Stephen’s note: Today, I’m giving John Pangere the floor to walk you through something fascinating happening behind the scenes of the artificial intelligence (AI) boom.

Most investors know AI requires massive data centers and powerful chips. But John’s going to show you a lesser-known angle—one that even companies like Meta Platforms (META) are using to their advantage.

It’s a unique way to tap into the infrastructure buildout powering AI… and it’s something everyday investors can take advantage of, too.

Here’s John…

***

Mark Zuckerberg has a secret. Probably one he’d rather not make public.

But if you look close enough, you can find it. And you’ll learn quickly why he—and billionaires like him—want to keep it a secret. Because once you understand it, you’ll realize this is an opportunity everyday investors can use, too.

We all know the story of Zuckerberg and the rise of Meta Platforms. Starting the company from his dorm room at Harvard in early 2004, it quickly became the social network.

Since then, it’s grown rapidly. In 2025, the company brought in over $200 billion in revenue. Its gross profit margin is north of 80%. And it produced about $46 billion in free cash flow—the amount left over after paying all its bills.

It’s wildly profitable. And it’s making a big push into AI to stay relevant.

If Meta wants to compete on the AI stage, it needs this above all else...

Meta wants to make AI a central part of its business. Zuckerberg even stated he wants people to think of Meta as an AI-first company.

He’s poured tens of billions of dollars into AI research and products—even going so far as to dangle $100 million or more pay packages to lure AI superstar researchers to Meta.

But if the company wants to compete on the AI stage, it needs one thing above all else: infrastructure.

That means hyper-scale data centers. The kind of massive structures that house racks of supercomputers needed to run an AI operation.

All told, Meta has about 24 dedicated data centers totaling roughly 53 million square feet of space. A number that’s only going to grow with the company committing to spend more than $600 billion for more hyper-scalers in the coming years.

That includes the Hyperion project in Richland Parish, LA. It will be Meta’s largest campus, totaling 5 GW of capacity.

Hyperion under construction | Source: Meta Platforms

There’s also Prometheus in New Albany, OH. It’s a 1 GW campus coming online later this year.

Inside and outside of Prometheus | Source: Meta Platforms

Building them is the easy part. Making them work is something else entirely.

Meta’s latest deal is a gamechanger...

Data centers are nothing more than massive racks of computers. The trouble is that you need the right equipment.

That includes the latest and greatest in computer chips—or, more specifically, graphic processing units (GPUs).

GPUs are the backbone of AI. They can process far more data than the chip in your typical computer.

Data centers chain together thousands of these GPUs to enable their tech, whether that’s from chip giant Nvidia (NVDA) or elsewhere.

The problem is that there’s only so much supply to go around.

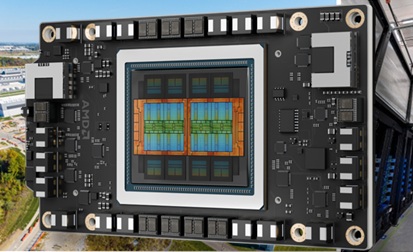

So it’s no surprise that Meta struck a deal with chipmaker Advanced Micro Devices (AMD) late last month. As part of the deal, Meta agreed to purchase up to 6 GW of AMD’s Instinct GPUs to power its data centers.

AMD Instinct GPU | Source: AMD

It’s a potential $60 billion deal for AMD.

That’s on top of the deal Meta made with Nvidia last year, where Nvidia is also supplying Meta with GPUs. Another multibillion-dollar deal.

But this deal with AMD is different. It’s buried in the details. And it’s a strategy you as an investor can capitalize on.

You don’t have to be Zuckerberg to do this...

As part of the deal, Meta is “investing” in AMD.

But this is no ordinary investment. It’s not a cash infusion.

Instead, Meta got something else in return. Something I built my career, and Strategic Trader, on...

Meta gets a warrant that lets it buy up to 160 million shares of AMD at 1 cent each. That means Meta can buy about 10% of AMD for just $1.6 million.

It’s a smart play. Zuckerberg wants the option to purchase a big chunk of AMD without a massive upfront cost.

Warrants give him that option.

|

Now, there are certain milestones to hit. Some are tied to shipments of GPUs, and some are tied to the stock price. But if everything works out, this tiny bet could be worth more than $96 billion to Meta.

That’s a potential return of about 60,000X the actual investment.

Make no mistake, Meta probably wouldn’t have agreed to the deal without that warrant. It’s a way to make a massive profit on its own spending.

It’s a shrewd move. Mark Zuckerberg isn’t stupid. He knows exactly what he’s doing. And it’s a strategy billionaires like him—including Warren Buffett—use all the time.

To be clear, 60,000X your money is unheard of for most people. And it’s a sweetheart deal for Meta with that kind of potential. A deal that no one but Zuckerberg—and his fellow billionaires—can actually make.

But we know something that probably 99% of investors don’t. You don’t have to be Mark Zuckerberg to get into deals like that. You don’t have to be a Wall Street guru to have access to warrants.

You can buy and sell warrants on the open market just like you do with stocks. And you can potentially see returns you never thought possible.

When warrants work, they really work

This is something I’ve helped my members discover over the past seven years.

They’ve had the chance to book a recent 942% win on BigBear.ai Holdings (BBAI) warrants…

Earn more than 2,100% on Target Hospitality Corp. (TH) warrants…

And make more than 50X their money on Purple Innovation (PRPL) warrants. Enough to turn even a tiny $100 bet in the warrants into more than $5,000.

There’s a reason savvy players like Mark Zuckerberg and his team of bankers use warrants. When they work, they really work. You don’t need a ton of cash to make a huge difference in your portfolio.

$1.6 million to Zuckerberg is pocket change. But a potential $96 billion score makes a huge difference to his wealth.

Warrants have long been the playground of wealthy, connected investors. Investors like Mark Zuckerberg.

But they don’t have to be. There are plenty of ways for regular investors to trade them. Which is exactly what we’ve done at Strategic Trader for the past seven years.

So the question isn’t, “What does Zuckerberg know that you don’t?” The question is, “Why aren’t you playing in the same sandbox?”

If you’re ready to put the power of warrants to work in your portfolio, with me as your guide, go here to learn more about a Charter Membership to Strategic Trader.