Editor’s note: “Effortless investing”... is it even possible in today’s chaotic markets?

Today, RiskHedge publisher Dan Steinhart shares more details on the dead-simple investing method he uses to manage the majority of his retirement funds. One that lets him sleep easy and profit when others are scared.

Here’s how it all started, and why you may want to consider this method for your own investing...

***

In 2013, an academic paper changed the way I think about investing.

It’s called A Quantitative Approach to Tactical Asset Allocation. Meb Faber—a widely respected quantitative analyst—wrote it.

This paper is unknown to most casual investors. But it’s admired among serious investing professionals… because its core idea is groundbreaking.

***Did you know you could have compounded your money at 18% per year since 1973 by following a dead-simple system that requires about five minutes of your attention a month?

Don’t brush aside that 18% return. It might “sound” small compared to huge one-off gains advertised on the internet. But make no mistake: 18% returns are a world-class result over a long time frame. High-net-worth folks pay hedge fund managers billions of dollars a year to get results like these.

(They almost always fall short.)

In fact, 18% returns per year are not far off from the legendary track record of the greatest long-term investor of all time. Warren Buffett has compounded his money at 20% per year in his holding company Berkshire Hathaway. That made him the third-richest man on Earth.

***Am I saying you can basically be Warren Buffett in just five minutes a month?

Not exactly.

Problem was, the results in Meb’s paper weren’t replicable for the average investor. They were calculated using “theoretical” data sets. Indexes of stocks and bonds that were grouped after the fact by economists... but not actually buyable for the average investor in the ‘70s, ‘80s, ‘90s, or most of the 2000s.

But that’s changed. Now that we have cheap ETFs… it IS possible to mimic this dead-simple strategy that rivals Warren Buffett.

Are you skeptical? You should be. “Back-tests” of investing strategies tend to be overly optimistic. A back-test measures how a strategy would have performed under perfect conditions had it existed in the past.

The real world is imperfect… so real-world results almost always underperform back-tests. In the real world, you run up against transaction fees, emotions, slippage, and execution risk, to name a few.

Well, even with all those real-world problems accounted for, this strategy STILL beats the market… by a lot over time.

Over the past 20 years, the S&P is up around 315%. This system is up 570%.

***The second most important thing to understand about this system is it’s “rules-based.”

“Rules-based” means you’re not making decisions on what to buy and sell.

Instead, it puts your investing decisions on autopilot. You’re not trying to predict interest rates, decipher Fed statements, or even forecast the cash flows of a business.

You’re not doing much at all except following the rules set at the start.

Why would you want to do this? Because it works. I can almost guarantee you will outperform 98% of individual investors over time following this system. I shared a more complete breakdown of the returns you can expect in my February RiskHedge Report.

***Most important, the system has crushed the market during crashes, recessions, and stagnant periods.

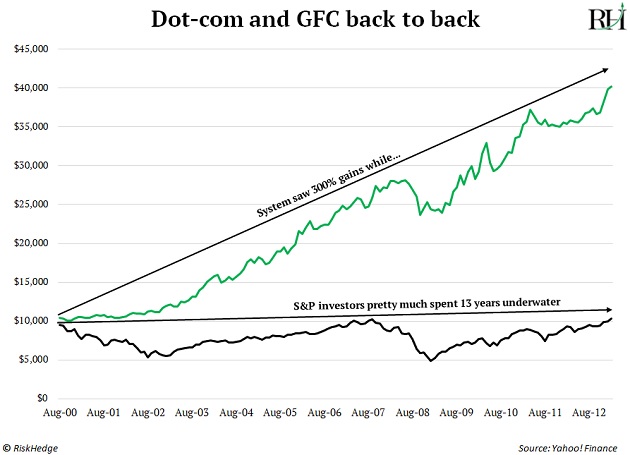

The bursting of the dot-com bubble in 2000 ruined retirement for millions of Americans.

The 2008 crash was even worse.

If you were using this system in 2000 and 2008, you’d have been sitting safely on the sidelines, mostly in cash, while most other folks were helplessly watching their wealth vanish.

This system is designed to get you OUT of markets before or in the early stages of bear markets.

Consider that 2000 to 2013 was one of the worst times in history to be an American investor. First we had the dot-com crash… then the Great Financial Crisis.

On August 1, 2000, the S&P 500 closed at 1,517.68.

On February 1, 2013… 12 ½ years later… the S&P 500 closed at 1,514.68.

That’s 12 ½ years of nothing. The S&P 500 went nowhere for 12 ½ years! And that’s before you adjust for inflation. Account for inflation, and you’d have lost around 25% of your money.

Twelve-and-a-half years is a long, long time. If you were 58 years old in 2000 and needed to retire at 70 in 2013, you were pretty much screwed by the awful performance of the stock market.

Meanwhile, this system gained over 300% during this period:

***What do you think the next 12 years will be like?

Do you think they’ll be wonderful, like the 2010s?

The 2010s were a “goldilocks” period of low inflation and rising asset values. It was easy to make money. A one-way bull market handed out returns of 190% to investors who simply bought the S&P 500.

Or do you think we’re more likely in a tumultuous period similar to 2000 to 2013? Markets crashed, recovered, crashed, recovered, but ultimately went nowhere.

If I had to guess… looking at the state of the world… I’d choose “tumultuous.”

But it’d just be a guess.

I don’t know.

No one does.

And that’s the beauty of this system, which I call Cornerstone. You don’t need to pretend to know the future.

You simply follow the rules… and enjoy a very high likelihood of collecting market-beating returns, backed by an ironclad 50-year track record.

No matter if markets sail smoothly for the rest of the 2020s… or crash and burn tomorrow.

***I just sent out the latest Cornerstone update to paid-up members...

Each month, I tell members exactly where Cornerstone is telling us to put our money today and at which percentage (cash, bonds, gold, emerging market stocks, small caps, real estate, value stocks, etc.).

This month, Cornerstone has us fully invested…

Including one specific asset it hasn’t recommended since 2021...

To discover more about Cornerstone—and to see if it’s right for you—go here. I also answer some of the most common questions about the Cornerstone method.

Dan Steinhart

Publisher, RiskHedge