I’ve been getting under some people’s skin.

And it’s because I’ve been unapologetically bullish for the last couple months.

I get it. No one wants to hear the bull argument after the horrible year we just had in stocks.

But things have changed.

Many investors haven’t entertained the possibility that last year’s bear market is over.

They’re certain the stock market will head much lower.

Their arguments sound something like: “Inflation is still too high; the economy is speeding toward a recession; the Fed isn’t done raising rates.”

I get where they’re coming from.

There’s a lot to be concerned about right now. But practically every investor has those same concerns. So, there’s a possibility the worst has already been priced into the markets.

As a trader, I prefer to listen to what the price action of stocks and other assets are telling me... rather than get caught up in various narratives.

And the price action I’m seeing is making me more bullish by the day. Let me explain.. and share six stocks to add to your watchlist.

- Today, the “right” stocks are leading the market…

You may be familiar with the concept of “rotation.”

Rotation occurs when investors move money from one sector of the stock market to another.

It’s called “rotation” because money typically rotates from sectors that are hot to sectors that have been lagging.

During bear markets, money rotates into “defensive” sectors like utilities, healthcare, and consumer staples.

During bull markets, money tends to flow into technology and consumer discretionary stocks.

In other words, you can learn a ton about the state of the market by observing which stocks are leading and which stocks are lagging.

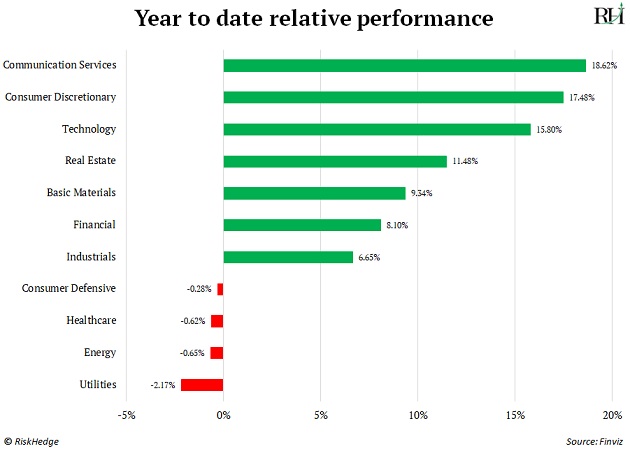

So far this year, the right stocks have been outperforming. You can see what I mean below. This chart shows the performance of the 11 sectors that make up the S&P 500:

The top-performing sectors this year are communication services (XLC), which include stocks Netflix (NFLX) and Meta Platforms (META), and consumer discretionary (XLY), which includes Home Depot (HD) and Nike (NKE).

These sectors have rallied 18.6% and 17.5%, respectively.

At the beginning of the year, I predicted communications stocks would be the big winners of 2023, and that hasn’t changed.

The worst-performing sectors this year include consumer staples (XLP), healthcare (XLV), and utilities (XLU). As I said, these are defensive sectors. Investors flock to them when they’re nervous about the stock market or economy.

But that’s not what’s happening right now. Instead, investors are bidding up consumer discretionary, technology, and beaten-down communications stocks.

This is “risk on” behavior. It’s exactly the sort of price action you’d expect to see in a bull market.

- Growth stocks have also woken up in a major way…

Growth stocks are some of today’s fastest-growing companies.

Many of them aren’t profitable yet. Some are years away from turning a profit. This makes them highly sensitive to inflation and higher interest rates.

Growth stocks peaked in 2021 well before the broad market did. The ARK Innovation ETF (ARKK), which many investors use as a benchmark for growth stocks, started falling in February 2021… 10 months before the S&P 500.

In short, growth stocks “sniffed” out that inflation and higher interest rates were coming well before the rest of the market did.

Now, the opposite is happening. High-quality growth stocks are leading the market higher.

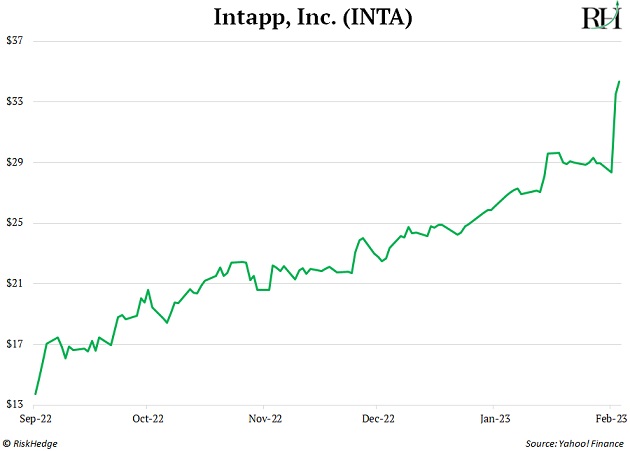

Look at Intapp (INTA), a software company. The stock has soared 115% since September:

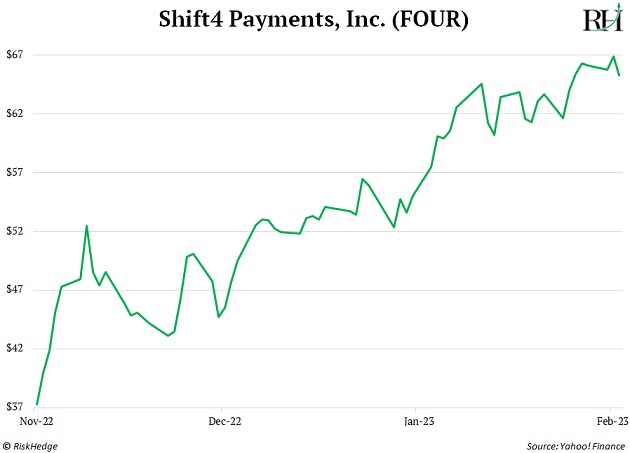

Shift4 Payments (FOUR) is another growth stock that’s been leading the market higher. It’s up 86% since November:

And here’s Shopify (SHOP), which is up 112% since October:

Many other beaten-down growth stocks are emerging from multi-month consolidation patterns and beginning new uptrends. Here are a few I’m closely monitoring:

- Freshworks (FRSH)

- Procore Technologies (PCOR)

- Flywire (FLYW)

- Riskified (RSKD)

- Confluent (CFLT)

- Weave Communications (WEAV)

I could go on and on. My point is that growth stocks are putting in a sustained surge for the first time in over a year.

This speaks volumes about the kind of environment we’re in right now.

I stand strong by my January call that the bear market has ended, and a new bull market has begun.

That said, now’s not the time to get overly aggressive. I recommend adding to your favorite stocks on weakness.

A dip would be normal and healthy soon after January’s big runup.

Justin Spittler

Chief Trader, RiskHedge

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.