Is the stock market running on fumes?

Stocks have been red-hot lately.

The S&P 500 (SPY) has rallied 28% since early April, while the Nasdaq 100 (QQQ) has surged 37% over the same period.

Many individual stocks have performed far better. It’s been a great trading environment.

So, what’s the problem?

My only concern is that EVERYONE is now bullish.

It wasn’t always like this. In the early stages of this rally, traders were nervous about the global trade war, the economy, and the conflict in the Middle East.

Those issues are still relevant today. But they’re not being taken nearly as seriously. Investors have become complacent. We can see this in several leading sentiment indicators…

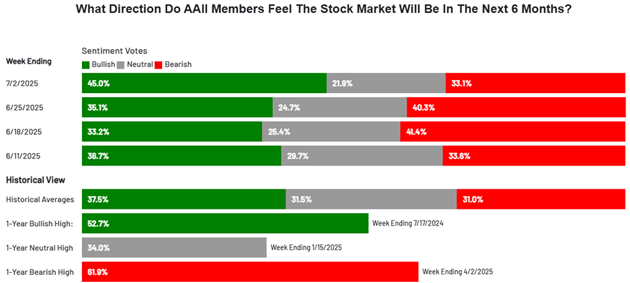

The American Association of Individual Investors (AAII) survey currently shows that 45% of investors are now bullish. That’s the highest reading of the year, and well above the historical average of 38%.

Source: AAII

Source: AAII

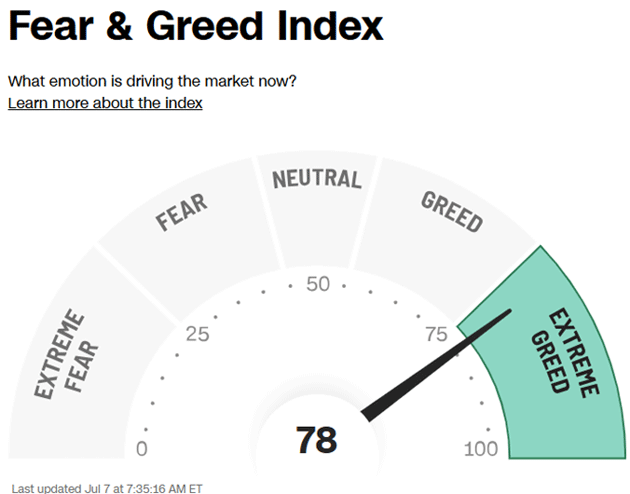

The CNN Fear & Greed Index has also hit 78. That’s firmly in “Extreme Greed” territory—and the highest rating in the past year.

Source: CNN

Source: CNN

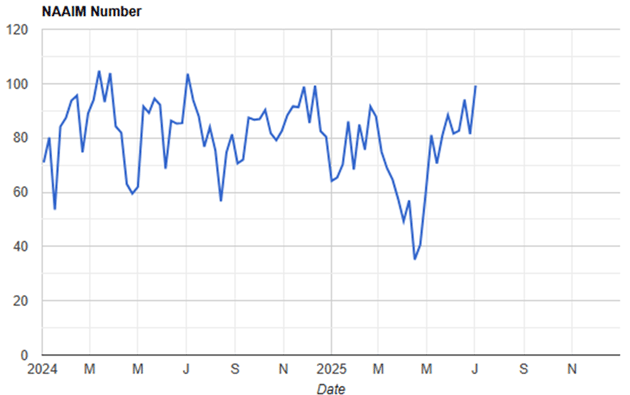

Finally, the NAAIM Exposure Index is currently at 99. That’s one of the highest readings of the year, and it’s 22% higher than a week ago.

Source: NAAIM

Source: NAAIM

Together, these indicators paint a euphoric picture. Unfortunately, sky-high sentiment readings aren’t the only red flag I’m seeing in the market.

The indices are also very extended. The S&P 500 is currently trading almost 4% above its rising 10-week moving average. QQQ is trading 3% above its 10-week moving average.

I see this ending one of two ways. One, the market pulls back. We get a correction that resets sentiment.

The other option is that the market corrects through time. Stocks trade sideways. This scenario could also reset investor sentiment in a big way. If the market’s choppy, breakouts won’t work as well. We’d also see corrections in small, more speculative names during this period.

Personally, I think the latter situation is more likely. But that doesn’t mean we shouldn’t exercise caution as traders.

Now is the time to tighten your risk management process. Avoid chasing stocks. Keep your position sizes smaller than usual. And be extra selective about the names you add to your portfolio.

In my Express Trader advisory, I’m only trading leaders of the strongest market groups that are showing A+ setups. If you’d like to follow along with me and get the three strongest stocks on my radar each week, you can join us here.

Justin Spittler

Chief Trader, RiskHedge