Stephen’s note: Gold is ripping... and after our popular essay on gold last week, readers are asking for our favorite gold stock to play it.

I’ve long been a believer in owning some physical gold. And eyeballing the charts, it looks like the price is headed much higher soon… but mining stocks are outside of my wheelhouse. So today, I’ve brought in my friend Marin Katusa to tell us about his #1 gold play right now...

Not only is he one of the most trusted and well-connected dealmakers in the industry... he has also personally financed some of the most successful mining businesses. And his track record in the junior mining space is unmatched, with wins as high as 2,400%... and even 4,160%.

In short, when he talks, it pays to listen.

***Disclaimer: At the end of our talk, Marin mentions a research report in which he recommends a tiny gold stock. Several principals of RiskHedge are personally invested in this tiny gold stock.***

***

Stephen: Marin, thanks for speaking with me today. With gold up 20% since November—a hair from all-time highs—I wanted RiskHedge readers to hear from you directly on today’s opportunity.

Last time we had a serious talk about gold was in April 2020, right after COVID shut the world down. We held an emergency briefing... where you explained why we were entering an era of incredible change and opportunity in the resources markets:

Today, you say the opportunity is even bigger...

Marin: That’s right, Stephen. And thanks for having me.

In short: what’s about to unfold in the global financial markets will be referred to as “the golden bull market of the century.”

This golden bull market will be fueled by a combination of factors, including central banks’ reckless monetary policies, geopolitical tensions, and dwindling gold reserves. It’s not a matter of if, but when this bull market will take off.

I predict millions of investors will flock to precious metals in search of a safe haven, driving the price of gold to levels never seen before. Central banks will scramble to increase their gold reserves, while ordinary citizens will turn to the yellow metal as a hedge against the eroding value of their hard-earned money.

But investors who act now will be ahead of the game.

|

Co-founder of RiskHedge: "This is the surest, easiest-to-follow, and quickest-to-get-started way to beat the market with your core portfolio I’ve found. And it works particularly well in highly uncertain markets like we’re seeing today." Click to discover more about the strategy and how this little-known way of investing produced 302% returns in the worst markets of our lifetimes. (Monthly subscriptions available.) |

Stephen: I think to most readers, it feels like gold is already pretty high. It’s currently sitting at around $1,950/oz...

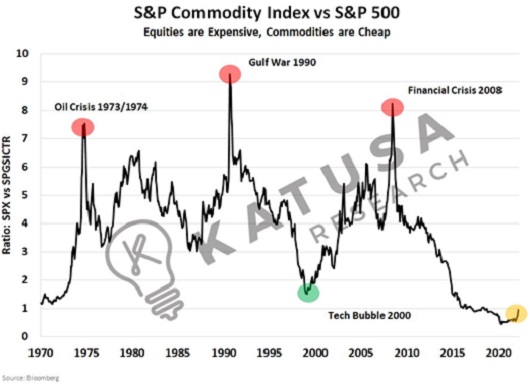

Marin: I understand folks might feel that way. But if you zoom out, you’ll see that relatively speaking commodities are the cheapest they have ever been compared to the S&P 500. There’s nowhere to go but up.

Source: Katusa Research

Source: Katusa Research

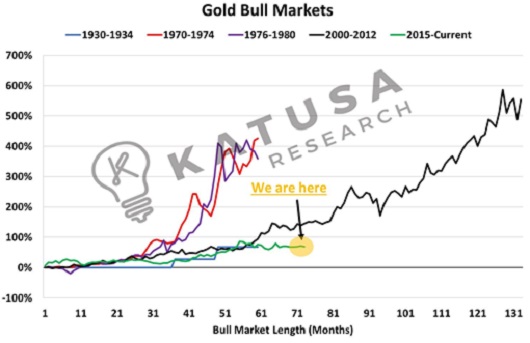

With gold specifically... By all metrics, the gold bull market remains at historic lows.

Stephen: Can you elaborate on that?

Marin: As you know, Stephen, the gold market has always moved in cycles. Going from dramatic boom to overnight bust, and eventually back again.

So far in this “boom,” gold has barely risen 20% from its floor. That’s not even close to the minimum required to qualify for a true “bull market” over the past century.

The smallest gold run-up in the past 90 years was 45%—more than twice the current gain. Every other rally was far, far bigger:

- From 1972–1974, the rally yielded a 100% gain.

- From 1978–1980, another 100% gain.

- Then from 2007–2010, a 67% increase in the price of gold.

Source: Katusa Research

Source: Katusa Research

Every single one of the years in the date ranges above saw an increase of more than 20%. That’s how you know the gold rally has barely just begun.

Meanwhile…

According to MarketWatch: “Goldman Sachs says it’s the beginning of a structural bull market in commodities.”

And the Wells Fargo Investment Institute wrote, “After a decade of poor performance… commodities look poised to outperform other assets (possibly for a decade or more)… a new bull supercycle.”

I rarely, if ever, agree with mainstream finance. But in this case, I called it three years ago when we held our emergency briefing: We are still very, very early in this gold and resource “supercycle” market, the likes of which the world has never seen before.

With gold prices spiking in short order the past two weeks, it has more than just regular precious metals investors paying attention.

Checking around with different gold dealers for actual bullion, it’s difficult to find gold eagles or maples. And if you do, be prepared to pay a significant premium on top of the current spot price hovering above $1,950 per ounce. We’ve seen some dealers charging well over $2,100 for a one-ounce gold coin.

Stephen: So, what’s the best way to profit from this boom?

Marin: You could buy gold bullion…

It’s independent of government-controlled financial systems. Your money will be relatively protected from the currency wars.

You could also buy gold-backed ETFs. They offer a little more leverage and can give you some quick profit when gold starts to rise.

But when gold starts going up, gold stocks tend to go up a lot. I love the high-risk, high-reward nature of gold stocks. But they’re not for everyone.

Stephen: For readers interested in dipping into the top gold stocks, you just released a brand new briefing called PROJECT GOLD RUSH...

Marin: Yes. My team and I released it yesterday, and it’s available to RiskHedge readers here. In it, I reveal details about one of the most exciting gold projects I’ve ever seen in my life.

Certain big investors are making major bets on gold, myself included.

And your readers can join me here if they’d like.

***Disclaimer: Several principals of RiskHedge have personally invested significant sums of money in the small gold stock Marin is promoting at that link.***

Stephen McBride

Chief Analyst, RiskHedge