Stocks have been red hot.

The S&P 500 (SPY) has ripped 32% higher off its April lows.

The tech-heavy Invesco QQQ Trust (QQQ) has performed even better. It’s surged 41% since April.

It’s been a rally for the ages. But the market is starting to get a little stretched.

A pause here wouldn’t be surprising. In fact, it would be healthy.

There’s good reason to think that happens. I say this for a few reasons.

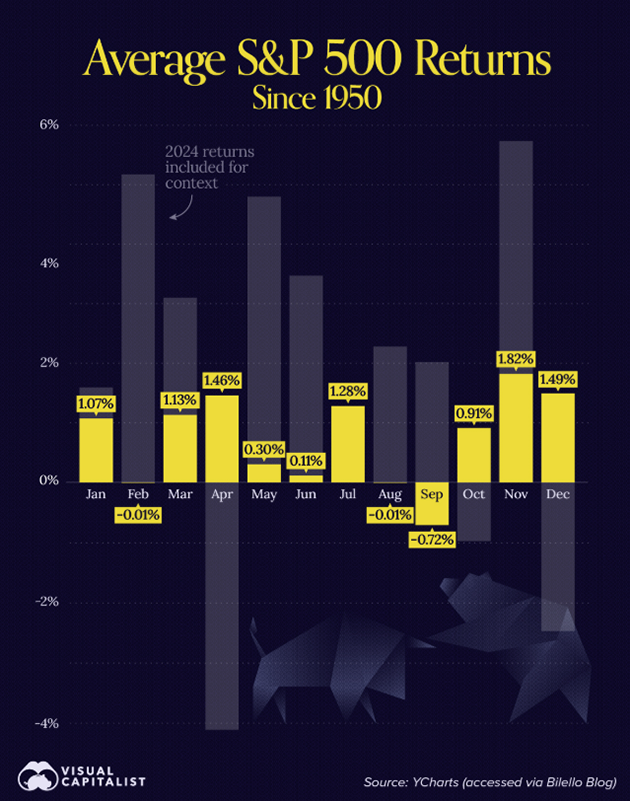

The first is seasonality. We’re about to enter one of the weakest periods of the year for stocks. Historically, the S&P 500 has delivered sub-par returns during the months of August and September.

Source: Visual Capitalist

Source: Visual Capitalist

The almighty dollar could also crash the party…

The US Dollar Index (USD) has been on the rise all month. It’s put in a series of higher highs and higher lows, and momentum is starting to pick up. A rising dollar is often a headwind for stocks.

Source: StockCharts

Source: StockCharts

Finally, volatility looks like it’s about to perk up. As we can see below, the Volatility Index (VIX) is at multi-month lows. The index measures how much traders expect volatility to rise in the near term. A low VIX reading can indicate complacency.

The VIX chart is also starting to get awfully tight. When a chart compresses like this, it often means that a big move is coming. In other words, we could see a big uptick in volatility soon.

Source: StockCharts

Source: StockCharts

If stocks do sell off, it doesn’t mean this bull market is over. Not by a long shot. Instead, it presents an incredible buying opportunity.

So don’t confuse caution with pessimism. The trend is still higher. But even the strongest markets need to breathe.

Inside my Express Trader advisory, I show readers exactly how to stay ahead of volatility with the three strongest trades I’m making each week.

Express Trader is simple, focused, and built for moments just like this. Here’s how to join.

Justin Spittler

Chief Trader, RiskHedge