Editor’s note: Today, RiskHedge publisher Dan Steinhart takes the reins to break down how much you can truly expect to earn investing. You might be surprised...

And if you haven’t read Dan’s invitation to join the new RiskHedge, go here now. (It comes offline in two days.)

***

How much money can you, as an individual investor, really expect to make from investing?

I’m not talking about in a single year… or even five years. I mean over the life of a typical investor—40 years or so.

What’s the best return you can hope for?

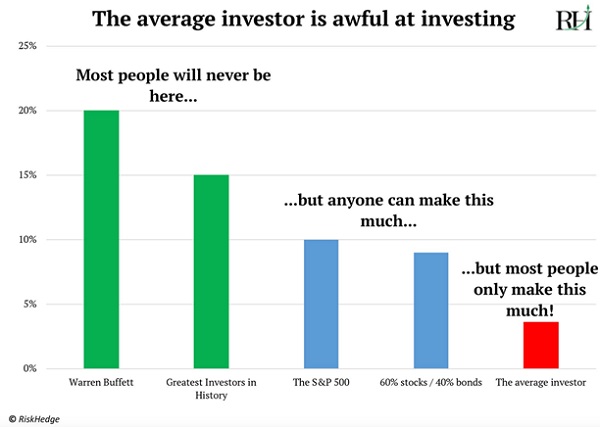

Warren Buffett is the greatest long-term investor in history. He’s compounded his money in his holding company, Berkshire Hathaway, at about 20% per year since 1965.

Now, 20% might not sound all that impressive. It looks small compared to the 1,000%+ gains that are achievable in individual investments. Yes, one great stock or crypto pick can multiply your money 10X, 20X, 30X.

But these are one-off gains. They happen once, and that’s it. Hitting a 20X will give you a hit of the feel-good chemical dopamine and something to brag about.

But to really move the needle on your wealth, you must focus on your total portfolio returns. One-off gains, no matter how big, can’t snowball or “compound” into lasting wealth like portfolio returns do.

Don’t get me wrong… it’s okay to speculate. It can be extremely profitable to speculate if you have the proper guidance. But here, I’m talking about achieving sustained success for an entire portfolio.

***Buffett’s 20% over 55 years led to 2,500,000% gains…

No one in history can match that.

Some candidates for the second-greatest investor of all time:

John Templeton made 15% over 38 years.

Seth Klarman’s hedge fund made 15% over about 35 years.

Peter Lynch compounded at 29%—but only for 13 years.

Notice that earning returns of 15% to 20% over long periods is top-of-the-mountain elite? Only a handful have done it. And they are all professional investors—people who dedicated their careers to squeezing out every last 0.1%.

In other words… collecting long-term returns of 15% to 20% isn’t exactly realistic for the average guy.

But here’s some great news: The S&P 500, by itself, has grown roughly 10% per year over the long term.

That’s pretty good! And you can collect it by doing almost nothing. Just put your money in the market and leave it alone.

If you invest $5,000 a year for 40 years and compound your money at 10%, you’ll have $2.4 million to retire on. Forbes says the average American needs $1.7 million to retire.

And the “benchmark” 60/40 portfolio—60% stocks and 40% bonds—isn’t far behind the S&P 500. It has compounded at roughly 9% per year.

***Now here’s the shockingly bad news:

The average investor, according to a comprehensive study done by JPMorgan, makes just 3.6% over the long term.

Disaster, right? You can DO ALMOST NOTHING and earn 10%.

Yet… most investors can’t just do nothing. They get greedy. They get scared. They’re seduced by slick talkers or rotten marketing.

Then they make mistakes.

Remember the scenario above? Now say you invest $5,000 a year for 40 years, but only earn returns of 3.6%. Now you’ve only got $448K when it’s time to retire. Uh oh. Forbes still says you need $1.7 million to retire.

Here’s how all this looks visually.

The green bars are the greatest investors of all time. It’s a worthy goal to earn 15%+ per year like they do, but don’t count on it. The blue bars are returns of simple “do nothing” styles—stocks and 60/40 portfolios. Anyone can easily be in that range by simply buying “the market.”

The red bar is how most people do:

***The first job of any smart investor is to get into the range of the two blue bars above.

That’s your #1 job, above all else. Figure that out first.

Then, and only then, should you think about more advanced things with higher upside, like individual stock picking.

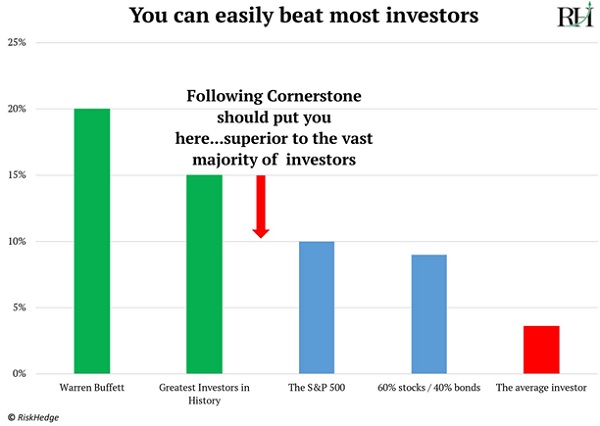

The great news is the Cornerstone method gets you in between the green and blue bars.

Regular readers know Cornerstone Club is our latest advisory at RiskHedge. It uses a rules-based method with a 50-year track record of beating the market... a method I’ve personally used to manage my family’s money since 2016.

Over the last 20 years, the Cornerstone method has averaged returns of about 11.5%. Not quite Warren Buffett… but pretty darn good.

With close to zero effort, you would’ve beaten the market and more than tripled the returns of the average investor!

Remember our hypothetical guy who retired comfortably with $2.4 million?

You can do better… a lot better. Invest $5,000 a year for 40 years and compound your money at 11.5%, you’ll have $3.7 million at the end. That’s $3.2 million more than the average investor who made pathetic 3.6% returns over 40 years.

Now you’ve got Forbes’ $1.7 million recommendation easily covered… plus $2.0 million more to have fun with.

***Following and sticking to the Cornerstone method is the best way I know of to consistently make superior investing returns...

Cornerstone tells you what to invest in, and when. If a major asset class is “working” somewhere in the world (prices are going up), Cornerstone makes sure you own it. And it ensures you don’t own falling or underperforming assets.

You simply follow the rules and enjoy a very high likelihood of collecting market-beating returns, backed by an ironclad 50-year track record.

So... what is Cornerstone saying today?

In short: It’s bullish.

Last year, Cornerstone directed me to be in mostly cash and commodities.

Now, it’s a different story. Cornerstone is 100% invested and 0% in cash for the first time since 2021.

Next month, that could change. That’s the great thing about Cornerstone: There’s no guessing. No emotions. Both of which kill the average investor’s returns.

We launched Cornerstone Club last year. It’s the first RiskHedge product designed to help manage your core portfolio. In short: I recommend “building around” the Cornerstone method. Use it to earn strong returns on the part of your portfolio you can’t afford to take big risks on. Then, use our other services, which include much higher upside individual ideas like microcaps and disruptor stocks, to speculate with a small slice of your portfolio.

If you haven’t yet read my invitation to you, this is the perfect time to capitalize off everything we have to offer. All our research. Every pick.

It’s all part of what I’m calling the “new RiskHedge”... the largest upgrade to how we deliver our research to you in our company’s history.

Click here to see why I’m doing it... and if you qualify for a personal credit. Just know this invitation will come down Wednesday at midnight.

As always, thank you for being a RiskHedge reader.

Dan Steinhart

Publisher, RiskHedge