It’s confirmed: We’re in a bear market.

Yesterday’s plunge put the S&P 500 down 20% from its January peak... which qualifies this as the first bear market since 2020… and 2008 before that.

Markets are ugly:

Source: FinViz

You’re looking at a “heat map” of the S&P 500. The stocks in red were all down last week. Amazon dropped 10%... Microsoft and Apple fell 6%... the list goes on. The few in green—mostly oil stocks—managed to inch higher.

Of course, it’s not just the S&P 500 struggling…

The tech-heavy Nasdaq is hitting lows not seen since 2020. And the Russell 2000, which tracks small-cap stocks, is flirting with lows not seen since 2018.

|

[RiskHedge Exclusive Report] The Triple Halving is the most exciting development in the world of crypto—possibly since the debut of bitcoin itself—and it could lead to gains ranging from 667% to as high as 7,976%. |

But outside of stocks, there’s a notable sector that’s holding up pretty well… and even finished last week slightly in the green.

Gold.

Today, I’ll explain why this could be the start of a major rally for gold, and why gold and gold stocks need to be on your radar. But let’s first look at why stocks continue to take a beating.

-

Inflation keeps roaring higher…

Coming into last week, many investors were optimistic that inflation was finally cooling off. Instead they got a nasty surprise. Headlines showed the rate of inflation accelerated again in May.

US inflation has now risen 8.6% from the same month a year ago. That’s its fastest pace since December 1981. There’s now talk that the Federal Reserve will raise its benchmark interest rate by 0.75% soon to cool inflation. That would be its biggest rate hike since 1994.

If that happens, interest rates will have risen by a massive 1.75% in a single year. These rapidly tightening financial conditions are putting intense pressure on stock prices.

-

Gold prices, on the other hand, are hanging in there…

Gold is a proven safe haven. For thousands of years, investors have used it to preserve their capital when markets get chaotic.

Over long periods of time, owning gold is also an effective hedge against inflation. Because unlike stocks and bonds, gold’s value isn’t dependent on the value of the US dollar.

Let’s look at how gold’s been holding up…

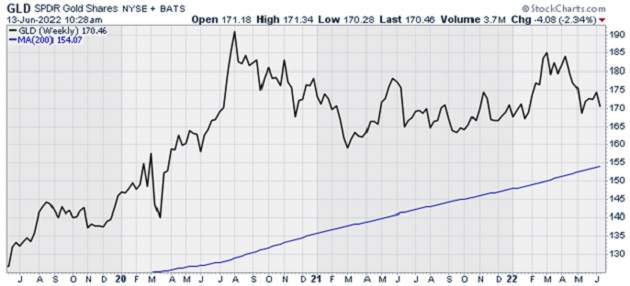

You’re looking at the SPDR Gold Shares (GLD), which tracks the price of gold. Here, we’ve zoomed out to a three-year chart of GLD. You can see that it hasn’t broken down like many stocks have lately. Instead, it put in a higher low.

Source: StockCharts

GLD also continues to trade above its 200-day moving average (blue line).

In other words, it’s bucking the trend in stocks and bonds. Gold is doing its job. Owning gold probably won’t make you rich… but it can help you minimize losses and ride out storms in the stock market.

-

Gold looks even better compared to stocks…

This next chart compares the performance of GLD with the SPDR S&P 500 ETF (SPY), which tracks the S&P 500. When this line is rising, gold is outperforming stocks.

Below, you can see gold has been decisively beating stocks this year. This chart shows a strong basing formation… which means there’s a strong likelihood gold will continue to outperform stocks for weeks or months.

Source: StockCharts

-

You should also keep a close eye on gold stocks…

Gold stocks refer to gold miners, primarily.

Gold miners have “leverage” to the price of gold. Meaning when gold moves an inch, gold stocks can move a mile. That makes gold stocks highly volatile—and therefore much riskier—than owning gold outright.

Take a look at the VanEck Vectors Gold Miners ETF (GDX) below.

Notice two things. One, gold stocks haven’t been immune to selling pressure. Two, gold stocks finished last week strongly. GDX is building a large base, which is a sign prices could soon move upwards:

Source: StockCharts

Keep in mind, gold stocks won’t stabilize your portfolio like gold will. Instead, they give you a chance to earn bigger, quicker profits when you catch an upswing. If gold prices continue to climb like I expect, gold miners look like a smart bet to see a big upswing.

I’m watching gold and gold mining stocks very closely. If they continue to show strength, I’ll be buying.

Justin Spittler

Chief Trader, RiskHedge

PS. If you’re interested in buying gold, consider our friends at Hard Assets Alliance.

They’ve made buying gold extremely simple… no matter if you’re a beginner or someone who’s been buying gold for years.

With Hard Assets Alliance, you can buy, sell, and store gold right from your computer. We’re talking fully insured, physical gold stored at the world’s most trusted vaults. And its network of wholesale dealers ensures you always get the best possible price.

For more information on gold, and why portfolios perform better with it, Hard Assets Alliance put together a free report for you here.

It details how much gold boosts your yearly returns, how it performs during recessions, and why it’s the “ultimate hedge.”