You won’t hear about it in the mainstream media…

But my favorite group of “sleeper stocks” is pulling away from the broad market.

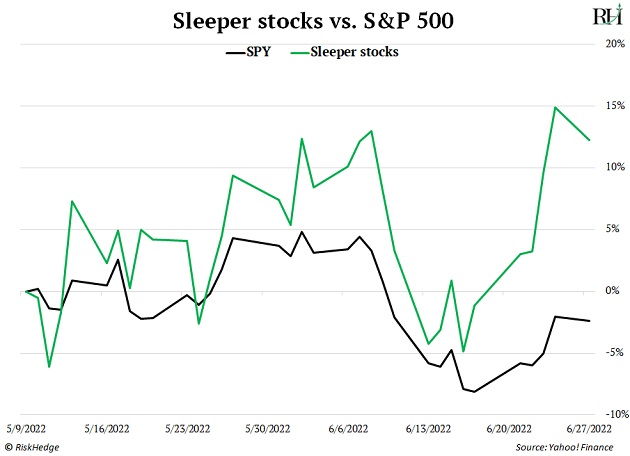

These sleeper stocks (green line) are up 13% over the past seven weeks. The S&P 500 is down 2% over the same time frame:

As their name implies… most folks aren’t thinking about sleeper stocks right now. They’re focused on the major indices like the S&P 500 and tech-heavy Nasdaq, which have plummeted due to sky-high inflation and rising interest rates.

But while the indexes get all the headlines… sleeper stocks are where true opportunity lies today. And it’s time to get your shopping list ready.

I’ll share why in a second, including one of my top sleeper stock picks. But first…

-

It’s time to shift your mindset on the “stock market.”

We’re now in an environment where it pays to think of it as “a market of individual stocks and sectors.”

What’s the difference?

In a “stock market,” almost all stocks move together. When the S&P is down, nearly every stock of significance is down. Only one thing matters: Is the stock market going up, or down?

|

Being a stock market winner means backing companies that change the world and transform huge industries. We call these “megawinners”—stocks that can multiply your money. If you’d like to see how to find the stock market’s next megawinners—including details on Stephen McBride’s top three—click here. |

Thinking about the stock market as one big blob is a simple mental shortcut. But it masks opportunities. For example, if you solely focused on the S&P 500’s big dip to start the year, you would’ve missed out on a nice trade in energy stocks. Which I said was my top “out of the box” idea on February 1.

The Energy Select Sector SPDR Fund (XLE), which tracks a basket of energy stocks, jumped for peak gains of 42% since then.

Today, a similar opportunity is presenting itself…

When you zoom in, you’ll see a select group of stocks is no longer falling while the rest of the market struggles.

-

I’m talking about IPOs…

As longtime readers know, IPO stands for initial public offering. This is when a company lists its shares on the open market for the first time.

IPOs are often the first chance for everyday people to invest in the next wave of disruptive companies. For this reason, IPOs are some of the most explosive stocks on the market. If you buy the right one at the right time, you’ll see big financial rewards.

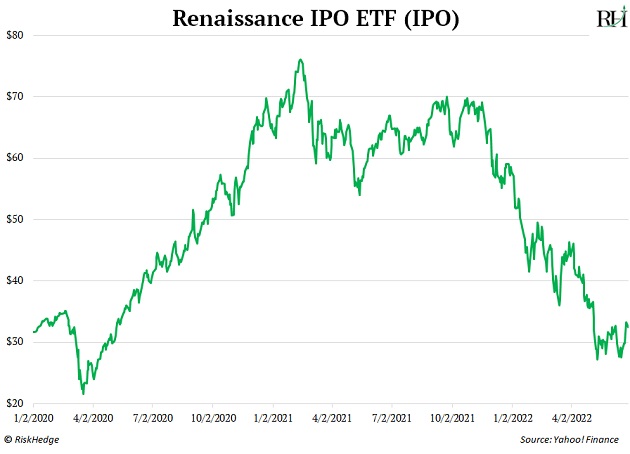

From March 2020-February 2021, IPOs were some of the hottest stocks on the market. The Renaissance IPO ETF (IPO), which holds a basket of recent IPOs, skyrocketed more than 200%.

But then IPO came crashing down…

In fact, IPO collapsed so hard that it’s now trading near where it was during the 2020 Covid crash:

Unlike in 2020‒2021, many recent IPOs have debuted on the market without much hype. Investors have been too worried about inflation, rising interest rates, and the major indices to pay attention to the IPO market.

Some individual IPOs have even fallen 60%... 70%... even 80% from their recent highs.

Other companies have gone public without much fanfare…

For example, take Duolingo (DUOL), the language learning app. It’s fallen 57% since it IPO'd last August.

Toast (TOST), the cloud-based restaurant software company, went public in September. It’s since fallen more than 80%.

These are solid companies. If they went public in 2020 they’d be all over the news. They simply went public at one of the worst times possible.

In short: IPOs have been left for dead.

But under the surface, I’m seeing positive signs…

-

Unlike the S&P 500 and the Nasdaq, the IPO ETF has not fallen to new lows.

IPO has not hit a new low since early May. In fact, it’s climbed higher over the past seven weeks.

Why is that important?

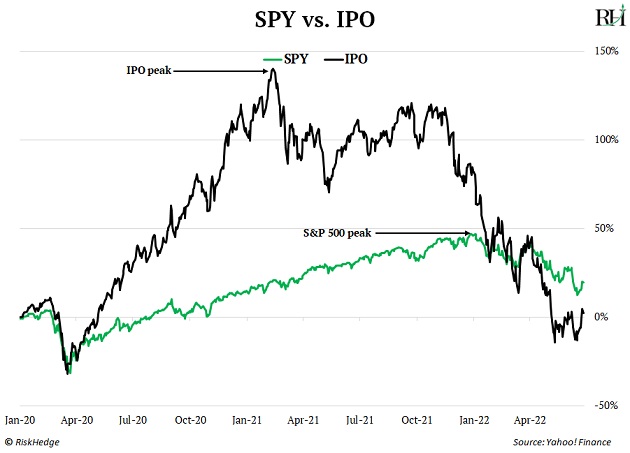

Because IPOs peaked long before markets did…

11 months to be exact.

Take a look. The US stock market peaked in January 2022. IPOs rolled over almost a year earlier in February 2021.

It is not unusual for IPOs to lead the market like this.

I expect IPOs to bottom well before the market too… and this new relative strength is an encouraging sign.

-

If you’re ready to put your IPO shopping list together, here’s my guidance:

Focus on the best-performing IPOs. There are two simple ways to do this.

- Look for IPOs that have held steady while the rest of the market has plunged. Even better if an IPO has managed to eke out a small gain while the rest of the market is down.

- Look for IPOs that are putting in higher highs and higher lows.

Next, focus on profitable IPOs or ones with a clear pathway to turning a profit. They have the best chance at thriving during the rising-interest-rate and high-inflation environment we find ourselves in today.

-

One sleeper stock IPO I’m watching closely is GitLab (GTLB)…

GitLab is a platform for open-source code collaboration. Developers use it to create, review, and deploy code faster.

The company is a clear leader in its industry. More than 100,000 organizations around the world use its platform, including Goldman Sachs, Delta Air Lines, and Nvidia. NASA and the United States Air Force also depend on the company.

GTLB went public in October—less than three months before the S&P 500 topped in early January. It’s down 44% since, but it’s still a phenomenal business.

The company reported earnings on June 6. Its sales surged 75% from last quarter to $87 million, beating consensus estimates by 12%.

GTLB surged 28% on the news, on very heavy volume. At this stage, GTLB appears very close to breaking its downtrend that it’s been in since November.

Keep an eye on this one. If GTLB continues to show strength, I’ll be officially recommending it to my paid-up IPO Insider members.

Justin Spittler

Chief Trader, RiskHedge