“Have fun staying poor!”

If you haven’t heard, this rude phrase has taken the internet by storm...

Many Bitcoin enthusiasts use it to mock investors who don’t own the popular cryptocurrency.

That’s right. Apparently, if you’re not “all in” on Bitcoin… you can kiss any chance of getting rich goodbye.

And while there’s no denying Bitcoin’s been one of the hottest investments on the planet…

There’s another asset class that’s been blowing Bitcoin’s gains out of the water lately.

Unlike Bitcoin, you won’t hear about it much in the mainstream media. And you won’t hear novice investors making up silly slogans about it…

But this sector can make you a fortune if you know what you’re doing.

I’m talking about microcaps.

And today I’m bringing in our expert on these tiny stocks, Chris Wood, to share the #1 advantage microcaps give him and his subscribers—that Bitcoin never will…

***

CR: Hey Chris, first off… did you catch that popular meme going around… Have fun staying poor?

Chris Wood: [laughs] Yes. Pretty childish. I get that these novice investors are excited about the money they’ve made... but a little humility goes a long way...

CR: Tell me… do you own Bitcoin?

Chris Wood: No, I haven’t touched Bitcoin… and I don’t plan to. Nothing against it. But I mean, look at this chart:

Source: YahooFinance

Source: YahooFinance

It’s up more than 120,000%.

Could it still hand out big gains in the years ahead? Sure... but it will do so without me involved.

CR: Why’s that?

Chris Wood: Two main reasons. First, because Bitcoin is huge. Its market cap is over $900 billion. That puts it in the same league as Apple, Microsoft, Amazon, and the other giant tech companies.

CR: I never thought about it like that…

Chris Wood: Yeah, it’s not a perfect “apples-to-apples” comparison. Bitcoin is a currency, and those are stocks.

But the point is, Bitcoin is already very large, and it’s run up far too high for my liking. The biggest upside is most likely gone.

CR: Can you explain your unique approach to investing—for our readers who aren’t familiar?

Chris Wood: Sure—I focus on small stocks that are going to grow BIG.

I only want to buy tiny businesses taking on very large markets. Little-known stocks on the cusp of transforming big industries, like AI… healthcare… and computing.

This is how a company can set itself up to grow 10X–100X, which leads to a soaring stock price.

Again: that’s the opposite of investing in Amazon, Google, and Microsoft right now. Don’t get me wrong: They’re all great businesses. But they’re gigantic already. It’s mathematically impossible for any of them to grow, say, 10X from here. The best you can really hope for is a double.

CR: Makes sense. How do you know you’ve found a great microcap?

Chris Wood: That gets at reason #2 why I’m not interested in Bitcoin...

Above all else, I work hard to build relationships with the real, live human beings who run the companies I recommend.

These days, anyone with an internet connection can find out all the publicly available information about any company in 5 minutes. There’s no edge to be gained sitting at your desk...

So I get out there and see how these microcaps are changing the world—firsthand. I meet the CEOs, in person.

I guess I’m old-school, but I believe there’s no substitute for shaking a CEO’s hand and looking them in the eye...

Of course, COVID made traveling tougher this year, but it didn’t completely hold me back.

CR: That’s right. I remember you flew across the country in October—pandemic still in full force—to investigate a tiny 5G filter company. I’ll admit: I thought it was a little crazy…

Chris Wood: Yeah, that was in Santa Barbara, California. And the company is Resonant (RESN). I flew out to their headquarters to meet with the CEO and see their game-changing 5G filter up close.

Here are two pictures I took. Excuse the mask…

Chris (right) with Resonant’s CEO

Chris (right) with Resonant’s CEO

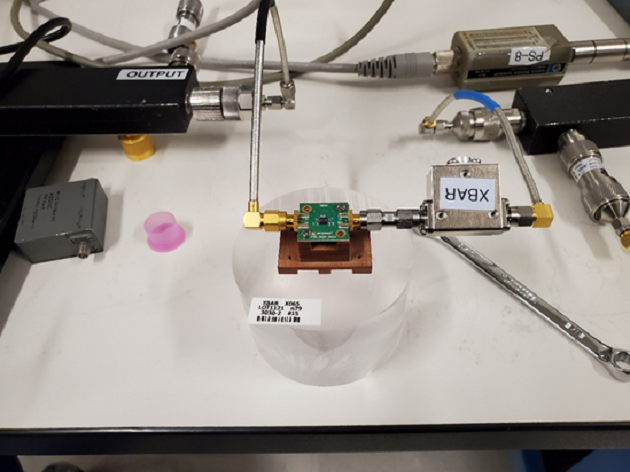

A prototype of the company’s game-changing 5G filter technology

A prototype of the company’s game-changing 5G filter technology

The trip was well worth it. I was able to confirm their technology and I recommended the company to my premium subscribers right away. Despite the recent pullback in tech stocks, we’re still up 110% on this one in just over 4 months.

CR: What about Atomera (ATOM)? For readers who don’t know... Chris started pounding the table on the stock last year. In short: It developed a breakthrough microchip material that’s superior to silicon.

But before he officially recommended it, he needed to make sure the team behind the company was the real deal…

Chris Wood: For that one I had to resort to meeting the CEO and CFO via a video call. Not my preferred way, but it turned out okay.

CR: I’d say…

The stock went on to explode 288% over the next 8 months before you recommend taking some profits.

Chris Wood: Yep, and I still keep in close contact with management to share any important updates on the company with my subscribers.

CR: Obviously, this isn’t something you could do with Bitcoin, right?

Chris Wood: You got that right. We don’t even know for sure who invented Bitcoin!

Most people say it’s a guy named Satoshi Nakamoto, although he has yet to reveal his identity. That might not even be his real name. Some say he’s not even alive.

In any case... I can’t meet the guy and chat over a beer with him, like I would the CEO of a microcap.

CR: Alright, last question…

Are you concerned about the big pullback we’re seeing in tech stocks? Growth stocks in particular have been getting hammered.

Chris Wood: I’m glad you brought that up. In short: Absolutely not. Fact is, our microcaps have been holding up quite well. But the real key is we’ve already taken 8 free rides this year to lock in profits…

In a free ride, if you aren’t familiar, you sell your initial position in a stock that’s appreciated. Then, you keep the profits and “let them ride.” In effect, we’re playing with “house money,” which eliminates any risk on these positions, no matter where the markets go.

CR: And I see you’ve recently closed 4 positions in just the past 4 months alone for big gains of 376%, 251%, 399%, and 422%...

Chris Wood: Yep. We’re taking some profits for sure. But I still see enormous upside ahead for microcaps.

I think this correction will be relatively short-lived. And if it drags on a bit longer, my readers are positioned in the stocks that will bounce back the fastest.

But right now, it’s presenting a “no-brainer” buying opportunity for some of the best microcaps on the planet. It’s a great chance to buy shares in the right microcaps on the cheap.

That’s what I’m currently doing with my own money (I just added to my positions last week)… and it’s what I recommend my readers do today.

CR: If you really want to book the biggest gains over the next year, Chris says forget Bitcoin…

His microcaps are running laps around the world’s most popular cryptocurrency… In the last 3 months alone, his picks have soared as high as 532%, 512%, 424%, and 373%...

And with the recent selloff, now’s the perfect time to get into his next huge winners.

In fact, this opportunity is so big, Chris just released a brand-new briefing TODAY with all the details…

Including how to buy his #1 pick when the opening bell rings tomorrow morning.

Go here to check it out now.

Chris Reilly

Executive Editor, RiskHedge