Thanks to the RiskHedge members who joined me in Boston. It was fun meeting you and talking stocks in Back Bay.

As a reminder, if you’re a RiskHedge Reserve member, you now have access to my full travel schedule. I’ll be in Abu Dhabi in July and hope to be in Austin, TX later this summer. Drop me a note if you’re in the area.

Today, I sit down with RiskHedge Executive Editor Chris Reilly to discuss a big industry artificial intelligence (AI) is ready to steamroll. In fact, it’s already underway... and it’s going to surprise many people who were used to this group of stocks only going up for the last 10 years…

***

Chris Reilly: Stephen, at your AI Summit last November, you named five big, popular stocks to avoid. You said they were sitting ducks to be disrupted by AI, and soon.

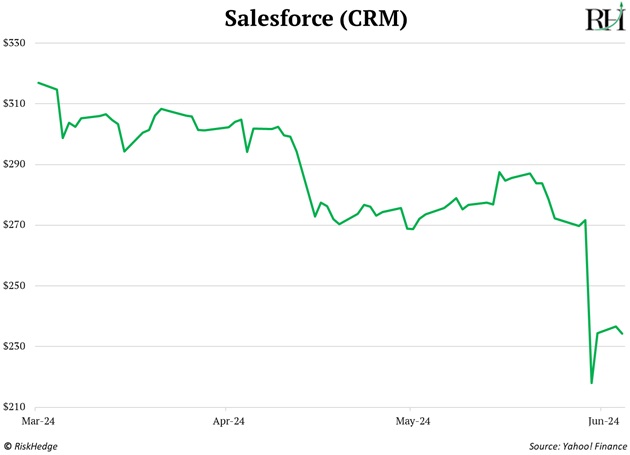

One of them was software giant Salesforce (CRM).

Hopefully viewers took your advice.

The stock just crashed 20% in one day after missing revenue expectations for the first time in nearly two decades. Look at this ugly chart:

Stephen McBride: Not good for the former Wall Street darling. But this is really just the beginning...

As you know, Chris Wood and I doubled down on this call in our December issue of Disruption Investor, calling software stocks as a whole one of the biggest “AI losers.”

Chris: Talk more about that...

Stephen: Software stocks dominated the stock market for the last decade. Legendary venture capitalist Mark Andreessen was right on the money in 2011 when he said:

Software is eating the world. We are in the middle of a dramatic technological shift in which software companies are poised to take over large swathes of the economy.

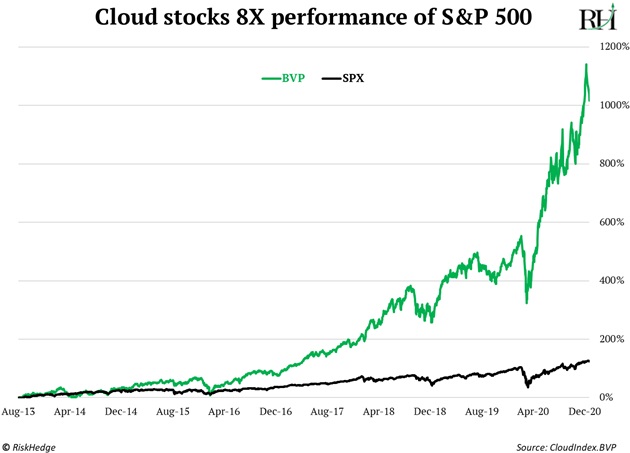

Software stocks, as measured by the BVP Cloud Index, gained 1,000%+ from 2013–2020, while the S&P gained just 150%:

Many individual software names like Trade Desk (TTD), HubSpot (HUBS), and Shopify (SHOP) soared many thousands of percent more.

Salesforce was the poster child of this boom. It introduced the software-as-a-service (SaaS) business model with its customer relationship management software tools. And from late 2011 to late 2021, its stock soared about 1,100%.

It was a great run...

But now it’s AI’s turn to eat the world.

Andreessen says so himself: “AI will replace software.”

Nvidia (NVDA) CEO Jensen Huang agrees, saying “AI is going to eat software.”

|

Chris: Why is AI such a threat to software stocks?

Stephen: AI can easily automate most of what these companies do. Startup Inflection AI, for example, can generate natural language content for lots of purposes, including sales and marketing. Tools like this can make Salesforce’s vaunted customer-relations software obsolete in a flash.

A lot of companies that pay a lot of money for Salesforce will adopt AI instead. Salesforce's revenue growth has already slowed to record-low levels.

Chris: But isn’t Salesforce’s CEO a big proponent of AI? I heard he was adding it to all their products...

Stephen: Technically, AI is just better software. And yes, Salesforce is investing in AI. It’s integrating conversational AI assistants within the user interfaces of its apps. And its Salesforce Einstein AI tool is already on the market.

But AI is so disruptive and such a great equalizer that small, nimble startups leveraging AI can disrupt big software companies like Salesforce.

And Salesforce is BIG. The gleaming Salesforce tower in San Francisco is the tallest building west of the Mississippi. Its shareholders have a lot to lose. Continue to avoid it and other software companies whose products can easily be improved upon with AI.

Chris: Where should investors focus if they want to profit from AI?

Stephen: Most everyone knows about Nvidia by now. We’ve taken profits on it twice since September 2020 in Disruption Investor, and we still hold a small position in the portfolio. It will continue to be a clear winner of the AI boom.

But right now, Chris and I are focused on the companies making the great AI infrastructure buildout happen.

The AI buildout is the largest infrastructure project ever. This year alone, Microsoft (MSFT), Amazon (AMZN), Google (GOOG), and Facebook (META) will spend more than $170 billion building data centers.

You must own the AI infrastructure companies capturing this spending. We detail the four winners in our Disruption Investor portfolio in our upcoming issue, which will publish tomorrow.

Chris: Thanks, Stephen.