to happen.

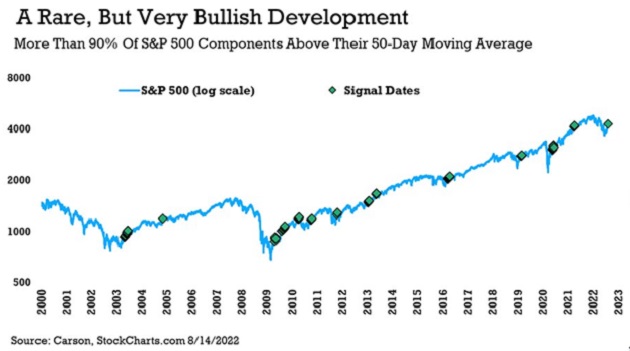

On Friday, 90% of stocks in the S&P 500 closed above their 50-day moving averages.

This is what’s known as a “breadth thrust.”

Previous instances where this has happened (green diamonds in the chart below) have been followed by powerful rallies. In other words, it’s historically been a strong buy signal.

Source: Carson

Source: Carson

Here’s another bullish development I’ve been tracking...

-

Stocks are no longer going down on bad news…

Facebook (META) had its worst quarter ever, and it didn’t break down to new lows. Instead, it’s rallied 11% since it reported earnings on July 27.

And that’s just one example.

Robinhood (HOOD) announced that it’s going to cut its workforce by 23%. It’s since gained 23%.

Pinterest (PINS) recently reported its lowest sales growth rate in years... and spiked 12% in a day.

Some investors might look at these moves off bad news as a sign that the market has lost touch with reality. But I see things differently.

You see, the market is a discounting mechanism. It often “prices in” good or bad news before you hear about it in the mainstream media.

For example, concerns about rising inflation or a slowing economy will show up in stocks before the government admits that either of these things is a problem.

On the flipside, the market will look forward and price in positive outcomes before the government or the mainstream media tells us that everything is OK.

-

I believe now is still a good time to buy stocks…

But it’s important to remain disciplined and selective.

Don’t chase.

Many stocks have already made powerful moves. Hundreds of others are setting up for their own explosive rallies.

So, there’s absolutely no reason to overpay for any stock in the current environment. Instead, exercise patience and wait for stocks to come to you.

Justin Spittler

Chief Trader, RiskHedge