I hope you own a little bitcoin (BTC).

BTC surged to new all-time highs of $91,000 last week. It’s jumped 30% since Election Day.

It’s been a great run. But is it drawing to a close?

No. My research shows we’re now entering the most profitable part of the bull market.

Today, I’ll share my new bitcoin price target with you. I’ll also take you inside the real wealth-creation opportunity in crypto that’s just getting started.

- Crypto is reliably cyclical, following a boom-and-bust pattern.

Bitcoin prices have followed a “3 up, 1 down” pattern. We call it the four-year cycle.

Every fourth year, crypto prices plunge. The last time that happened was in 2022.

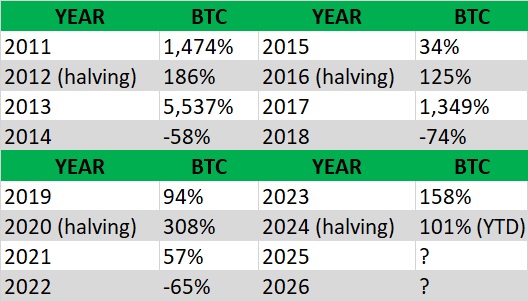

Markets then recover slowly, with the biggest gains being handed out in years 2 and 3, as this table of bitcoin’s annual returns shows. Year 2 is now, and year 3 is next year:

We’re in the sweet spot of the cycle, which typically produces the biggest gains.

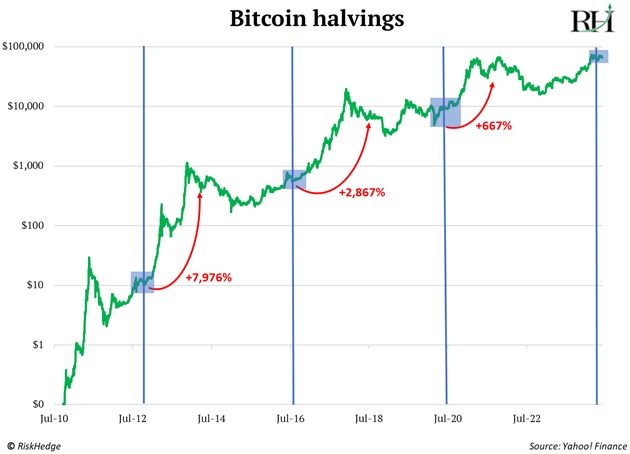

This lines up perfectly with how the bitcoin halving cycle usually unfolds.

After each halving (blue lines on this chart), there’s a period of accumulation before a big swoosh higher:

After chopping sideways since the latest halving in April, we’re now experiencing that next big swoosh higher. Bitcoin is right on script.

BTC convincingly broke above its previous all-time high last week. If you’ve been investing in crypto for a while, you’re smiling.

The last three times BTC made fresh highs, it doubled in 40 days, on average. If that pattern were to hold, BTC would hit $140,000 by the end of December.

That sounds hard to believe. But having invested through many crypto cycles…

- This is the time when things start to get a little crazy.

Crazy in a good way, if you own the right cryptos.

Here’s how the cycle works. Bitcoin leads in the early stages. Then, as the mania heats up, Ethereum (ETH) and smaller cryptos start to outperform.

This has been a bitcoin-led market so far. But the US election results just kicked off the next phase of the bull run where smaller cryptos outperform.

As we discussed on Wednesday, the US government has stifled crypto for four years.

|

Imagine trying to build a business with your hands tied behind your back. That's what crypto entrepreneurs faced.

An alphabet soup of regulators leaned on banks to shut down the accounts of crypto entrepreneurs. They made it illegal to launch quality tokens. They stopped Wall Street from backing innovative crypto projects.

The lack of regulatory clarity was the #1 thing holding crypto back. I’d chat with builders at conferences, and they’d say things like, “I’d love to create this product, but I don’t want to go to jail.”

Good news: The war on crypto is finally over.

BTC has jumped 30% since election day. Dozens of smaller cryptos are up much more.

Hivemapper (HONEY), a crypto project aiming to disrupt Google Maps, has surged 47%.

Render Network (RNDR), which is like “Uber” for GPU computer chips, has shot up 51% over the past two weeks.

Congratulations to RiskHedge Venture members who own both.

“Meme coins” and other more speculative tokens have also doubled or more.

- BTC $250,000?

Price targets are silly. But RiskHedge members asked me how high bitcoin can go this cycle, so I should weigh in.

When bitcoin was at $27,000, I said it would hit $150,000 this bull market. Now I believe we can reach $250,000 within the next 12 months. The facts have changed, so I’m changing my mind.

President-elect Trump and several US senators want the US government to buy billions of dollars’ worth of BTC to create a US Strategic Bitcoin Reserve.

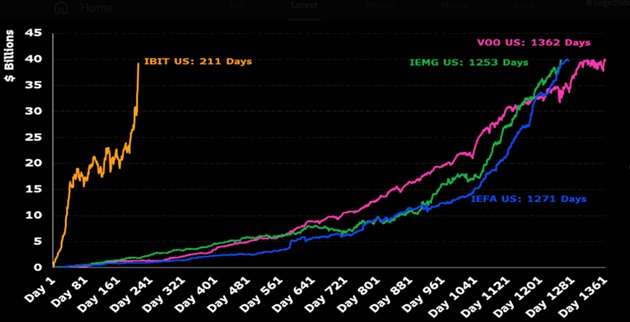

And have you seen how much money is flowing into bitcoin ETFs? BlackRock’s (BLK) ETF—iShares Bitcoin Trust ETF (IBIT)—has raked in $40 billion in assets since launching roughly 200 days ago.

It absolutely annihilated the previous records, as this chart shows:

Source: Bloomberg

Despite only launching 10 months ago, IBIT is already in the top 1% of ETFs by assets.

While bitcoin grabs headlines, the real wealth-creation opportunity lies in quality crypto businesses that have been freed from the regulatory cage.

My friend who runs a crypto fund told me he’s gotten more calls from prospective investors since the election than he’s received in the past two years!

Expect crypto funds to begin raising billions of dollars early next year. Most of this money will flow into smaller tokens, not bitcoin.

The smart money is already moving into quality crypto businesses that were held back by regulation. Smaller, more quality cryptos have outperformed bitcoin over the past two weeks than at any other time this year.

- It’s time for a new playbook: A.B.B.—Anything But Bitcoin.

The real money will be made buying great crypto businesses emerging from regulatory purgatory.

This is the best setup for crypto in years. We’re on the cusp of regulatory clarity. We’re in the “sweet spot” of the bitcoin halving and four-year cycle.

It’s clear new all-time highs are coming across the board.

The biggest mistake investors are making today is not owning any crypto. I think everyone should own at least a little crypto because of its rare wealth-making potential.

If you’re interested in crypto, and don’t want to go it alone...

Or if you own some already but want access to my RiskHedge Venture portfolio full of real crypto businesses that should thrive in this new era—including the two brand-new picks I just recommended on Thursday...

Then go to this page. I’m here to help guide you every step of the way.

And right now, Venture is available at a special election discount. Go here to check out the details. I’d love to have you onboard.

Stephen McBride

Chief Analyst, RiskHedge