Most people think they’ve missed the boat on crypto.

Bitcoin (BTC) launched way back in 2008. It soared from less than a dollar to $115,000 today.

Likewise, Ethereum (ETH) has been around for 10 years already. It’s surged +120,000% since, turning every $100 bill into $120,000.

But if you’ve been following along, you’ve heard me say it before: It’s still early days for crypto.

The total amount of money invested in crypto is tiny. Especially compared to what’s coming next.

For Day 5 of Crypto Week, let me show you how big the crypto market can get and how to claim your share, should you choose.

Let’s start with some simple math.

- US retirement funds hold $48 trillion.

Less than 1% of it is in crypto.

If Americans allocated just 1% extra, that’s an additional $480 billion dollars… more than the entire value of Ethereum.

An additional 4% allocation would release $2 trillion into crypto.

An 8% allocation would double the size of the entire crypto market.

And some highly credible investors are saying even that’s not enough.

- A few days ago, Ray Dalio surprised almost everyone with his latest advice.

If you don’t know Ray, he’s the founder of the largest hedge fund in the world—Bridgewater Associates. Dalio has made billions identifying major macro trends before they go mainstream.

In a recent interview, he recommended a 15% allocation to gold or bitcoin. Ray thinks it’s the best way to hedge against growing government debt.

Even just one year ago, this would have never come out of an “old school” Wall Street guy’s mouth. Let alone Dalio, an investing legend and pioneer who commands the respect of just about everyone.

Owning crypto is becoming the norm, even for Wall Street, which resisted it for years.

Unclear regulations, a lack of simple investment vehicles like spot ETFs, and complicated storage methods all kept Wall Street locked out of crypto.

But those roadblocks are vanishing.

The House recently approved three major crypto bills. Bitcoin and Ethereum ETFs are breaking records. And major players like BlackRock (BLK), Franklin Resources (BEN), and Fidelity are launching dedicated crypto funds.

Wall Street is marching into crypto. The amount of money this shift could unlock is astounding.

Together, Wall Street institutions manage some $43 trillion dollars.

We estimate less than 0.5% of that is in crypto. In other words, they’ve barely dipped their toes.

Every 1% increase would unleash another $430 billion into the crypto market. And a recent Ernst & Young survey showed most money managers plan to allocate over 5%.

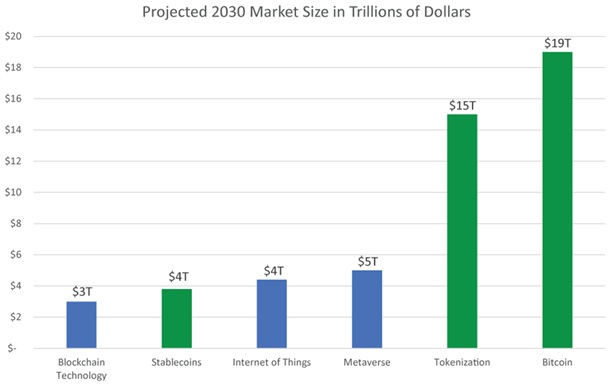

Boston Consulting Group and Citibank estimate the crypto market will grow from $3.8 trillion today to $38.7 trillion by 2030—a 10X increase in five years:

Source: Boston Consulting Group; Citi

- When you first got into crypto, what did you buy?

Bitcoin, right? Then maybe Ethereum. Then, if you stuck around, you found yourself exploring smaller cryptos.

Wall Street is following the same playbook, just 10 years behind.

They’ve finally started buying bitcoin. Now, they’re warming up to Ethereum.

But the vast majority of institutions haven’t gone beyond that.

That’s why bitcoin and Ethereum represent 73% of the entire crypto market. They’re the easiest choice.

Closing that gap is one of the biggest opportunities in finance today.

Back in 2021, a wave of retail buyers flooded into altcoins like Solana (SOL), Avalanche (AVAX), and Uniswap (UNI). They saw gains of 1,000%… 5,000%… even more.

Now imagine what happens when institutions—with far deeper pockets—start investing beyond BTC and ETH.

- For the last few months, I’ve been building our Venture portfolio around the cryptos Wall Street will want to buy.

I recently released a new special report highlighting my top five picks members can buy into today, three of which are trading for under a dollar.

They all meet our strict Venture framework. They’re real businesses solving real problems, and they each have strong tokenomics.

Stephen McBride

Chief Analyst, RiskHedge

PS: The biggest investing trends are often obvious in hindsight. The Jolt helps you spot them early—before the crowd catches on. If that’s the kind of edge you’re looking for, you can join me here.