Digital assets like Bitcoin and Ethereum have proven to be great investments over the long term.

Since 2015, BTC is up 22,000% and ETH is up 90,000%.

The problem is, most investors avoid investing in crypto because of how volatile this asset class is.

Plus, with tens of thousands of coins on the market, choosing the right one isn’t easy.

If you’re new to cryptocurrency investing or are struggling to create an optimal crypto portfolio, keep on reading…

How do cryptos fit into my overall portfolio? What percentage of my portfolio should I put into crypto?

I don’t know your financial situation or your risk tolerance. So I can’t answer that question for you.

As a general rule of thumb, I suggest putting no more than 5% of your investable assets into crypto.

Above all else: ***DON’T INVEST ANY MONEY INTO CRYPTO YOU CAN’T AFFORD TO LOSE.***

Only invest money you’re willing to speculate with. Don’t invest your mortgage money or your kids’ college money. There are many cryptos with exciting stories and profit potential that may compel you to “bet the farm.” Please don’t do this. Please respect the fact that crypto is the most volatile asset class on the planet.

Here’s a quick test to determine if you’re investing too much in a crypto position…

Before you buy, ask yourself: “What if this position loses 50% of its value by next week?” If this would stress you out, you’re investing too much.

In volatile assets like crypto, you need “staying power” to remain invested while prices are swinging around. The best way to have staying power is to keep your position sizes small.

How much of my crypto portfolio should I allocate to major cryptos vs. smaller altcoins?

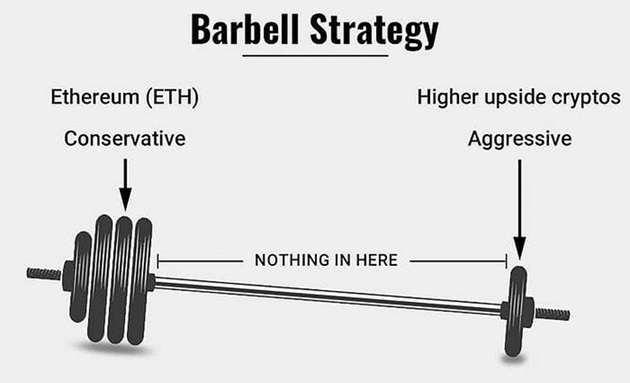

I suggest adopting the barbell strategy.

The barbell strategy is a portfolio construction tool that strikes the right balance between risk and reward. It does so by investing in two distinct types of assets, on both extremes. On one end, you have “safer” assets.

On the other, you have “higher upside” assets. Just like a barbell, you’ll load it on either end, with nothing in the middle. This will allow you to potentially earn higher returns… while the “safe” portion cushions potential losses. (I put “safer” in quotes because crypto is an early-stage technology, and no crypto has a comparable level of safety to financial assets like government bonds, cash, and certain groups of stocks.)

Here’s how it works: You would put the majority (75% to 90%) of your crypto investments in the safer portion. The other 10% to 25% would be allocated to higher-upside assets. So, your crypto portfolio would resemble a lopsided barbell:

In my RiskHedge Venture crypto advisory, I recommend investing 75% of your crypto allocation to “safer” and bigger cryptos, like Ethereum and Solana. Then, I recommend putting the remaining 25% into higher-upside tokens.

Please note: Crypto is just one asset in an overall portfolio. I recommend putting around 1% to 2% of your total assets into crypto — and definitely no more than 5%.

How do you find good quality cryptos?

Dozens of real crypto businesses produce millions of dollars in cash flows each day. That means we can determine their value like we would a stock.

You can compare how much revenue Ethereum rakes in each year to its market cap to get an idea of how “expensive” or “cheap” it is—just like a stock. I evaluate crypto opportunities just like Warren Buffett assesses a stock. I analyze the underlying business.

It’s important to understand that almost no one else views cryptos as businesses, yet. The vast majority of crypto investors have a trading mentality. They aim to find a hot crypto… ride it higher… then jump quickly to the next hot trade. This can be a profitable strategy. But it’s rarely as profitable as identifying a great crypto business very early on and holding it as it flourishes.

Here are some basic questions my team and I first ask when we’re evaluating a crypto:

- Who are the key people involved?

- What does the company actually do?

- What important problem is it solving?

- How much money is it making?

- How fast is the business growing?

- What advantage does it have over competitors?

- What are the “tokenomics?” (Think of each crypto project as its own little economy. A crypto’s “token economics” defines how money—tokens—is distributed and earned in its economy.)

The vast majority of cryptos are total garbage, like Cardano (ADA) for example.

That’s why a big part of my crypto research is a process of elimination.

I write about crypto and other disruptive technologies in my M/W/F investing letter The Jolt. You can join for free here.

Stephen McBride

Chief Analyst, RiskHedge