Be careful out there…

Earnings season just kicked off.

This is when publicly traded companies tell the world how business is going. They say how much money they made last quarter… and what they think the rest of the year has in store.

A good earnings report can trigger an explosive move higher. A bad report can send a stock into a tailspin.

Unfortunately, it’s very difficult to know how a stock will react to earnings.

That’s why patience is often the best strategy during earnings season. In other words, you’re usually better off waiting until after a company has reported earnings to buy in.

That brings me to my latest Trade of the Week: Goldman Sachs (GS).

Goldman is one of America’s largest investment banks. Last week, the company reported strong earnings. Its stock reacted positively to the report, but the move was somewhat muted due to the fact that the indices were under so much pressure.

However, financials recently broke out to new 52-week highs versus the S&P 500, indicating this is a good area of the market to be involved in.

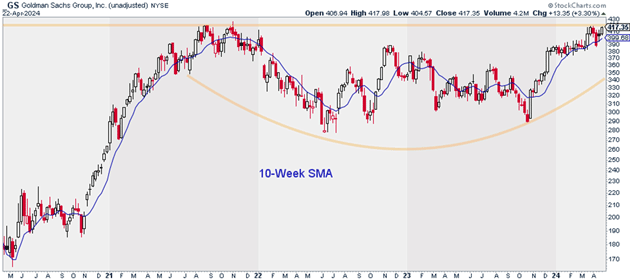

I think we’ll see a “delayed” earnings reaction for GS. Once the broader market settles down, I expect GS to break out of this base it’s spent nearly three years building:

Source: StockCharts (Click to enlarge)

Source: StockCharts (Click to enlarge)

Having said that, GS likely won’t be the fastest horse. But the best trades during times of market uncertainty rarely are.

I suggest picking up a half position in GS today. I believe it can hit $500 within the next 12 months.

Exit your position if GS closes below $388. That gives us a risk-reward ratio of nearly 3:1 on this trade.

Action to take: Buy GS at current market prices.

Risk management: Exit your position if GS closes below $388.

Justin Spittler

Chief Trader, RiskHedge