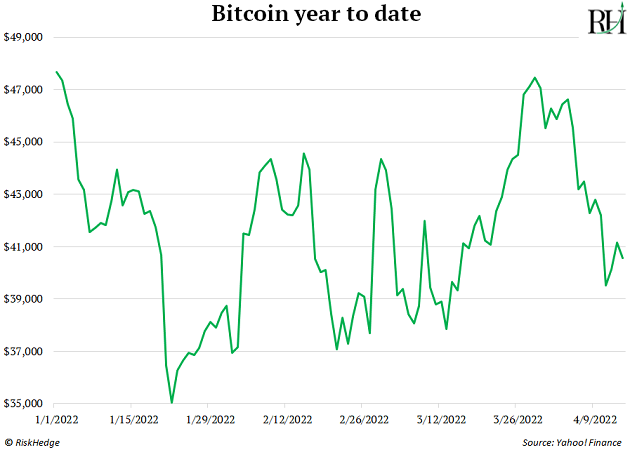

Bitcoin prices are bouncing up and down like a yo-yo.

The world’s largest crypto started the year at around $50,000, plunged to $35,000, then rebounded to $40,000…

If you’re new to crypto, bitcoin’s price swings can be confusing. But as I’ll show you today, not only is this volatility normal: you can use it to your advantage.

You see, volatility goes both ways. I’ll expand on that in a moment, but first…

-

What if I told you that over the past 10 years, bitcoin has had the equivalent of three Great Depressions and five 2008 crises?

In the Great Depression, the S&P 500 plunged 89%.

In the 2008 financial crisis, the S&P 500 plunged 56%.

|

[Free Video Presentation for RiskHedge Report Readers] Don’t sit on the sidelines as millions of Millennials disrupt the economy—and a new breed of stocks takes over the market. |

Those were two of the worst drops for US stocks ever. In fact, the only other time in the past 90 years that US stocks fell more than 50% was in 1937.

While a huge 50% drop is a once-in-several-decades event for the US stock market… it’s a normal occurrence for crypto. Bitcoin, the largest crypto, trades like a tiny, speculative stock.

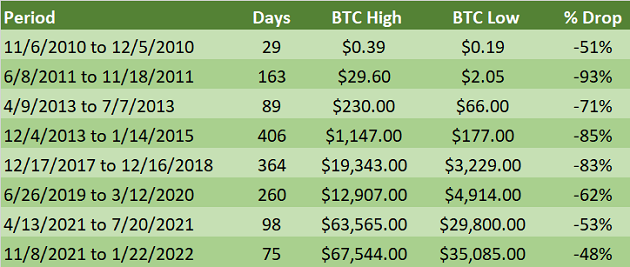

As you can see, bitcoin has suffered eight 48%+ corrections since 2010:

Source: BuyBitcoinWorldwide.com

Source: BuyBitcoinWorldwide.com

In other words, roughly every 18 months, bitcoin gets cut in half.

-

“Stephen… Why would anyone buy such a volatile asset?”

Because volatility cuts both ways.

Bitcoin has vicious selloffs, but it has even bigger rebounds.

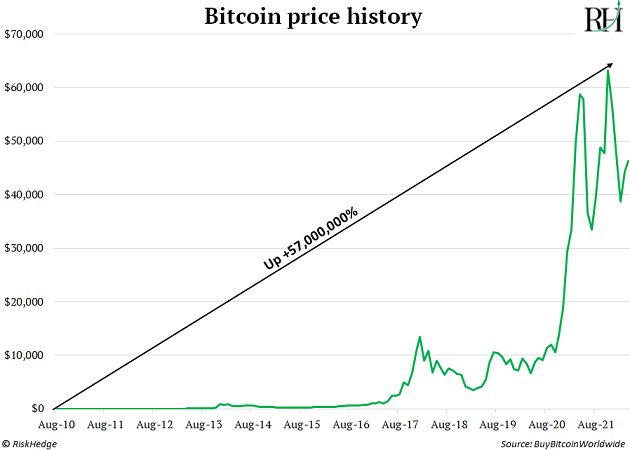

Despite getting chopped in half eight times since 2010, bitcoin soared 57,000,000% in this period.

- If you bought bitcoin each time it got cut in half, you made money. A lot of money.

Bitcoin soared an average of 234% six months after suffering a 50% correction. Those average gains jump to 382% when you zoom out to one year.

It’s frightening to see half your money evaporate, often within a few weeks. But the facts show that buying bitcoin after it crashes has been a winning strategy.

How can we use this to guide us today?

Bitcoin last peaked at $67,500 last November. It bottomed at $35,000 in late January. That’s roughly a 50% drop.

In other words, if history holds true, bitcoin could have a big run into the summer.

If it matches past rebounds, bitcoin would soar past $130,000/coin in the coming months. That’s a 215% rise from today’s prices.

- Did you know US stocks were once as volatile as bitcoin?

I love reading financial history.

Knowing a lot about the past helps you recognize patterns. When you read enough, you discover the same things happening over and over again.

One of the most exciting periods in financial history is the first 120 years or so of the US stock market. This period is littered with panics and crashes.

You had the panic of 1819, the panic of 1837, the financial crisis of 1873, the meltdown in 1907, the Great Depression in 1929, and many more panics in between.

Markets melted down every couple years. And stocks were insanely volatile.

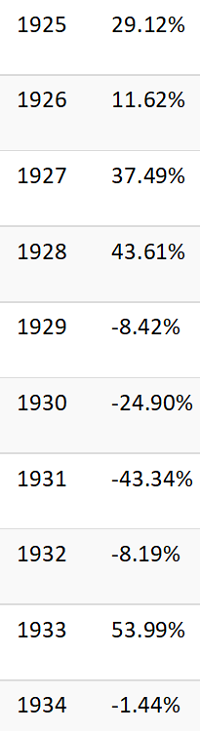

Since 1825, US stocks posted annual gains or losses of 50% or more six times. Five of those years happened before 1940…

Seven of the ten worst years in stock market history happened prior to 1935…

And remember, volatility works both ways. Eight of the ten best years in stock market history happened before the 1930s.

We all remember March 2020. COVID-19 hit, and US stocks plunged to their fastest bear market ever. Then the S&P 500 rebounded to finish the year up 18%.

Imagine that volatility… for a decade straight. Look at the wild swings US stocks experienced in the 1920s and ‘30s.

-

Crypto is the “new” stock market.

Do you see the parallels between US stocks a century ago and crypto today?

Back then, stocks were a brand-new asset class. Buying a piece of a business was a weird concept. Even by 1920, only around 1% of Americans owned stocks.

Stock prices experienced wild swings. Back then, they were just numbers on a board to most folks. Nobody knew how to value or analyze stocks.

Sounds like crypto today, right? It’s a new asset class… extremely volatile, and most investors still don’t own it. A CNBC poll found only one in five Americans have owned crypto.

Crypto’s big moves can be hard to stomach. But you should learn to embrace them.

Anyone who bought and held US stocks when they were a new, volatile asset got incredibly rich.

Investors who bought US stocks in 1900 triple their money in just over a decade.

Sky-high volatility is a hallmark of new asset classes. Crypto prices are volatile because we’re so, so early. And there’s a lot of money to be made.

-

Here’s my #1 tip to make money in crypto: size your positions properly.

Sitting through 50% selloffs is easier said than done.

I’ve seen many investors panic and hit the sell button at exactly the wrong time. Their biggest mistake? They invest too much money.

When you have too much money in an asset that plunges 50%, you’ll likely panic.

The solution is correct position sizing. Investing only a small amount of money in crypto allows you to sit tight through nasty selloffs… and stick around for the big gains that typically follow.

Crypto has been the best performing asset class in the world over the past decade. Bitcoin soared 57,000,000% since 2010. Many smaller cryptos have handed out incredible gains too.

With these types of gains, you don’t need to go “all in.” You can invest 1–2% of your portfolio in crypto and still make great money.

Stephen McBride

Editor — Disruption Investor

PS: Next month, I’ll be speaking at the prestigious Strategic Investment Conference—a closed-door gathering of many of the world’s greatest investors, which will be virtual again this year. I’ve gone for the past five and got to meet true legends and billionaires like Jeff Gundlach, John Burbank, and Mark Yusko (who convinced me to buy bitcoin back in 2017, back when it was trading for only $1,500). I even got to chat and shake hands with a former president.

This year, I’ll be talking about a specific, game-changing crypto event happening soon that anyone interested in the space needs to know about. I’ll share all the details and how to play it during my presentation on May 13.

In total, there will be 52 expert speakers, 40 live presentations and fireside chats, and six days full of timely insights and analysis, which you can watch from the comfort of your own home with a virtual pass.

Hope to “see” you there. Check out the full lineup of speakers—and claim your virtual ticket for 44% off if you’re interested—right here.