Thank you for the dozens of kind messages you sent about my trip to Abu Dhabi.

RiskHedge readers are a very well-travelled bunch! I got emails from people living on every continent except Antarctica.

Abu Dhabi was awesome… except when my wife decided we should walk 25 minutes in 104° heat. Drenched.

Quick reminder: Today is your last chance to join our RiskHedge All-Access program and gain access to everything we publish over the next 18 months (including six months of free membership). Go here to make your final decision. Doors close at midnight tonight.

Let’s get after it.

- Watch these two key earnings reports to know where we are in the AI boom.

The big banks kicked off earnings season last week.

Pay close attention to what ASML Holding (ASML)—reports Wednesday—and Taiwan Semiconductor (TSM)—reports Thursday—say this week.

We know the artificial intelligence (AI) buildout is the largest infrastructure project ever. This year alone, Microsoft (MSFT)… Amazon (AMZN)… Google (GOOG)… and Facebook (META) will spend more than $170 billion building data centers.

ASML and Taiwan Semiconductor are involved in making the ultra-powerful chips inside these AI factories. They basically touch every high-end chip on the planet.

Their earnings will give us a sneak peek into where we are in the AI buildout and set a tone for the rest of earnings season.

Disruption Investor members are sitting on gains of close to 100% in TSM.

- TV streaming is now being disrupted by…

Other streamers.

Twenty-five million Americans canceled their cable TV bundle in the past five years as services like Netflix (NFLX) disrupted them.

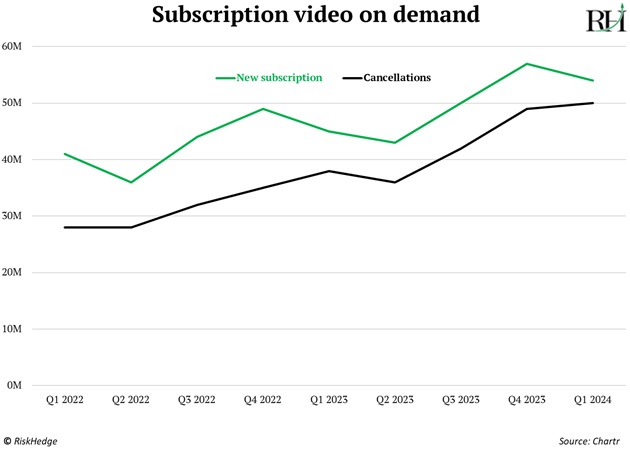

Netflix and Disney (DIS) brag about how many subscribers they add each quarter. But the amount of folks who turn right around and hit the “unsubscribe” button is shocking.

More than 50 million Americans canceled a streaming service in the first three months of 2024:

Streaming falls into the “awesome service, bad business” bucket.

The “holy grail” of investing is owning businesses in a league of their own.

For example, only one company makes the fastest AI chips…

Nvidia (NVDA). That’s it.

Streaming is the opposite. You have Netflix… Disney+… Amazon Prime… Apple TV+. And the competition doesn’t stop there.

As Netflix founder Reed Hastings once said, "Netflix's biggest competitor is sleep."

Avoid streaming stocks.

- Imagine an early warning “app” for Alzheimer’s.

You speak into your iPhone for two minutes each morning.

Then, an AI app analyzes your voice to tell if you’re at risk of Alzheimer’s.

Sounds like a fairytale, right? Well…

Boston University researchers recently built an AI system that predicts if someone is at risk of developing Alzheimer’s with 80% accuracy by simply analyzing their speech.

Today, an Alzheimer’s diagnosis involves a lot of tests: brain imaging… blood… and spinal fluid tests. And by the time symptoms develop, it’s usually too late. Memories have already started slipping away.

An early warning “app” could help us catch this insidious diseases years before it does any damage.

|

Early detection is increasingly important because the Food and Drug Administration just approved a new drug to fight Alzheimer’s.

Eli Lilly’s (LLY) “Kisunla” isn’t a cure, but it’s the next best thing. It slowed cognitive and functional decline by up to 35% after 18 months in trials.

It basically works by removing the buildup of “bad” proteins in the brain, which are a key indicator of Alzheimer’s.

Early warning systems + new drugs = possibly turning Alzheimer’s from a death sentence into a manageable disease, like HIV now is.

We’re entering a golden age for biotech. As Matt Ridley (the original Rational Optimist) told me, biotech is the next big transformational disruption.

You can spot big transformational disruptions by looking at the pace of innovation. And few areas are seeing more breakthroughs than biotech right now.

This year alone, we’ve gotten cancer vaccines… blindness-curing eyedrops… and gene editing allowing deaf kids to hear.

We’ve barely scratched the surface of what’s possible when it comes to curing disease and longevity.

I’m confident this biotech revolution will lead to some incredible breakthroughs. Expect a rapid burst of innovation.

We recently added one of the world’s best biotech companies to the Disruption Investor portfolio.

- “A lot of people are wrong about solar.”

That’s what chief economist at The Abundance Institute Eli Dourado told me in Washington, DC a few weeks ago.

The biggest knock against solar energy is the sun doesn’t shine at night. Fair.

On average, solar panels only produce energy eight hours a day.

The solution is SUV-sized batteries that can store energy and power the grid long after it goes dark.

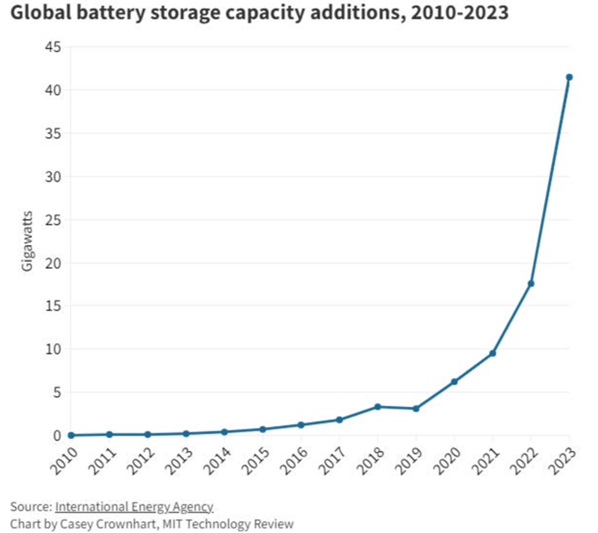

Solar power generation is hitting record highs. We’re also installing record amounts of battery storage. How’s this for exponential growth?

Source: International Energy Agency

Battery costs have plunged 90% since 2010, making it much cheaper to store energy.

And batteries will only get bigger and more powerful as entrepreneurs continue to innovate.

Solar isn’t ready to fully replace fossil fuels. But it’s improving rapidly, and that’s what people are missing.

We recently booked 30% profits on a solar business in Disruption Investor and are hunting for more opportunities.

To take advantage of all our research and picks, RiskHedge All-Access membership is still open… but closes tonight at midnight.

See you Wednesday.

Stephen McBride

Chief Analyst, RiskHedge