** Old friends coming out of the woodwork

** Don’t buy “bottle rocket” stocks

** The #1 way to build lasting wealth

Should I be investing?

What are the “hot” stocks?

How much money do I need?

Chris! HELP!

My phone’s been lighting up over the past few weeks.

Old friends from college who I haven’t talked to in years…

Texting me about stocks—for the first time ever.

From what they remember… I was the friend who “did stocks after graduation.”

I’m not surprised. They’ve been seeing “GameStop short squeeze” and similar headlines plastered across their Facebook and Twitter feeds 24/7…

They’re intrigued. They’re confused. They want to know how they can get rich!

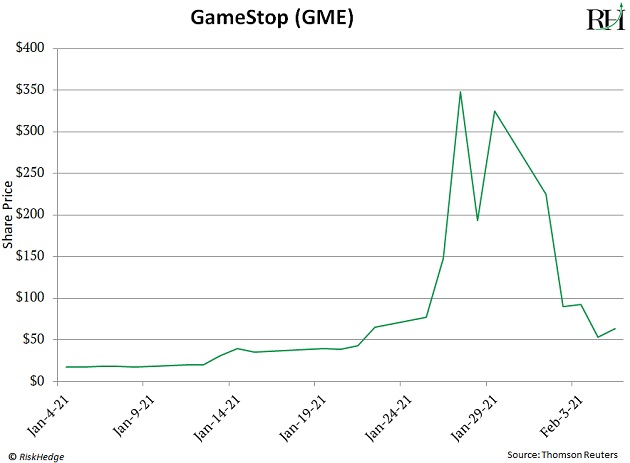

One even asked if he should put $5,000 into GameStop (GME)… after it had already surged a mind-boggling 1,900%.

I told him not to touch it.

He would have gotten taken to the cleaners (and probably scared off from ever investing again).

As you’ve probably seen, shares have fallen off a cliff recently… crashing 85%:

…which would have shrunk his $5K into less than $600—in a matter of days.

- Some say this craziness is a sign of the top…

And yes, it would be completely normal—and healthy—for the market to pull back here. After all, the S&P 500 has rallied nearly 20% over the past 3 months alone.

But I’m happy to see folks getting interested in investing for the first time ever.

It’s all part of what our Chief Analyst Stephen McBride calls the “start of a new megatrend that will propel stocks higher for years.”

In his Thursday essay, Stephen pointed out that Millennials--the largest (and soon to be richest) generation in American history—are pouring into the stock market for the first time ever.

And it’s a GREAT thing.

As Stephen said:

Tens of millions of young investors are flooding into the market. And that’s a wonderful thing for stock prices.

These Millennials aren’t interested in owning boring bonds. This is a generation of stock pickers.

Fundstrat estimates $6 trillion could flood into stocks over the next decade.

You don’t want to be sitting on the sidelines as this massive shift kicks into high gear.

In a minute, I’ll share the type of stock Stephen recommends buying. It’s also one of the single greatest ways to build long-lasting wealth.

But first, here’s how NOT to build long-lasting wealth:

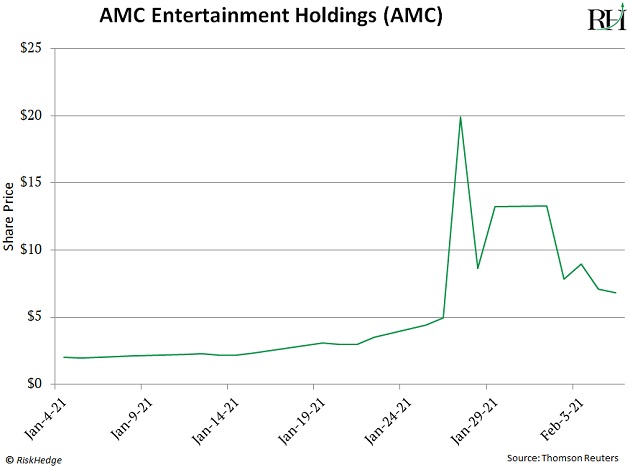

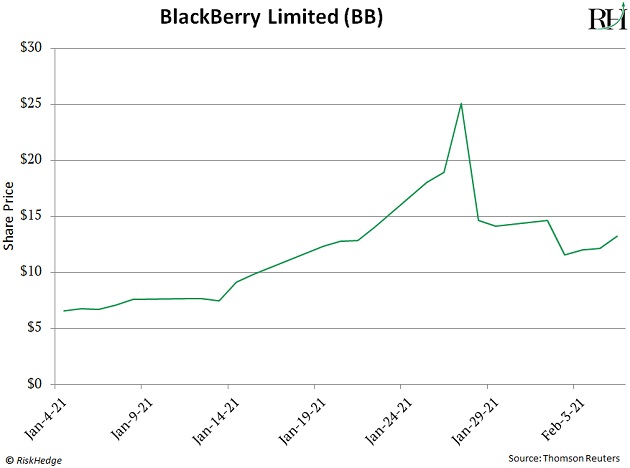

- After GameStop, my friends started asking me about the other “flavor of the week” stocks…

Like AMC Entertainment (AMC):

And BlackBerry (BB):

After soaring to the moon, these stocks are falling back down to earth just as fast…

Both plummeting more than 50% in a week.

This isn’t how you succeed in the markets.

This is how you go BROKE.

GameStop… AMC Entertainment… Blackberry…

- We call these “bottle rocket” stocks…

Bottle rockets shoot up...

Then they plunge back to earth.

It’s exciting... but over in an instant.

Source: Wikipedia

Source: Wikipedia

That’s exactly what we saw with all of these pumped-up stocks over the past week.

I told my friends to stay away and never look back.

Then I sent them this essay from Stephen… one of my all-time favorites.

As Stephen says, owning stocks is the single best way to get rich over time. But you have to be smart… and patient.

The important thing is to break the inertia and start investing. No excuses.

It’s very hard to get truly wealthy by “renting out your time” alone.

Think about it… you can only work so many hours. So even if you’re earning thousands of dollars a day, your “upside” is capped.

It also means you’re not earning money when you’re sleeping… when you’re on vacation, or when you’re retired.

But when you save and invest your savings in a successful business, you accumulate assets that earn money while you sleep.

That last part is key.

Investing in successful businesses.

That’s the opposite of GameStop, the dying video game retailer that’s following the same dark path as Blockbuster.

Or AMC, which owns and operates a chain of movie theaters. Its business has been decimated by COVID, not to mention the explosive growth in streaming.

Instead, you want to own world-class businesses. Companies that are changing the world. Ones that will dominate for a long time.

- Here at RiskHedge, we call these “disruptors.”

Disruptors are companies that create and transform whole industries.

In other words, disruptors invent the future.

Netflix wasn’t just another TV network. It changed the way we watch TV.

Priceline wasn’t just another travel agent. It changed the way we book travel.

And Amazon wasn’t just another department store. It changed the way we buy things.

They completely flipped their industries upside down.

And most important, disruptors can hand you investing profits you simply won’t find elsewhere.

For example:

- Southwest Airlines (LUV) disrupted flying when it pioneered discount air travel. It forced the whole industry to rethink their business strategy and slash ticket prices. From 1980 to 1999 it handed investors 7,450% gains.

- Starbucks (SBUX) got America hooked on high-end coffee. It normalized paying $6 for a latte. Although it spawned a dozen competitors, Starbucks still managed to hand investors 9,050% gains from 1992 to 2012.

- Intuit (INTU) disrupted personal finance. Through its development of do-it-yourself financial programs QuickBooks and TurboTax, it freed millions of Americans from having to hire an expensive accountant. Investors who got in around 1993 collected gains of 2,460%.

In short: You want to own UNSTOPPABLE DISRUPTORS.

Not bottle-rocket stocks that pop off then fade away.

- One of Stephen’s favorite stocks today is a unique type of disruptor.

I mentioned Amazon earlier. It handed out huge profits over the years. But its “disruption days” are over. This company Stephen found is much smaller. He calls it the Amazon Killer.

Simply put, it operates an internet “tollbooth.” In other words, it’s set up to collect a cut of potentially every online transaction in America.

Every time your monthly Netflix renewal is processed... Every time someone buys crafts on Etsy.com (ETSY)...

Every time someone buys a house, car, or talks to a doctor online... this little company can potentially get paid. And so can you as a shareholder.

Not only that, it’s one of the safest disruptors you can own today. In fact, it’s the ONLY stock Stephen owns in his daughter’s college fund.

You can get all the details on this opportunity right here.

Chris Reilly

Executive Editor, RiskHedge