There are 2,755 billionaires on earth, according to Forbes.

But only four are rich enough to qualify as “centi-billionaires”—worth $100 billion or more.

Amazon founder Jeff Bezos is #2.

Tesla’s Elon Musk sits in the 3rd spot…

Microsoft founder Bill Gates is #4.

But #1 will probably surprise you.

It’s not super-investor Warren Buffett. It’s not Facebook CEO, Mark Zuckerberg.

It’s not a hedge fund manager, a banker, or a Russian oligarch.

-

The richest person on earth is a French guy who sells women’s purses...

On Monday, Bernard Arnault’s personal fortune grew to $186 billion.

If you don’t know the name, Arnault is CEO of luxury empire LVMH (LVMUY)—best known as the parent company of Louis Vuitton. He also owns $116 billion fashion giant Christian Dior.

Bezos and Gates made their fortunes “the regular way”—by developing game-changing products that hundreds of millions of people use every day. Eight in every ten computers run on Microsoft’s software. Over 100 million Americans subscribe to Amazon’s Prime delivery service.

Elon Musk is following this path by pioneering high-performance electric vehicles.

Arnault got rich in a whole different way. He built super luxury brands like Louis Vuitton, Givenchy, Hublot, and Dom Perignon.

A prestigious brand is a powerful thing. A no-name handbag from Target might cost $100—tops. But women line up around the block to hand over $5,000 for a Louis Vuitton.

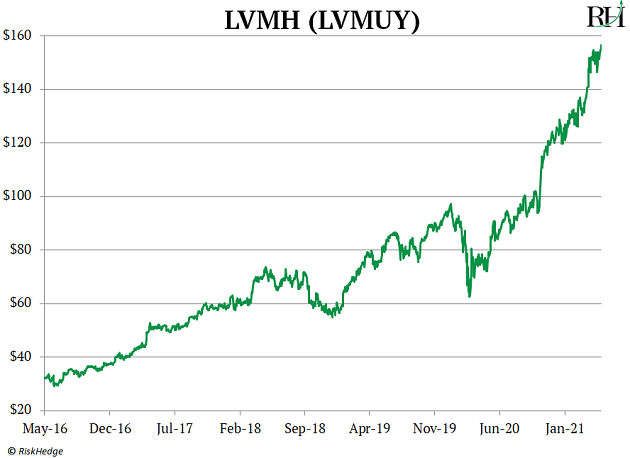

LVMH’s business is booming. Sales have surged 50% in the past four years, and its stock has shot up 380% since 2016, vaulting Arnault into the centi-billionaire club.

-

Gucci is booming too...

Like Louis Vuitton, Gucci is a super-luxury brand. If you want a pair of Gucci sneakers, prepare to drop at least a thousand bucks.

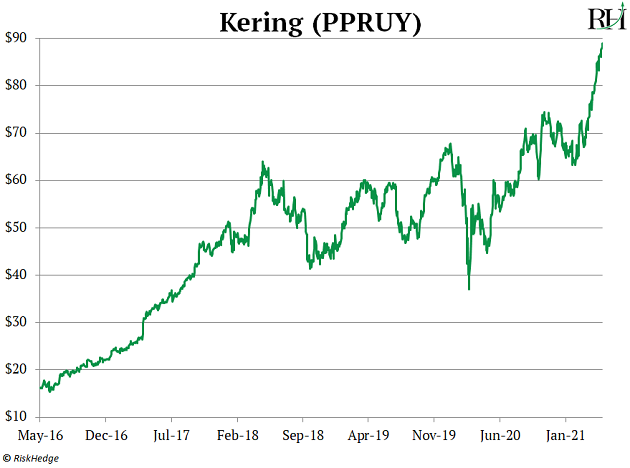

It might sound ludicrous to spend the equivalent of a small mortgage payment on shoes, but Gucci’s are flying off the shelves. Profits at its parent company, Kering (PPRUY), have more than doubled over the past four years.

Kering’s stock is on fire. It’s surged 445% in the past five years, outpacing Amazon and Microsoft over the same period.

-

But Stephen, what about the “death of retail?”

You know all about how online disruptors like Amazon are putting regular stores out of business.

According to leading retail research firm Nielsen, more than 30,000 stores have shut their doors in the past few years.

Yet online disruption hasn’t hurt luxury sellers one bit. Super luxury companies have proven totally immune to the internet wrecking ball. A recent study from “Big 4” accounting firm Deloitte found sales for luxury retailers have more than doubled in the past five years!

Instead, it’s the middle-of-the-road retailers that are getting crushed.

Toys “R” Us… Sears… J.C. Penney… Borders… Circuit City… and RadioShack are all bankrupt.

Meanwhile, many other middling retailers are barely clinging to life. Despite its recent run, Macy’s (M) stock has been cut in half over the past five years. Mall owner Simon Property Group (SPG) has collapsed 40% over the same timeframe.

-

These disrupted stores made one mistake there’s no coming back from...

They tried to be everything to everyone.

The “department store” business model used to work okay. Open a big store, sell everything from blouses to outdoor grills to video games. As long as the store was located in a place with enough people coming through—like a city or a shopping mall—it could do good business.

Those days are long gone. Internet shopping has blown up unspecialized, “middle of the road” stores.

-

Meanwhile, low-end discount stores are doing just fine...

According to Deloitte, discount store sales have surged 60% in the past five years.

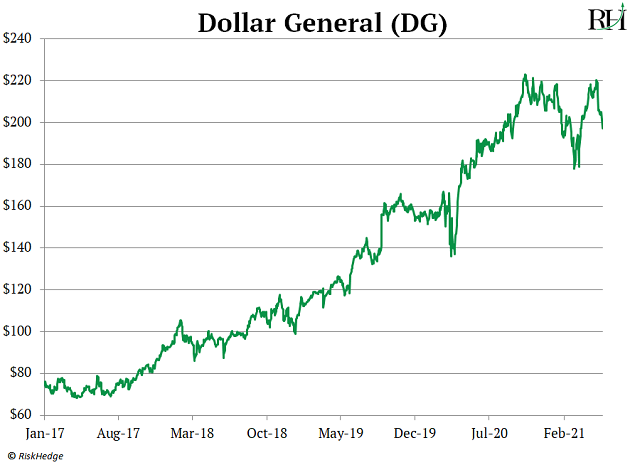

Dollar General (DG), for example, is America’s largest dollar chain. You could have tripled your money on its stock in the past four years:

Dollar General is now the largest US retail chain by store count. It operates almost 17,000 stores—more than McDonald’s, Starbucks, or Walmart.

Revenue has shot up 150% in the past decade. And it’s not just low-income folks shopping there. According to JP Morgan, households earning between $50,000 and $75,000 per year are Dollar General’s fastest-growing customers.

-

The hollowing out of the “middle” is a disruptive theme rippling across many industries...

Where will it strike next?

Longtime RiskHedge readers know robotaxis are going to disrupt the auto industry. In fact, automakers have been among the worst-performing stocks for years.

Despite a big bounce this year, Ford (F) is still 65% below its 1999 peak. German automaker Volkswagen (VWAGY) is trading at the same price it was in 2008.

Super luxury carmakers are doing just fine, though. Sportscar maker Ferrari’s (RACE) stock has handed investors 280% gains since going public in 2015!

So what should a disruption investor do with this information?

Steer clear of “average” stocks. Avoid mediocre, conventional, or “good enough” businesses.

For better or worse, the middle is dying as its lunch is eaten from above and below.

What mediocre company will be disrupted next? Tell me your thoughts at stephen@riskhedge.com.

Stephen McBride

Editor — Disruption Investor