“Air is coming out of the balloon.”

A lot of traders are saying this right now, and it’s because speculative stocks are getting crushed.

Over the last five sessions, Rigetti Computing (RGTI)—a leader in the quantum computing space—has plunged 32%.

Oklo (OKLO)—a leader in the nuclear modular reactor space—is down 28% over the same stretch.

IREN Ltd. (IREN)—one of the leading data center stocks—has dropped 26% in short order.

Rare earth stocks—one of the hottest themes—have also been getting slammed.

Naturally, this has some folks worried. The concern is that the sharp pullback in speculative stocks could spell trouble for the market at large.

I see things differently…

You see, speculative stocks are a tiny segment of the market. They’re a rounding error in the grand scheme of things.

They do tell us a lot about “animal spirits,” or how much risk appetite there is in the market. But they hardly tell the whole story.

The bigger story at the moment is ongoing market rotation. Money is flowing out of hyper-extended spec names and into “real” companies.

The charts tell the story…

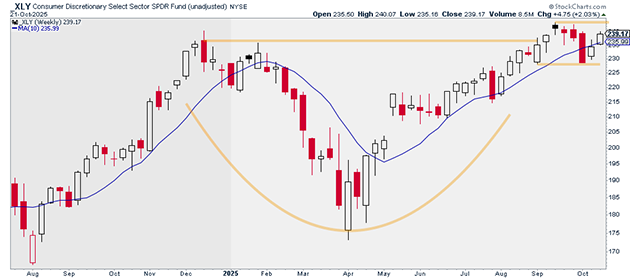

Take a look at the Consumer Discretionary Select Sector SPDR Fund (XLY). It’s already up 2% on the week and has reclaimed its key short-term moving averages on the daily.

It’s also firmly back above its 10-week moving average:

Source: StockCharts

Source: StockCharts

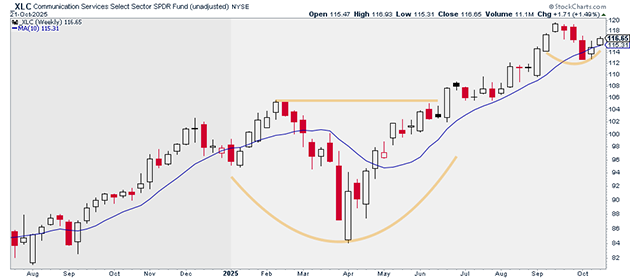

Communication stocks are also getting back on track.

The Communication Services Select Sector SPDR Fund (XLC) is up 1.5% on the week. It too has recaptured its 10-week moving average:

Source: StockCharts

Source: StockCharts

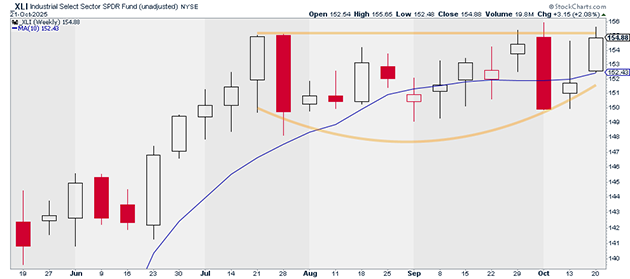

Next, we have industrial stocks.

The Industrial Select Sector SPDR Fund (XLI) looked iffy heading into the week but bounced back in a big way.

XLI is up more than 2% on the week already and back above its 10-week moving average:

Source: StockCharts

Source: StockCharts

These major sector groups are FAR more important than themes like quantum computing, rare earths, or nuclear tech.

So, I don’t think the ongoing selloff in speculative names is a major warning sign for most investors or traders.

These stocks were just extremely extended. Some had more than doubled or tripled in value in the span of a few weeks. It’s perfectly normal for those stocks to get “killed” before beginning a new leg higher.

Bottom line: This isn’t a broad selloff. It’s rotation. The key is to stay focused on what’s working and not get shaken out by noise in the fringe corners of the market.

In my Express Trader advisory, I’m continuing to recommend new trades in today’s strongest themes. We just picked up a top cybersecurity name yesterday, and I believe it will soon cement itself as one of the market’s liquid leaders.

To see what other areas of strength we’re buying into—and to get my three strongest trades every week—sign up for Express Trader here.

Justin Spittler

Chief Trader, RiskHedge